The review of draft budgetary plans for 2020 – some implications for a reform of fiscal governance

Published as part of the ECB Economic Bulletin, Issue 8/2019.

On 21 November 2019 the European Commission released its opinions on the draft budgetary plans of euro area governments for 2020, together with an analysis of the budgetary situation in the euro area as a whole. Each opinion includes an assessment of the compliance of the relevant plan with the Stability and Growth Pact (SGP) based on the Commission’s 2019 autumn economic forecast. This review exercise also assesses whether countries have incorporated into their plans the country-specific recommendations for fiscal policies that were addressed to them under the 2019 European Semester, as adopted by the Economic and Financial Affairs Council on 9 July 2019.[1] The recommendations call on countries with high ratios of government debt to GDP to aim for a sufficiently fast reduction of these ratios. Some countries with room for budgetary manoeuvre are recommended to make use of this room, including for achieving an upward trend in government investment. The review of the draft budgetary plans identifies weaknesses in the follow-up to the recommendations. It is important that such shortcomings be addressed, inter alia, in the Commission’s forthcoming review of the “six-pack” and “two-pack” regulations, which were implemented in 2011 and 2013 respectively in the aim of strengthening fiscal governance.

The draft budgetary plans for 2020 result in a slightly expansionary fiscal stance for the euro area as a whole while reflecting very different fiscal developments across countries. Measured as a deterioration in the structural primary balance amounting to 0.4% of GDP, the planned fiscal stance in 2020 would provide support to economic activity in the euro area. As regards its composition, however, the Commission concluded that “compliance with the Stability and Growth Pact by euro-area Member States not at their medium-term budgetary objectives combined with a bigger expansion by euro-area Member States with fiscal space would result in a better differentiation between euro-area Member States”.[2] In view of the weaker growth outlook for the euro area and the elevated level of uncertainty, the Eurogroup stated that it “stands ready to co-ordinate” a differentiated fiscal response if downside risks were to materialise.[3]

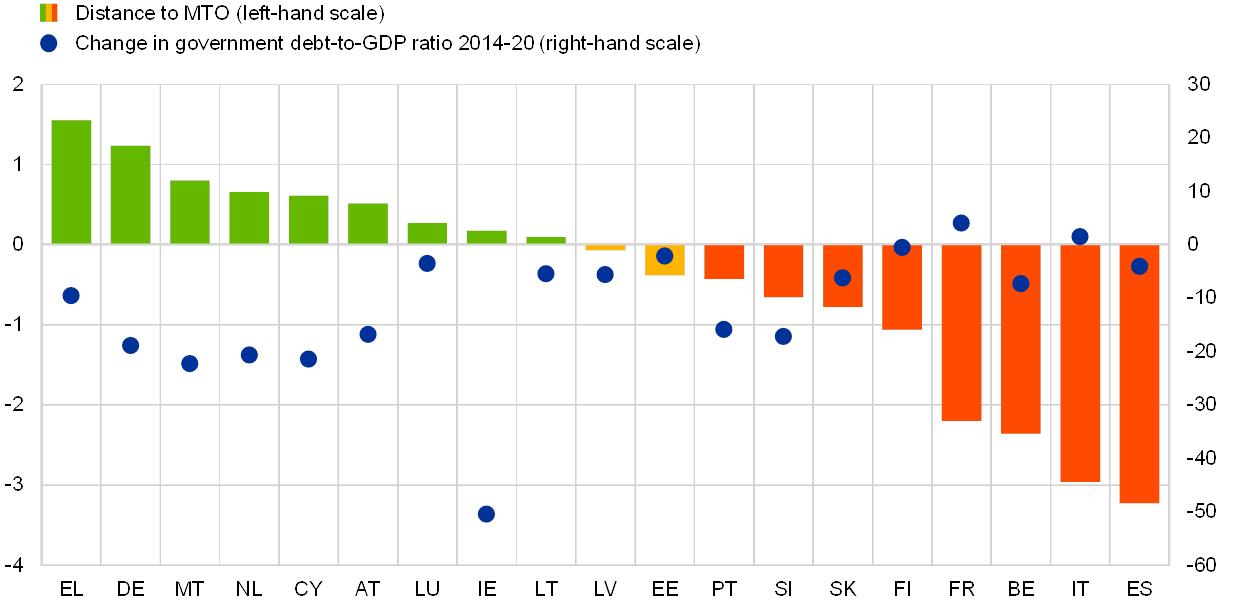

In the Commission’s opinions, the draft budgetary plans of nine euro area countries are deemed to be compliant with the SGP: Germany, Ireland, Greece, Cyprus, Lithuania, Luxembourg, Malta, the Netherlands and Austria. These countries are projected to record sound fiscal positions in 2020 as defined by their medium-term budgetary objectives (MTOs). In this context, the Eurogroup welcomed that some “Member States with a favourable budgetary situation have made use of it and plan to use it further to boost investment and growth, while preserving the long-term sustainability of public finances”. In addition, the Commission considers that the draft budgetary plans of Estonia and Latvia are “broadly compliant” with the SGP.[4] The Eurogroup invited these two countries to ensure compliance with SGP provisions within the national budgetary processes.

