TARGET Services at a glance – key facts and figures 2024

Foreword

2024 was the first full year of operation of the consolidated TARGET Services. Since the go-live of T2 – the new real-time gross settlement (RTGS) system and central liquidity management tool – in March 2023, T2 and T2S have been integrated onto a single platform. Consequently, we decided to merge the hitherto separate T2 and TARGET2-Securities annual reports into one consolidated TARGET Services Annual Report and to add a specific section on TARGET Instant Payment Settlement (TIPS). From next year, the Eurosystem Collateral Management System (ECMS), which was successfully launched on 16 June 2025, will also be covered in the TARGET Services Annual Report. Following the previous launches of T2 and TIPS, the go-live of the ECMS marks the completion of the Eurosystem’s Vision 2020 initiative, which encompassed a consolidated Eurosystem market infrastructure, enhancements in the field of instant payments and a common Eurosystem collateral management system.

The period under review in this report saw an increase in transaction volumes in all TARGET Services. This surge was particularly visible in TIPS, which experienced a five-fold increase in volume, highlighting its growing role in the European instant payments landscape. TARGET Services also provided high levels of performance and technical availability. However, there is no room for complacency. Given the importance of TARGET Services for the functioning of the financial system and the potential adverse effects of any technical issues, it is of the utmost importance to make continuous efforts to further increase the systems’ security and stability.

Maintaining a leading position in a world of evolving user needs and market requirements means that we need to keep up our service enhancements. Access for non-bank payment service providers to T2 and TIPS, a possible extension of T2 opening hours, moving to a shorter standard securities settlement cycle in T2S, and improving cross-border payments by enabling cross-currency settlement in TIPS are some of the enhancements we are working on.

Additionally, we are facing challenging geopolitical conditions that are affecting our market infrastructure operations and development. To better withstand external pressures, it is important to further enhance the cyber resilience of our market infrastructures. We also need to strengthen European autonomy in terms of market infrastructure to support the international role of the euro.

The increasing use of TARGET Services’ multi-currency capability provides evidence of its attractiveness. In 2024 Sweden joined TIPS with its national currency. This year, the Danish krone, which has already been in use in TARGET2-Securities since 2018, also became available for settlement in T2 and TIPS. More currencies are expected to join TARGET Services in the years to come, which will support financial integration in Europe and add value in terms of increased transaction volumes and cost-sharing opportunities.

Looking further ahead, the digital euro, the deployment of distributed ledger technology, and the interlinking of TIPS with other fast payment systems will strengthen European sovereignty, enhance competitiveness and pave the way for more integrated and resilient financial market infrastructures. As the world is constantly changing, the Eurosystem’s TARGET Services need to continuously evolve, and as we look back on past achievements, we are already working towards new objectives.

Frankfurt am Main, July 2025

Piero Cipollone

Member of the Executive Board of the ECB

Facts and figures

High-level summary

2024 was the first full year of operations for the consolidated TARGET Services, comprising T2, a real-time gross settlement (RTGS) system for euro payment transactions supporting the Eurosystem’s monetary policy operations, bank-to-bank transfers and commercial payments; TARGET2-Securities (T2S), a single platform for securities settlement in Europe; and TARGET Instant Payment Settlement (TIPS), which settles payments instantly in central bank money. TARGET Services offer harmonised market infrastructure services at EU level, with a single set of rules, standards and tariffs, to a wide range of financial institutions.

In 2024 all TARGET Services saw an increase in transaction volumes compared to 2023. The surge was particularly strong in TIPS, which experienced a five-fold increase in volume, highlighting its growing role in the instant payments landscape. Despite being long-established services, T2 and T2S also saw higher total settlement volumes, with increases of 3.6% and 14.0% respectively.

Participation in TARGET Services enables access to the Eurosystem’s monetary policy operations, as well as to payment and securities settlement in central bank money. On 17 July 2024 the Governing Council of the ECB approved the Eurosystem policy on access by non-bank payment service providers (PSPs) to TARGET Services and to retail payment systems operated by euro area national central banks. The policy sets out, as a general principle, that access to euro area central bank-operated payment systems is to be granted to non-bank PSPs provided that all necessary risk-mitigation requirements are met. The Eurosystem implemented the policy by way of a Decision adopted by the Governing Council on 27 January 2025, with related updates to the TARGET Guideline to follow. Changes to the access criteria will become effective in 2025.

TARGET Services achieved high levels of performance and technical availability in 2024. Incidents, i.e. unplanned interruptions or reductions in the quality of agreed services, were followed up through detailed reporting and risk management processes with the goal of continuously improving the services and enhancing the ability to prevent or mitigate such incidents in the future. Given the importance of TARGET Services for the functioning of the financial system and the potential adverse effects of any malfunctions, it is of the utmost importance that continuous efforts are made to further increase the systems’ security and stability.

In 2024, 99.73% of payments in T2 were processed in less than two minutes. Technical availability stood at 99.97%. The number of incidents halved in comparison to 2023, resulting in some delays in cut-off times but not necessitating the use of the contingency solution.

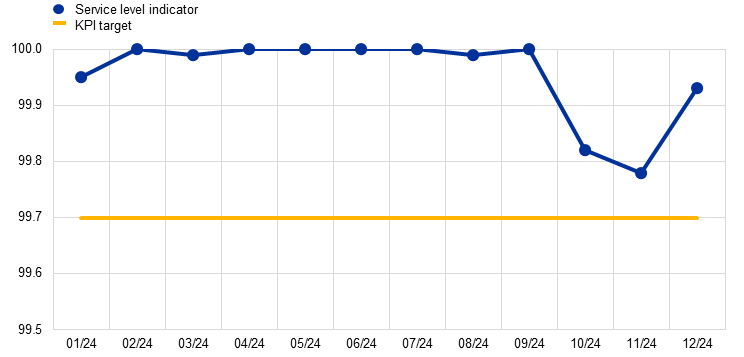

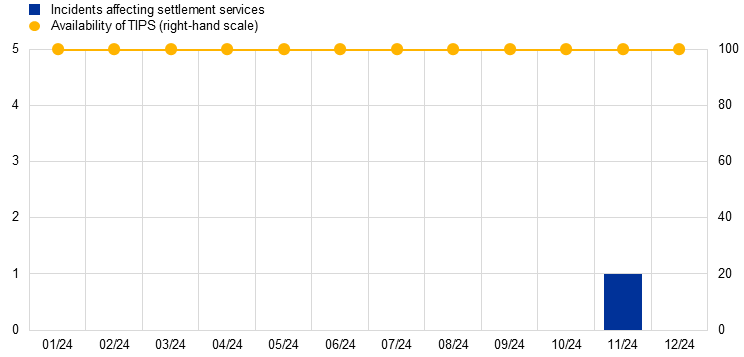

In T2S, availability exceeded the target of 99.7%. The average duration of the three critical phases of the business day remained well within the target durations, although there were individual breaches on two occasions due to incidents that resulted in longer than usual night-time settlement. No major incidents were reported.

TIPS achieved 100% technical availability throughout the year; and 99.99% of payments were executed within 5 seconds, well above the target of 99%.

The RTGS component of T2, the T2S platform and TIPS operate on a full cost recovery and not-for-profit basis, meaning that operational and investment costs have to be covered by fees. The platforms are broadly on track to achieve full cost recovery by the end of the amortisation periods, although a need for fee adjustments may arise.

The multi-currency feature of TARGET Services allows settlement services to be provided in currencies other than the euro. Until 2024 this feature was used only in T2S for settlement of securities in Danish kroner. Sweden became the first non-euro area country to join TIPS with its national currency in 2024 and is already a major driver of TIPS traffic, accounting for more than half of TIPS’ volume in 2024.

Sveriges Riksbank is also investigating the possibility of joining T2 with the Swedish krona. Having used T2S for securities settlement since 2018, Danmarks Nationalbank joined T2 and TIPS in April 2025, after signing a formal currency participation agreement (CPA) in March 2024. Norges Bank signed a CPA with the Eurosystem in November 2024, and the Norwegian krone is expected to migrate to TIPS during the first half of 2028. In September 2024 Seðlabanki Íslands (Central Bank of Iceland) sent a letter of intent regarding the potential onboarding of the Icelandic króna onto TIPS. The TIPS CPA for Iceland is in preparation and a feasibility assessment is currently underway.

Besides the deployment of the multi-currency capability in TARGET Services, the Eurosystem has also launched initiatives to enhance cross-border payments within the EU and beyond. These include (i) the implementation of a cross-currency settlement capability in TIPS that will allow instant payments originating in one TIPS currency to be settled in another TIPS currency in central bank money, and (ii) exploratory work on linking TIPS with other fast payment systems.

In view of the increasing market interest in experimenting with and deploying distributed ledger technology (DLT) in the area of financial market infrastructures, and based on the experience of individual euro area national central banks, in 2024 the Eurosystem carried out exploratory work on the provision of central bank money for settlement of wholesale DLT-based transactions. This exploratory work focused on interoperability-based services which enable external DLT platforms to connect to a central bank-owned platform for central bank money settlement. Under a common legal and access framework and based on a level playing field among all stakeholders, the Eurosystem allowed eligible market stakeholders to carry out experiments (mock transactions) and trials (real transactions), testing a variety of use cases. Following the successful conclusion of this exploratory work, the Governing Council of the ECB decided to continue work on settling transactions recorded on DLT platforms in central bank money.

1 Introduction

Financial market infrastructures (FMIs) are one of the three core components of the financial system, alongside markets and institutions. FMIs provide the networks that connect financial institutions and markets, enabling the circulation of money and the clearing and settlement of financial transactions. It is therefore crucial to ensure the safety and efficiency of these infrastructures in order to maintain a stable and well-functioning economy.

The Eurosystem has the statutory task of promoting the smooth operation of payment systems, and one of the ways it does this is by providing settlement facilities. This is essential for maintaining a sound currency, conducting monetary policy, ensuring efficient market functioning and securing financial stability. In 1999 the Eurosystem created the Trans-European Automated Real-time Gross settlement Express Transfer (TARGET) system for the settlement of large-value payments in euro across national borders in the euro area. In May 2008 TARGET was replaced by a second-generation real-time gross settlement (RTGS) system, TARGET2. In June 2015 the Eurosystem launched TARGET2-Securities (T2S), an integrated platform connected to TARGET2 for processing securities transactions against central bank money in euro. T2S played a key role in simplifying cross-border settlement and easing the difficulties caused by a highly fragmented securities settlement landscape in Europe. In November 2018 TARGET Instant Payment Settlement (TIPS) was launched to provide round-the-clock instant settlement of payments on an individual basis.

Building on the synergies between these market infrastructures, the Eurosystem worked intensively to consolidate TARGET2 and T2S services. This allowed the provision of state-of-the-art multi-currency RTGS services, establishing a single point of access for all Eurosystem market infrastructure services, as well as optimising participants’ liquidity management across settlement services. Cyber resilience capabilities were also strengthened. Finally, the initiative supported multi-vendor connectivity, thereby fostering competition among network service providers.

In March 2023 TARGET2 was replaced by a third-generation system, T2. Technically, T2 comprises: (i) a central liquidity management (CLM) component for settling central bank operations and managing participants’ liquidity, and (ii) an RTGS service for payments and ancillary system settlement. Like TARGET2, T2 is connected to T2S and TIPS.

2024 was the first full year of operation of the consolidated TARGET Services, which comprise T2, T2S and TIPS. TARGET Services offer harmonised market infrastructure services at the EU level to a wide range of financial institutions, with a single set of rules, standards and tariffs, thereby ensuring a level playing field and market integration. Almost 1,000 direct participants in Europe use T2 for payments. Taking into account branches and subsidiaries, around 40,000 banks (identified as business identifier code (BIC) holders) worldwide (and all their customers) can be reached via T2. T2S connects 24 central securities depositories (CSDs) and their participants across 23 markets, allowing securities transactions to be settled against euro or Danish kroner. TIPS connects almost 15,000 banks, offering instant payment settlement in euro and Swedish kronor. Overall, TARGET Services contribute to financial integration, financial stability and liquidity efficiency in the euro area.

2 Activity in TARGET Services

In 2024 all TARGET Services saw an increase in activity compared to 2023. The surge was particularly strong in TIPS, which experienced a five-fold increase in volume, highlighting its growing role in the instant payments landscape. Despite being long-established services, T2 and T2S also saw higher total settlement volumes, with increases of 3.6% and 14.0% respectively.

In terms of value, TARGET Services settled €712,999.3 billion in 2024, a 3.7% increase from the previous year. On average, €2,784.8 billion was settled across TARGET Services each day. While TIPS experienced an 87.1% rise in value, the 24.0% increase in T2S activity had a greater impact on the total, given its larger weight. Conversely, T2 experienced a 4.7% decrease as a residual effect of the move to the consolidated T2-T2S platform. Overall, these developments underscore the significant expansion of TIPS and the robust performance of T2S.

Technical note

In early 2025 the Eurosystem made an adjustment to the T2 statistical reporting framework that excludes additional liquidity transfers between the CLM component and the RTGS service from T2 traffic statistics.[1] To ensure comparability with 2024, in this report T2 traffic statistics related to 2023 have also been revised.

Table 1

TARGET Services traffic at a glance

Volume (number of transactions) | Value (EUR billions) | ||||||

|---|---|---|---|---|---|---|---|

2023 | 2024 | Change (%) | 2023 | 2024 | Change (%) | ||

T2 | Total | 104,273,922 | 107,999,982 | +3.6% | 486,793.1 | 463,735.6 | -4.7% |

Daily average | 408,917 | 421,875 | +3.2% | 1,909.0 | 1,811.5 | -5.1% | |

T2S | Total | 177,766,588 | 202,602,542 | +14.0% | 200,746.6 | 248,939.7 | +24.0% |

Daily average | 699,868 | 791,416 | +13.1% | 790.3 | 972.4 | +23.0% | |

TIPS | Total | 269,766,787 | 1,354,847,183 | +402.2% | 173.1 | 324.0 | +87.1% |

Daily average | 741,118 | 3,681,650 | +396.8% | 0.5 | 0.9 | +85.1% | |

Total | Total | 551,807,297 | 1,665,449,707 | +201.8% | 687,712.8 | 712,999.3 | +3.7% |

Daily average | 1,849,903 | 4,894,941 | +164.6% | 2,699.8 | 2,784.8 | +3.1% | |

Source: TARGET.

Note: There were 256 operating days in 2024 and 255 operating days in 2023. T2S traffic comprises traffic in both euro and Danish kroner (converted into euro at an exchange rate of DKK 1 = EUR 0.13). TIPS traffic comprises traffic in both euro and Swedish kronor (converted into euro at the SEK/EUR exchange rate of the last business day of each year). As TIPS data per calendar day are not available for 2023 and not fully available for 2024, the daily average volumes and values have been calculated using a proxy for the applicable number of calendar days.

2.1 Participation in TARGET Services

Participation in TARGET Services enables access to the Eurosystem’s monetary policy operations and payment and securities settlement in central bank money (money held in an account at a central bank). Financial institutions can choose to access TARGET Services directly (as direct participants) or indirectly (via a direct participant). From a legal perspective, direct participants hold TARGET accounts in the TARGET component systems of their respective central banks.

Via the CLM component, participants are able to participate in central bank refinancing operations, make use of the Eurosystem’s standing facilities, access the intraday credit line, and steer, manage and monitor liquidity across all TARGET Services.[2] In December 2024 there were a total of 5,889 CLM accounts in T2 (Table 2). Participants may hold multiple accounts, depending on their own structure or internal organisation. Holding an account in the CLM component is a pre-requisite to access settlement in any TARGET service.

Table 2

Accounts per TARGET service at the end of 2024

Number of accounts | |

|---|---|

T2 CLM | 5,889 |

T2 RTGS | 1,230 |

T2S DCAs | 926 |

T2S SACs | 2,774,992 |

TIPS | 341 |

Source: TARGET.