Chart A

Government debt and the gap between structural balances and MTOs in 2020

(percentages of GDP)

Sources: European Commission 2019 autumn economic forecast and ECB calculations.

Notes: The chart depicts the deviation of countries’ structural balances in 2020 from their MTOs. Green (orange) bars denote countries whose draft budgetary plan for 2020 is considered by the European Commission to be (broadly) compliant with the SGP. Red bars denote countries whose draft budgetary plan for 2020 is considered by the European Commission to be at risk of non-compliance with the SGP.

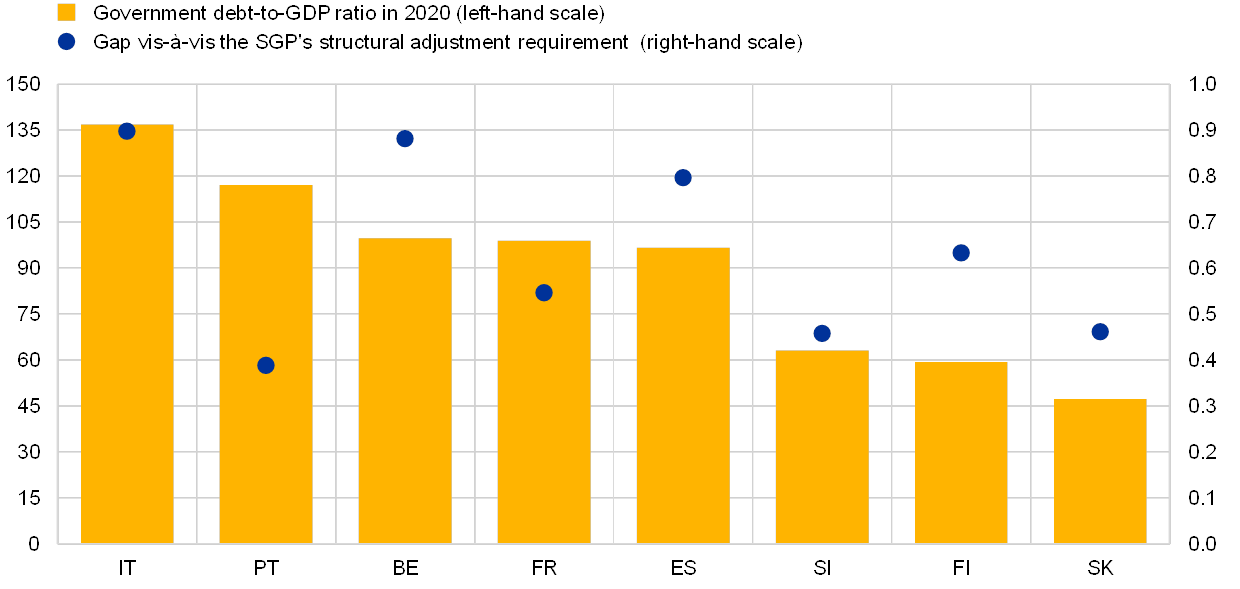

The draft budgetary plans of a sizeable number of euro area countries are assessed to pose risks of non-compliance with the SGP, which is a matter of particular concern for countries with high government debt ratios.[5] According to the Commission’s forecast, the planned structural adjustments are expected to fall significantly short of the SGP’s requirements in eight countries, namely Belgium, Spain, France, Italy, Portugal, Slovenia, Slovakia and Finland (see Chart B). Among them, Belgium, Spain and Portugal submitted plans on a no-policy-change basis, reflecting the election of new governments in the latter two countries and the ongoing process for the formation of a federal government in Belgium. The Eurogroup invited all eight countries “to consider in a timely manner the necessary additional measures to address the risks identified by the Commission and to ensure that their 2020 budget will be compliant with SGP provisions”. Importantly, it reiterated that “a slow pace of debt reduction from high levels in a number of Member States remains a matter for concern and should be decisively addressed, including by making use of windfall gains from low interest rates”. This applies notably to Belgium, Spain, France and Italy, which continue to record very high debt ratios that are yet to commence a steady downward trend. By contrast, Slovakia and Finland are forecast to post debt ratios below the Treaty reference value of 60% of GDP in 2020, while in Portugal and Slovenia government debt has been put on a continuous downward trajectory.

Chart B

Government debt in 2020 and gaps vis-à-vis the SGP’s structural adjustment requirements in Member States whose draft budgetary plans are assessed as being at risk of non-compliance with the SGP

(percentages of GDP) Sources: European Commission 2019 autumn economic forecast and the country-specific recommendations for fiscal policies as adopted by the Economic and Financial Affairs Council on 9 July 2019 and updated in the Commission’s staff working documents providing analysis on the draft budgetary plans for 2020.