Note: Technical accounts and sub-accounts are not included in the statistics for the CLM component or the RTGS service.

In the RTGS system, participants can exchange bank-to-bank payments, customer payments and transactions related to settlement in other FMIs. As participation in the RTGS is optional, monetary policy counterparties can open an account in the CLM component without holding an account in the RTGS service. This is typically the case for small institutions which may rely on other RTGS participants to send and receive their payments indirectly. As a result, the total number of RTGS accounts, which stood at 1,230 at the end of 2024, is lower than the total number of CLM accounts.

T2S provides harmonised and commoditised securities settlement to central securities depositories (CSDs) and applies a single set of rules, standards and fees to all of them. Market participants may hold a dedicated cash account (DCA) with one of the central banks connected to T2S and a securities account (SAC) with a connected CSD. This set-up ensures the simultaneous, efficient and secure exchange of securities and cash. Securities settlement is available in central bank money against both euro and Danish kroner. A total of 24 CSDs across 23 markets were connected to T2S as of 2024. In December 2024 the total number of T2S DCAs denominated in euro or Danish kroner stood at 926.

In TIPS, PSPs can transfer funds on behalf of their customers in real time 24 hours a day, every day of the year. TIPS offers final and irrevocable settlement of instant payments in euro and, since 19 February 2024, Swedish kronor.[3] In December 2024, the total number of TIPS DCAs and ancillary system technical accounts (ASTAs) denominated in euro or Swedish kronor was 341.

Participation in the RTGS

The T2 RTGS service facilitates the settlement of large-value payments in central bank money. Financial institutions can choose to become direct participants in the service, opening one or more accounts, or to participate indirectly via correspondent banks. The T2 RTGS directory lists all the participants and institutions addressable in the RTGS system and is available to all direct participants for information and routing purposes.

At the end of December 2024, 957 direct participants held an RTGS account in T2 and were registered as such in the directory (Table 3).[4] Through these, 5,471 correspondents worldwide were able to settle transactions in T2. Including the branches of direct participants and correspondents, a total of 40,142 BIC holders around the world (54.3% of which were located in the European Economic Area – EEA) were accessible via T2 at the end of 2024. This figure represents a marginal increase of 0.8% compared to 2023, driven by all participation types.

Table 3

T2 RTGS participants by type in 2024

Number of accounts | |

|---|---|

Direct participation | 957 |

Multi-addressee – credit institution | 49 |

Multi-addressee – branch of direct participant | 926 |

Addressable BIC – correspondent | 5,471 |

Addressable BIC – branch of direct participant or entity that is part of the same group | 22,831 |

Addressable BIC – branch of indirect participant or entity that is part of the same group | 1 |

Addressable BIC – branch of correspondent or entity that is part of the same group | 9,907 |

Source: T2.

Besides banks and investment firms, FMIs can also participate directly in the RTGS service. In T2 these are referred to as “ancillary systems”. The CPMI-IOSCO Principles for financial market infrastructures require an FMI to “conduct its money settlements in central bank money, where practical and available, to avoid credit and liquidity risks”.[5] Moreover, settlement in central bank money in T2 is mandatory for FMIs that have been designated as such under the Systemically Important Payment Systems (SIPS) Regulation[6]. A total of 71 ancillary systems used the RTGS service for settlement purposes at the end of 2024. These were mainly retail payment systems (32), securities settlement systems (18) and central counterparties (14).

Participation in TIPS

TIPS allows the settlement of instant payments in central bank money. PSPs can choose to become direct participants in the service, opening one or more TIPS dedicated cash accounts (DCAs), or to be addressed indirectly as reachable parties within TIPS.[7] Reachable parties can settle payments via a direct participant’s account. In this case, participants can define payment capacity limits – “credit memorandum balances” (CMBs) – for their reachable parties. Like the T2 RTGS directory, the TIPS directory lists all participants and reachable parties and is available to TIPS participants for information and routing purposes.

Besides direct and indirect participation of PSPs, TIPS also enables clearing and settlement mechanisms (CSMs) which have declared compliance with the EPC’s SCT Inst scheme to hold an ASTA, allowing their respective settlement members to fund and defund their positions.

All participants (direct participants, reachable parties and ASTA holders) may either exchange messages with TIPS directly or may use instructing parties. An instructing party acts as a technical intermediary, sending and receiving messages to or from TIPS on the participant’s behalf.

For payments in euro, at the end of December 2024, 323 direct participants held TIPS DCAs and 12 CSMs held TIPS ASTAs (Table 4). Through these, 14,884 parties were reachable via TIPS.

Table 4

TIPS euro settlement participants by type in 2024

Number of parties | |

|---|---|

Direct participants – DCA holders | 323 |

Direct participants – ASTA holders | 12 |

Reachable parties | 14,884 |

Source: TIPS.

Box 1

Non-bank PSPs’ access to TARGET Services

On 18 July 2024 the Governing Council approved the Eurosystem’s policy on access by non-bank PSPs to all euro area central bank-operated payment systems and to central bank accounts.[8] The policy sets out, as a general principle, that access to euro area central bank-operated payment systems is to be granted to non-bank PSPs that meet all the risk-mitigation requirements. The holding of a central bank account implies placing funds necessary to meet settlement obligations only, and the Eurosystem will not offer non-bank PSPs access to accounts for the purpose of safeguarding client funds. To mitigate central bank-specific concerns from the perspectives of financial stability and monetary policy, the Eurosystem will impose a maximum holding limit on accounts held by non-bank PSPs. The policy follows the enactment of the Instant Payments Regulation[9], which, among other things, amended the Settlement Finality Directive[10] to allow non-bank PSPs to participate in designated payment systems. The Eurosystem implemented the policy by way of a Governing Council Decision[11], with related updates to the TARGET Guideline[12] expected to enter into force in October 2025.

2.2 T2

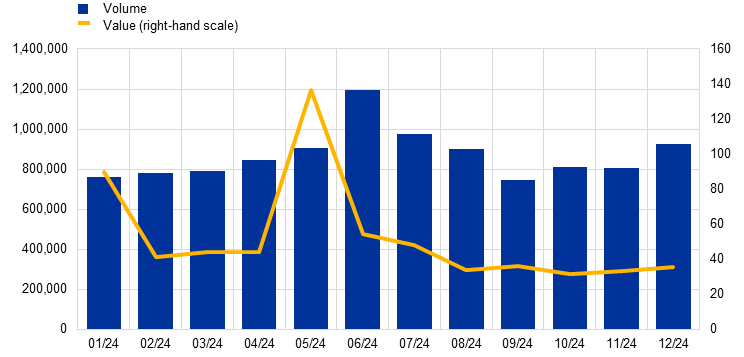

Volume developments

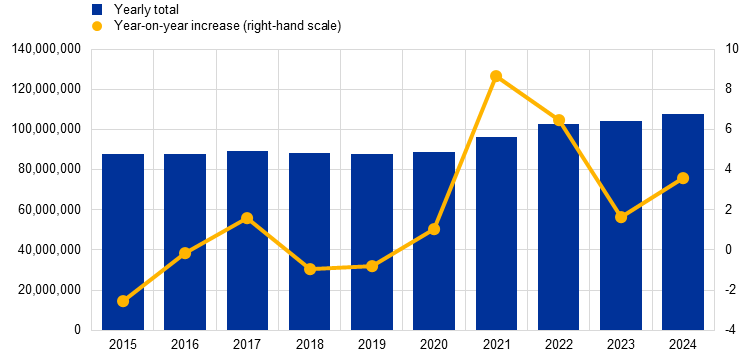

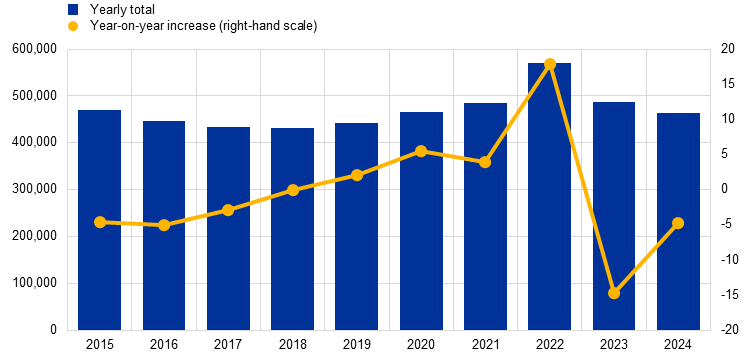

The volume of payments settled in T2 reached a new historical peak in 2024 with a total of 107,999,982 transactions, exceeding the previous peak of 104,273,922 transactions in 2023. Volumes have been increasing constantly since 2020, with yearly growth of 8.7% in 2021 and 6.5% in 2022. Although the pace slowed, growth continued at 1.6% in 2023 and 3.6% in 2024 (Chart 1). This still represents a strong performance and confirms that the system is overwhelmingly supported by its participants. The increase was mostly driven by customer payments, which also constitute the bulk of T2 volumes.

Chart 1

Volumes settled in T2 over time

(left-hand scale: yearly totals, number of transactions; right-hand scale: percentages)

Source: T2.

Note: Data before 20 March 2023 relate to TARGET2.

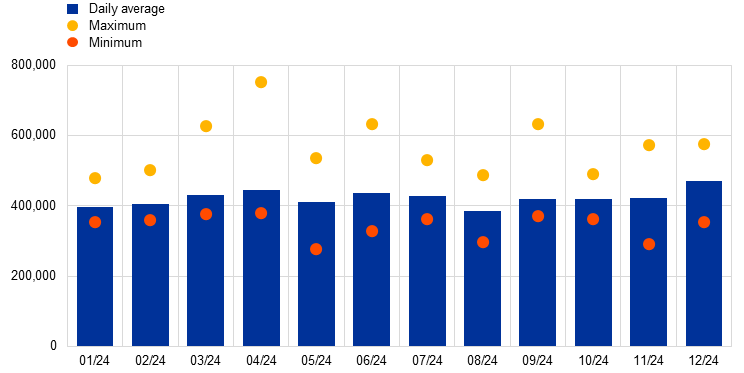

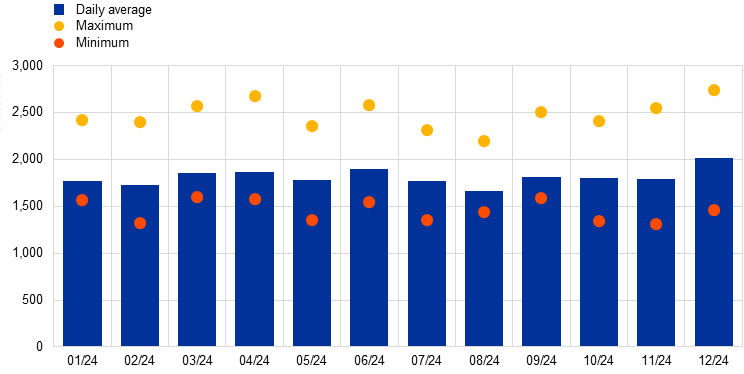

The average daily volume stood at 421,875 payments in 2024, compared to 408,917 in 2023. The lowest volume of the year was recorded on 9 May (Ascension Day), which was a holiday in many EU Member States. On that day, traffic amounted to 276,629 payments (Chart 2). The highest volume was recorded on 2 April, the first business day after the Easter break, when the figure rose to 752,175 payments. This is not an unusual pattern, as it follows the closure of the system for four days in a row. Overall, the seasonal pattern of T2 volumes in 2024 was similar to that of the previous years.

Chart 2

Volumes settled in T2 in 2024

(number of transactions)

Source: T2.

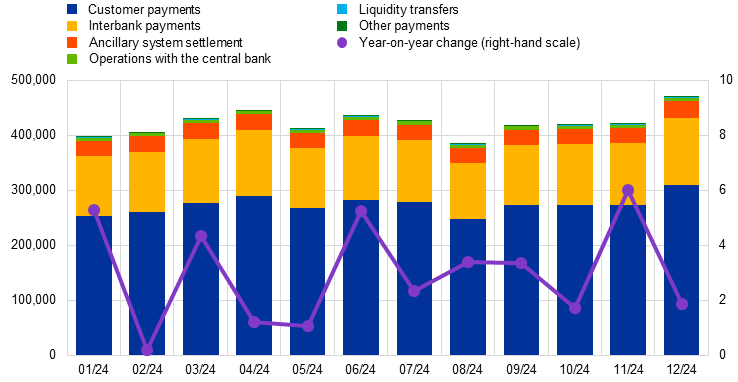

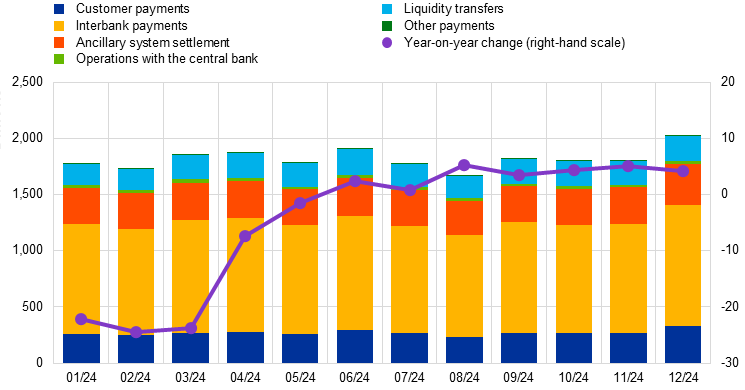

Traffic in T2 can be divided into six categories: (i) interbank payments, (ii) customer payments (payments made on behalf of customers), (iii) operations with the central bank (such as monetary policy operations, banknote and coin withdrawals and deposits), (iv) ancillary system settlement, (v) liquidity transfers, and (vi) other payments (a residual category comprising, for instance, return payments).

Customer payments represent the majority of T2 volumes, and in 2024 the daily average number of customer payments ranged between 248,682 in August and 310,265 in December (Chart 3). Customer payments accounted for 65.0% of T2 volumes in 2024 and grew by 6.1% compared to 2023, with growth spread across participating countries. These positive figures show that, so far, the number of customer payments settled in T2 has not suffered from the uptake of instant payments in Europe. The second largest contributor to T2 volumes was interbank payments, with a daily average of 112,276 payments, or 26.6% of T2 volumes. Ancillary system settlement reached 28,425 payments on average per day, representing 6.7% of T2 volumes. Operations with the central bank, liquidity transfers and other payments accounted for 7,102 payments per day, corresponding to less than 2% of T2 volumes.

Each month in 2024 saw an increase in the daily average volume compared to same month in 2023, ranging between 0.2% and 6.0%.

Chart 3

Volumes settled in T2 by payment category in 2024

(left-hand scale: number of transactions, daily averages; right-hand scale: year-on-year growth, percentages)

Source: T2.

Each payment in T2 has an assigned priority, which influences its speed of settlement. In general, payments in T2 are settled immediately on a “first in, first out” basis, as long as sufficient liquidity is available in the debited participant’s account. If this is not the case, payments are queued according to their priority. While liquidity transfers and ancillary system settlement are processed with the highest priority, T2 also offers its participants the possibility of actively assigning and managing priorities for the remaining payments in the RTGS service and of reserving a certain amount of their account balance for such payments. The priorities for pending transactions can be changed at any time in application-to-application (A2A) or user-to-application (U2A) mode via the RTGS graphical user interface (GUI).