Note: The structural adjustment requirement for Italy does not yet include the request by the Italian authorities for flexibility under the unusual event clause of the SGP.

The exercise of reviewing the draft budgetary plans is a reminder that the EU’s fiscal governance framework should be improved to facilitate a smoother operation of policies in Economic and Monetary Union (EMU). In particular, the SGP’s rules remain asymmetric and thus cannot guide the aggregate euro area fiscal stance. Countries that have not yet achieved their MTOs need to make progress towards them, while countries that have reached them are not required to use their buffers. This can lead to procyclical fiscal policies in times when the euro area economy as a whole would benefit from support from budgetary policies. Moreover, in several countries the pace of the reduction in government debt from high levels remains far from sufficient, despite the strengthening of the rules in 2011 which set in place a debt rule to accelerate the decline in government debt-to-GDP ratios towards the Treaty reference value of 60% of GDP. Notably, owing to the cumulative effects of different forms of flexibility provided for in the SGP, it is not possible to ensure that countries – especially high-debt countries – will converge towards their MTOs sufficiently rapidly. Finally, the fact that the plans of a number of countries with high government debt levels contain significant shortfalls in structural adjustments from the Council’s recommendations shows that the draft budgetary plan review introduced with the “two-pack” regulations is not exerting the needed pressure to correct fiscal imbalances.[6]

The European Fiscal Board (EFB), which was mandated by the Commission President to assess the functioning of the EU’s fiscal rules in the light of the “six-pack” and “two-pack” review, has proposed options for a reform of fiscal governance in the EU.[7] The EFB suggested changing the anchor for the rules from the MTO to a long-term ceiling in terms of government debt to GDP. It also suggested that this be combined with an expenditure rule as the only operational indicator to guide fiscal policies. According to the EFB, existing flexibility clauses should be merged into a single escape clause, to be triggered on the basis of independent economic judgement. In this context, a stronger role is foreseen for independent fiscal councils, while the Commission should have greater independence in its assessments. Sanctions, which have proven difficult to apply, could be complemented or replaced by incentive mechanisms. Such mechanisms could entail linking access to a macroeconomic stabilisation function (a “euro area fiscal capacity”) to compliance with the fiscal rules. All these suggestions merit in-depth discussion in the context of the forthcoming “six-pack” and “two-pack” review.[8]

Looking ahead, the operation of the EU fiscal framework is a prerequisite for further deepening EMU. Beyond the recently adopted budgetary instrument for convergence and competitiveness[9], further progress on establishing a genuine macroeconomic stabilisation function for the euro area remains indispensable. Such a function typically exists in other monetary unions to better address economic shocks that cannot be managed at the national level.[10] This type of central fiscal stabilisation tool would reduce the risk of overburdening the ECB’s monetary policy instruments in severe euro area-wide recessions.[11]

- See the country-specific recommendations under the 2019 European Semester for more information. For more background information and further details, see the box entitled “Priorities for fiscal policies under the 2019 European Semester”, Economic Bulletin, Issue 5, ECB, August 2019.

- See the Commission's communication on the draft budgetary plans for 2020.

- See the Eurogroup statement on the draft budgetary plans for 2020.

- For countries subject to the SGP’s preventive arm, draft budgetary plans are “broadly compliant” if, according to the Commission’s forecast, they may result in some deviation from the MTO or the adjustment path towards it, but the shortfall relative to the requirement would not represent a significant deviation from it. Deviations from the fiscal targets under the preventive arm are classified as “significant” if they exceed 0.5% of GDP in one year or 0.25% of GDP on average in two consecutive years.

- For countries subject to the SGP’s preventive arm, the Commission assesses a draft budgetary plan as being “at risk of non-compliance with the SGP” if it forecasts a significant deviation from the MTO or the required adjustment path towards the MTO in 2020 and/or non-compliance with the debt reduction benchmark, where that benchmark is applicable.

- For a discussion on why the draft budgetary review exercise has lost effectiveness over time, see the box entitled “An assessment of the review of draft budgetary plans based on the 2018 exercise”, Economic Bulletin, Issue 8, ECB, 2017.

- See the EFB report entitled “Assessment of EU fiscal rules with a focus on the six and two-pack legislation”, August 2019.

- For an overview, see also Kamps, Christophe, and Leiner-Killinger, Nadine, “Taking stock of the functioning of the EU's fiscal rules and options for reform”, Occasional Paper Series, No 231, ECB, Frankfurt am Main, August 2019.

- For details, see the term sheet agreed by the Eurogroup in inclusive format on 10 October 2019.

- See the article entitled “Fiscal rules in the euro area and lessons from other monetary unions”, Economic Bulletin, Issue 3, ECB, 2019.

- See the article entitled “Fiscal spillovers in a monetary union”, Economic Bulletin, Issue 1, ECB, 2019.