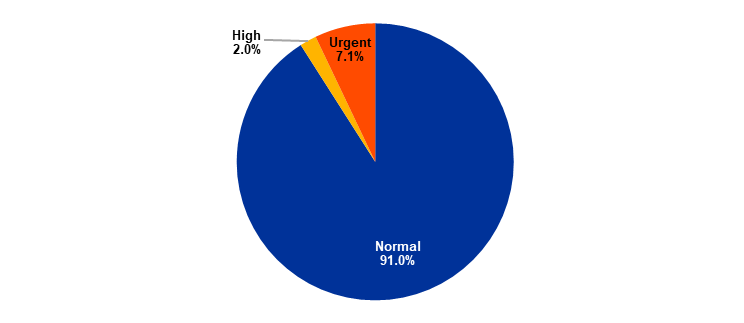

In the RTGS service, 91.0% of payments had “normal” priority in 2024 (Chart 4). Only 2.0% of payments had the intermediate “high” priority, while 7.1% of payments had the highest “urgent” priority. It should be noted, however, that in value terms, more than a fifth of the payments were urgent. This is understandable, as urgent payments are typically low in number but high in value.

Chart 4

Volumes settled in the RTGS service by priority in 2024

(percentages)

Source: T2.

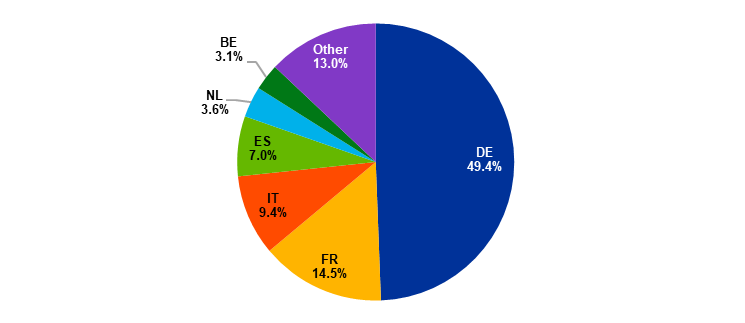

The distribution of T2 volumes across banking communities was largely unchanged compared with the previous year. The largest contributors in 2024 were Germany, which accounted for almost half of the transactions settled in the system (49.4%), and France (14.5%) (Chart 5). Next came Italy (9.4%) and Spain (7.0%). The Netherlands and Belgium contributed similar amounts to T2 volumes, namely 3.6% and 3.1% respectively. All the other countries together accounted for 13.0%.

This concentration is a consequence of several factors, including the size of the national banking system, the presence of FMIs, the location of banking groups’ headquarters, and the role of institutions based in the country in providing access to T2 to non-euro area banks. Moreover, from a technical viewpoint, the system allows the activities of banking groups to be consolidated in a single RTGS account held by the group’s head office, thus increasing concentration in countries where a large number of such groups are domiciled.

Chart 5

Volumes settled in T2 by country in 2024

(percentages)

Source: T2.

Note: The country is identified as the location of the central bank of the debited participant for each payment.

Value developments

The total value of payments settled in T2 amounted to €463,735.6 billion in 2024, compared to €486,793.1 billion in 2023 (Chart 6). Thus, the total value of T2 traffic was down 4.7% in 2024 compared with the previous year. However, the decline was much smaller than between 2022 and 2023, when it dropped by 14.7%, mainly as a consequence of the technical changes brought about by the go-live of the T2-T2S consolidation project.[13] The impact of these technical changes was still visible in the first quarter of 2024, with a sharp year-on-year decline in the value of operations with the central bank and interbank payments. By the second half of the year, year-on-year growth had resumed.

On average, T2 settled the equivalent of the euro area’s annual gross domestic product (GDP)[14] in around eight days of operations in 2024. This reflects the efficiency of the system and the crucial role it plays, providing intraday finality for transactions and allowing the funds credited to the participant’s account to become available for other payments immediately. Consequently, in a single day the same euro can be reused several times by several participants.

Chart 6

Values settled in T2 over time

(left-hand scale: EUR billions, yearly totals; right-hand scale: percentages)

Source: T2.

Note: Data before 20 March 2023 relate to TARGET2.

T2 settled on average €1,811.5 billion worth of payments each day in 2024, with the daily average ranging between €1,663.0 billion in August and €2,019.8 billion in December (Chart 7). The lowest daily turnover was €1,307.7 billion, which was recorded on 11 November, i.e. Armistice Day. The highest daily turnover was €2,747.1 billion and was recorded on 20 December.

Chart 7

Values settled in T2 in 2024

(EUR billions)

Source: T2.

Box 2

Adjustments to the T2 statistical reporting framework

After the replacement of TARGET2 with T2 on 20 March 2023, the framework for reporting traffic statistics previously defined for TARGET2 was adapted to T2 following the same principles. The guiding principle of the TARGET2 statistical framework had been to report traffic from a business perspective, i.e. reporting only transactions leading to a change of ownership of the funds and excluding liquidity transfers among different accounts of the same participant, technical transactions and recourse to the deposit facility. The Eurosystem agreed that the same principle should continue to apply to T2 and developed a statistical framework for traffic computation in the months following the go-live of T2. Although the overall reported traffic for T2 showed continuity with that of its predecessor TARGET2, the Eurosystem acknowledged that revisions and further refinements might still be made to take into account the considerable technical and functional changes in the new platform which were also reflected in the data.

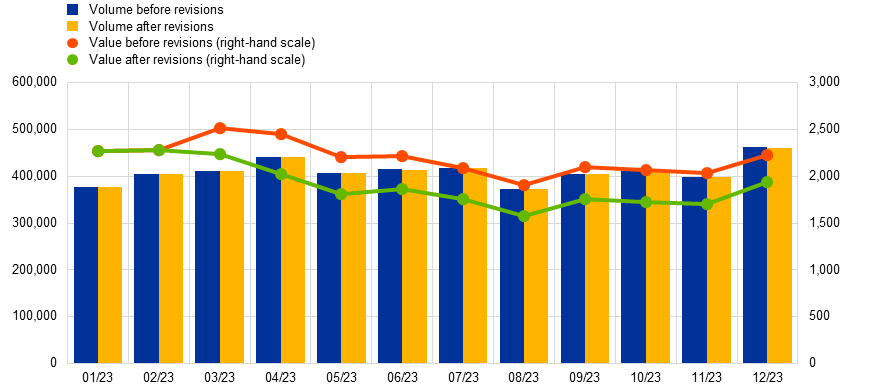

With the experience gained through working on the T2 data, over the last year the Eurosystem was able to improve the identification of liquidity transfers. This led to additional liquidity transfers between the CLM component and the RTGS system where the parties owning the debited and the credited accounts were the same being excluded from the traffic computation. In early 2025, after a phase of testing, corrections to the statistics were deployed. To ensure full comparability, all the published statistics, e.g. on the ECB’s website, in the current report and other documentation, were revised backwards.[15]

The recalculated T2 traffic statistics were largely unchanged in volume but experienced a downward shift in value. The difference is fairly consistent over time. This was expected, since liquidity transfers are typically stable flows that are low in number but high in value. On average, daily volumes of liquidity transfers decreased by 262 between April and December 2023, resulting in a revised daily average traffic of 412,761 payments (Chart A). In value terms, the daily average traffic decreased by €348.4 billion to €1,787.5 billion over the same period.

Chart A

Traffic settled in T2 in 2023 before and after methodological revisions

(left-hand scale: number of transactions, daily averages; right-hand scale: EUR billions, daily averages)

Sources: TARGET2 and T2.

Overall, the adjustments to the T2 statistical reporting framework have allowed a more precise calculation of T2 traffic. A comparison of the statistics before and after the revision confirms that the impact was not significant in volume terms but was more pronounced in value terms, although trends remained largely unchanged. The Eurosystem can therefore continue to carefully monitor and inform the public about T2 traffic developments on the basis of a robust statistical framework.

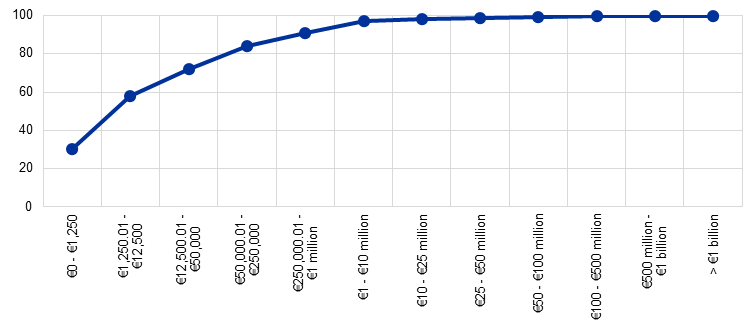

More than 70% of payments in T2 had a value of €50,000 or less in 2024, while transactions with a value of more than €1 million accounted for 9% of traffic (Chart 8). Although the average payment size was €4.3 million, the median value was much lower at €6,532, meaning that half of the transactions settled in 2024 were below this amount. These results are fully in line with previous years, showing that T2 was still widely used for low-value payments in 2024, in particular for urgent customer payments. This confirms that T2 offers a range of features that are also attractive for low-value transactions, which are mainly of a commercial nature. The fact that a large-value payment system like T2 is also used for settling low-value payments is not unusual and is also observed in other systems worldwide. It remains to be seen whether the increased prominence of instant retail payments will have an impact on this trend in the future, although so far there does not seem to be any indication of a substitution effect.

Chart 8

Distribution of T2 transactions across value bands in 2024

(percentages, cumulative)

Source: T2.

While customer payments represent the majority of T2 volumes (as shown in Chart 3), interbank payments are traditionally the largest contributors to T2 values (54.2% in 2024). The daily average value of interbank payments ranged between €904.5 billion in August and €1,071.5 billion in December (Chart 9). The average daily value of ancillary system settlement in 2024 was €324.0 billion, followed by customer payments at €269.0 billion and liquidity transfers at €211.6 billion, corresponding to 17.9%, 14.8% and 11.7% of T2 values respectively. The highest daily values for ancillary system settlement and customer payments were recorded in December, while the lowest occurred in August, in line with interbank payments.

Chart 9

Values settled in T2 by payment category in 2024

(left-hand scale: EUR billions, daily averages; right-hand scale: year-on-year growth, percentages)

Source: T2.

Between January and May 2024, daily average T2 values fell compared to the same months in 2023 (Chart 9). This was mainly driven by the residual impact of the technical changes due to the T2-T2S consolidation on operations with the central bank and interbank payments. Although less than half of the participating countries experienced a decrease in interbank payments, these included some of the larger countries, such as Germany, France and the Netherlands. At the same time, the decline in ancillary system settlement that began in 2023 continued in 2024, albeit at a progressively slower pace. As of June 2024, when the effects of the go-live of the T2-T2S consolidation project and of the subsequent stabilisation phase was over, the daily average values returned to growth (in line with volumes), ranging between 0.8% and 5.3% each month.

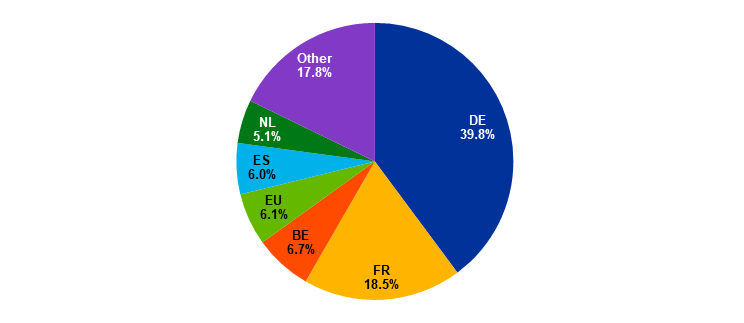

As in the case of volumes, the distribution of T2 values across banking communities was largely unchanged in 2024 compared with 2023, with Germany (39.8%) and France (18.5%) being the two largest contributors (Chart 10). Belgium, the ECB, Spain, and the Netherlands accounted for similar shares of 6.7%, 6.1%, 6.0% and 5.1% respectively.

Chart 10

Values settled in T2 by country in 2024

(percentages)

Source: T2.

Note: The country is identified as the location of the central bank of the debited participant for each payment.

As in 2023, the ECB was among the top contributors in terms of value settled. Like any other Eurosystem central bank, the ECB has its own TARGET component system. However, the ECB’s participants include FMIs of European or international relevance, such as CLS, EURO1 and STEP2. These FMIs conduct relatively few transactions, but the amounts are very large, which explains why the ECB’s component system makes up a significant share of total T2 turnover.

The asymmetry in the contributions to T2 volumes and values indicates that T2 traffic in France, the Netherlands and Belgium tends to be relatively more value-intensive, while in Germany, Italy and Spain it tends to be relatively more volume-intensive. As discussed in relation to Chart 5, this is a result of the characteristics of each national banking community.

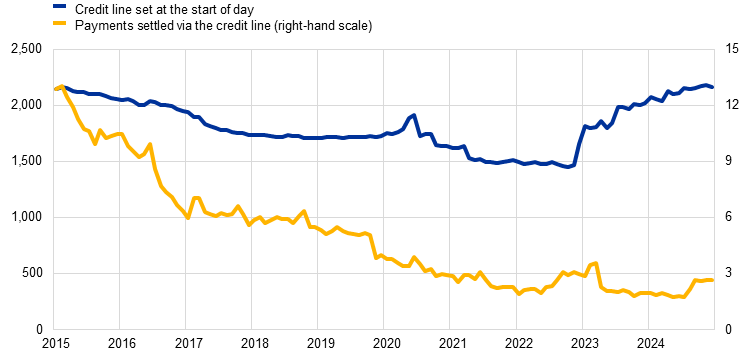

Intraday credit

The intraday credit line is a facility in T2 whereby participants can overdraw their intraday account against eligible collateral.[16] Intraday credit is provided interest-free on participants’ accounts in the CLM component and has to be repaid by the end of the day. At the end of 2024 the average daily credit line granted to participants at the start of the business day amounted to €2,165.7 billion, representing a 7.1% increase compared with the previous year (Chart 11). This value has been growing since the end of 2022, and the increase in 2024 marked a return to levels last recorded in early 2015. This is linked to the release of collateral following the repayment of targeted longer-term refinancing operations (TLTROs) by Eurosystem counterparties. These counterparties were able to use the freed-up collateral to obtain intraday credit in T2.

Chart 11

T2 intraday credit line

(left-hand scale: EUR billions, daily averages; right-hand scale: percentages)

Source: T2.

Notes: The intraday credit line is calculated as the sum of the individual intraday credit lines granted at the start of day. Data before 20 March 2023 relate to TARGET2.

At the same time, only a small share of the T2 payment values was settled via the credit line in 2024. In general, T2 participants can rely on three sources of liquidity to fund their payments: incoming payments, their account balance, and intraday credit. Intraday credit is used when the other two sources are not sufficient. Since the start of the public sector purchase programme (PSPP) in 2015, abundant central bank reserves have made participants less reliant on intraday credit, resulting in an around 10 percentage point decline in the share of payments settled via this facility. In 2024 payments settled via the credit line represented between 1.8% and 2.7% of T2 traffic by value.

Business day phases

The RTGS business day is composed of four main phases: (i) the start of the day, which lasts from 18:45 CET to 19:30 CET; (ii) the real-time settlement window I (RTGS RTS I) from 19:30 CET to 02:30 CET; (iii) the real-time settlement window II (RTGS RTS II) from 02:30 CET to 18:00 CET; and (iv) the end of the day. The RTGS RTS II phase may be interrupted by an overnight maintenance window, which is optional between two consecutive business days and mandatory over the weekend.

During the RTGS RTS I phase, only ancillary system settlement and liquidity transfers can be processed. In 2024, out of the total traffic settled in this phase, ancillary system settlement represented on average 83.0% by value and 97.9% by volume. Since the system is closed to other forms of payment processing during this part of the operational day, ancillary systems can take advantage of participants’ stable and predictable liquidity positions and settle their transactions efficiently and safely. In general, this phase is mainly used by retail payment systems to settle their members’ positions.

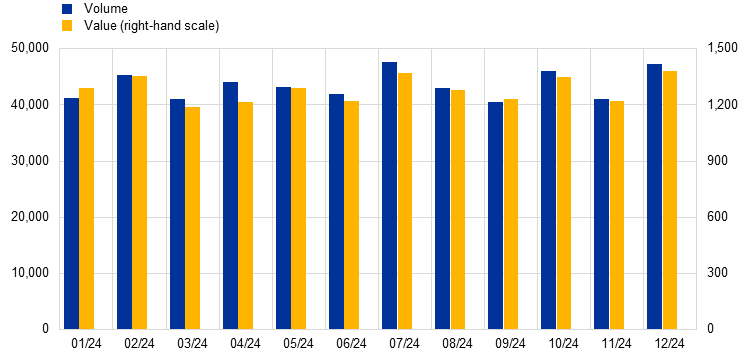

In 2024 a total of 43,513 payments were settled each month during the RTGS RTS I phase, corresponding to a daily average of 2,040 payments (Chart 12). In value terms, this corresponded to a monthly total of €1,283.2 billion, or €60.1 billion daily.

Chart 12

RTGS RTS I settlement in 2024

(left-hand scale: number of transactions, monthly totals; right-hand scale: EUR billions, monthly totals)

Source: T2.

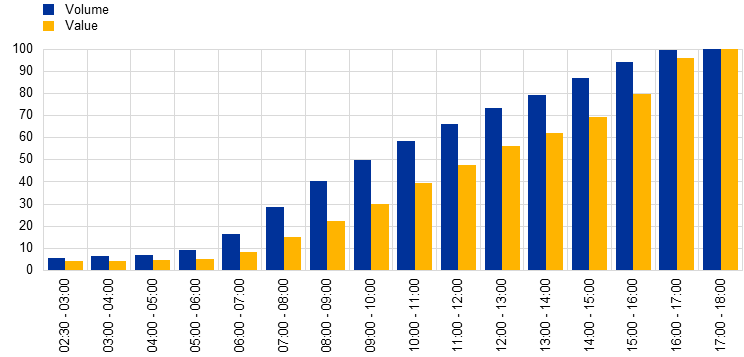

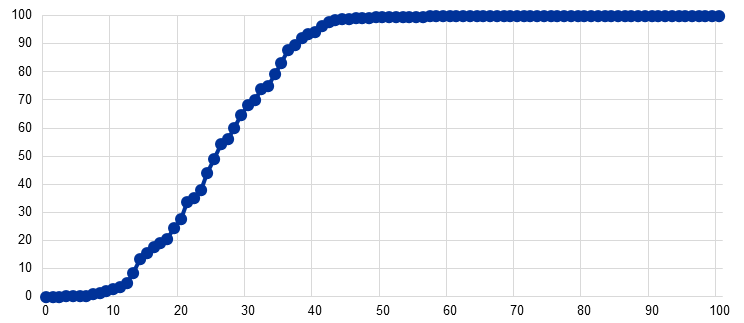

During the RTGS RTS II phase, all categories of payments can be processed. In 2024, on average, 16.3% of payments by volume and 8.2% of payments by value were settled between 02:30 CET and 07:00 CET (Chart 13). Within the next hour, from 07:00 CET to 08:00 CET, these percentages nearly doubled, reaching 28.4% and 15.0% respectively. Payment settlement continued smoothly throughout the day. By 17:00 CET, which is the cut-off time for customer payments, 99.7% by volume and 96.0% by value were settled. During the last hour until 18:00 CET, the remaining payments, which are typically low in number but large in value, were settled. This distribution gives confidence to the T2 operator that settlement is evenly spread throughout the day.[17]

Chart 13

RTGS RTS II traffic distribution in 2024

(x-axis: time (CET); y-axis: percentages, cumulative)

Source: T2.

Payments in T2 can be introduced in advance in the form of “Warehoused payment orders”. “Warehoused payment orders” are submitted to T2 for settlement on specific days and at specific times up to ten calendar days later. As most warehoused transactions are settled immediately after the opening of the RTGS service, a significant share of them fall between 02:30 CET and 03:00 CET. Most of the warehoused transactions are introduced into the system between 10:00 CET and 12:00 CET or between 16:00 CET and 18:00 CET.

Unsettled traffic

Payments that are not processed by the end of the business day, either because they were erroneous, insufficient funds were held in the account to be debited, or the sender’s limit was breached, are ultimately rejected when the cut-off time is reached in T2 and thus count as unsettled transactions at the end of the day.[18] Other unsettled transactions occur, for example, when a participant actively cancels a submitted payment.

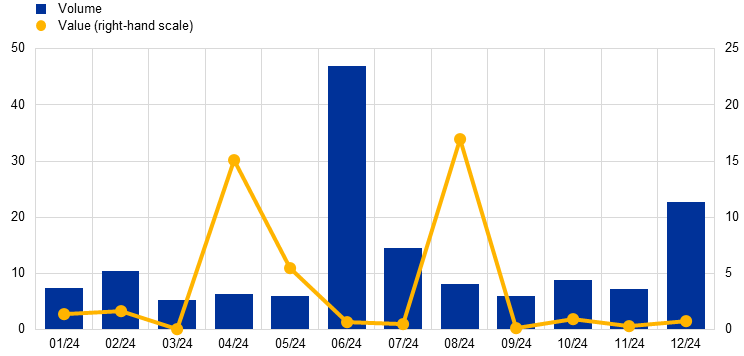

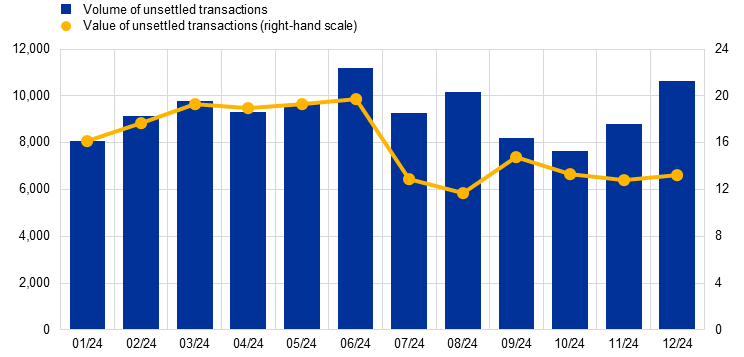

The T2 operator carefully monitors the number of transactions rejected by the system, as this may have operational risk implications. In 2024 the daily average number of rejected payments in the RTGS service ranged between five in March and 47 in June (Chart 14). The peak in June was driven by a higher than usual number of unsettled low-value payments due to technical issues affecting one participant. In value terms, unsettled payments ranged between a daily average of €0.1 billion in March and €17.0 billion in August. The peak in August was driven by an incident on 30 August, while a similar peak in April was due to the failure of a single very high value payment on one day.

Chart 14

Rejected payments in the RTGS service in 2024

(left-hand scale: number of transactions, daily averages; right-hand scale: EUR billions, daily averages)

Source: T2.

These results were in line with 2023, confirming that, since the go-live of T2, rejected payments have stabilised at a very low level. It shows in particular that, in the new system, rejections due to lack of funds have been reduced thanks to the liquidity optimisation mechanisms that have been implemented.

Cross-border traffic

T2 contributes to strengthening financial integration among EU Member States and plays a key role in sustaining the global reach of the euro. Information on the full payment chain (originator, sending settlement bank, receiving settlement bank, beneficiary and any intermediate agents) can help shed light on both the European and global dimensions of T2.

Focusing on the sending and receiving settlement banks in the RTGS service, the share of inter-Member State traffic indicates the percentage of traffic exchanged between direct participants belonging to different banking communities.[19] In 2024 the share of inter-Member State traffic was 52.4% in volume terms and 61.0% in value terms (Chart 15), which was similar to the levels in 2023 of 52.3% and 60.8% respectively. This indicator increased, especially in value terms, between 2022 and 2023, primarily as a result of a change in the calculation methodology when T2 replaced TARGET2.[20]

Chart 15

Share of inter-Member State traffic in the RTGS service over time

(percentages)

Source: T2.

Note: Data before 20 March 2023 relate to TARGET2.

Tiered participation

Tiered participation arrangements are made in a system such as T2 when a direct participant in that system provides services that allow other participants to access the system indirectly. The indirectly connected participants benefit from the clearing and settlement facility services offered by direct participants.

While indirectly connected parties (referred to as “addressable BIC holders” in T2) benefit from a settlement facility that would otherwise be costly to access directly, such arrangements also entail risks. Tiered participation arrangements can create dependencies that may lead to credit, liquidity or operational risks for the payment system and its participants and, ultimately, risks to the stability of the banking system. Close monitoring of the tiering level in T2, especially in value terms, has thus always been of paramount importance. It is also an oversight requirement under Article 17 of the SIPS Regulation.

Over the last ten years, the share of payments sent or received by direct participants in T2 (or TARGET2 before March 2023) has followed an upward trend. The level of tiered traffic in value terms ranged between 4.9% and 7.0% between 2015 and 2022 on both the sending and the receiving side (Chart 16). The methodological changes applied when T2 went live explain most of the increase observed in 2023, when the share of tiered traffic in value terms reached 10.6% on the sending side and 9.3% on the receiving side.[21] In 2024 this share increased further to 12.4% on the sending side and 9.8% on the receiving side. Meanwhile, between 2015 and 2024 the tiered volume increased steadily from 17.0% to 25.3% on the sending side and from 11.7% to 19.0% on the receiving side.

Chart 16

Tiering levels in T2 over time

(percentages)

Source: T2.

Note: Data before 20 March 2023 relate to TARGET2.

There is persistent asymmetry between the share of tiered traffic in value terms and the share of tiered traffic in volume terms, as well as between payments that are tiered on the sending side and those that are tiered on the receiving side. This suggests that indirect participants use direct participants in T2 to settle transactions more frequently on the sending side than on the receiving side and that the average tiered transaction is larger on the receiving side than on the sending side.

For tiered payments sent to T2 in 2024, the tiering at system level reached around 12.4% in terms of value and 25.3% in terms of volume (Chart 17). This means that, on average, for every euro sent by direct participants in T2 during the year, only 12.4 cent was settled on behalf of indirectly connected parties outside their banking group. More than 75% of the tiered business (consolidated at banking group level) came from outside the EEA, showing that T2 contributes to the international role of the euro and makes it possible for institutions around the world to access the euro market.

Chart 17

Tiered traffic sent to T2 in 2024

(percentages; ten-day moving averages)

Source: T2.

2.3 T2S

This section reports on T2S statistics covering securities settlement in both euro and Danish kroner.[22]

Volume developments

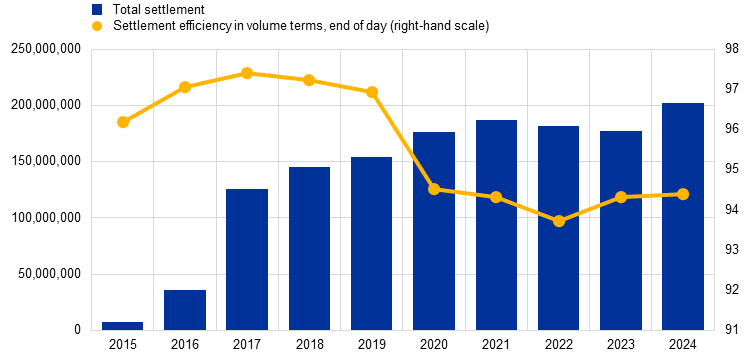

In 2024 total volumes settled in T2S increased by 14.0%, reaching a record of 202,602,542 transactions (Chart 18). This follows two consecutive years of small declines (-2.3% in 2023 and -2.9% in 2022) which amplified the observed increase in 2024.[23] The increase in volume is partly due to 2024 being the first full year of activity of the five new CSDs that joined T2S in September 2023, with Euroclear Finland being particularly notable. The German market also made a significant contribution to this increase following the introduction of a new market participant.

Settlement efficiency in volume terms was almost unchanged compared to the previous year at 94.4% (Chart 18).[24] Over the years, settlement efficiency has always stood at high levels, ranging from 93.7% in 2022 to 97.4% in 2017. In 2020, following the introduction of the new T2S statistical framework, settlement efficiency in volume terms was 2.4 percentage points lower than the previous year at 94.5%, owing to a new calculation methodology.[25] Since 2020 settlement efficiency has remained fairly stable, varying by less than 1 percentage point.

Chart 18

Volumes settled in T2S and settlement efficiency over time

(left-hand scale: number of transactions, yearly totals; right-hand scale: settlement efficiency at end of day, percentages)

Source: T2S.

Notes: CSDs joined T2S in several migration waves and subsequent expansions: 22 June-31 August 2015 (wave 1); 29 March 2016 (wave 2); 12 September 2016 (wave 3); 6 February 2017 (wave 4); 18 September 2017 (wave 5); 27 October 2017 (NCDCP); 29 October 2018 (Danish kroner); 11 September 2023 (BNBGSSS, CDAD, SKDD, Euroclear Finland and Euroclear Bank). The migration day of 11 September 2023 is excluded from the statistics reported.

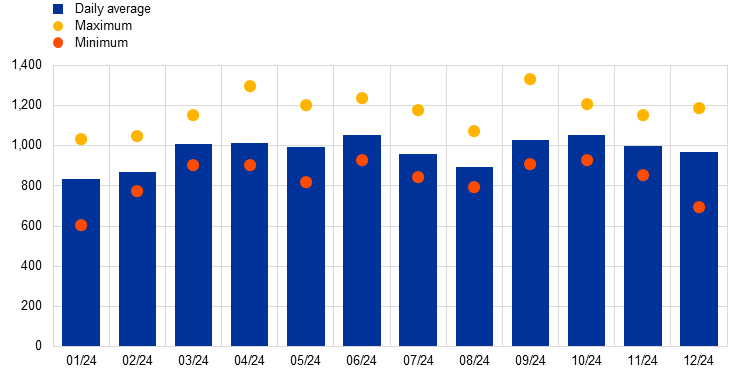

In terms of daily volumes, T2S settled an average of 791,416 transactions per day in 2024, 13.1% more than the previous year (Chart 19). The highest daily volume settled was reached on 5 March (1,524,346 transactions) following a large issuance of Italian government bonds. The lowest daily volume was recorded on 30 December (449,576), as a result of typical reduced trading over the Christmas period.

Chart 19

Volumes settled in T2S in 2024

(number of transactions, thousands)

Source: T2S.

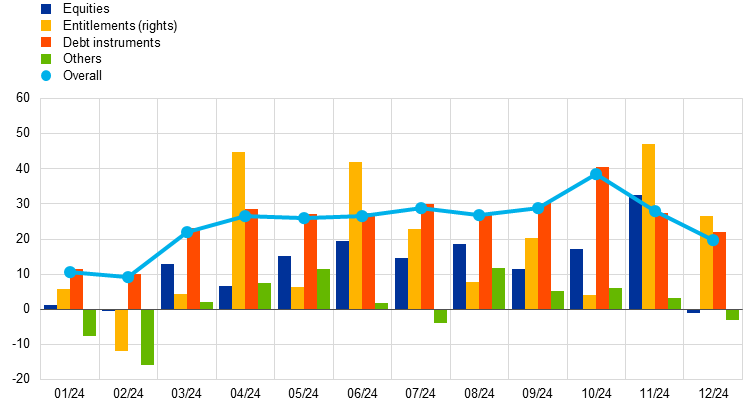

Year-on-year growth in monthly T2S volumes was generally high (above 10%) in 2024, with the exception of October (1.2%) and December (6.7%) (Chart 20). The lower growth rates in October and December were primarily driven by negative growth rates in equities and to a lesser extent by negative or low growth rates in debt instruments. The high growth rates throughout the rest of the year were supported by equities and entitlements (rights). Equity volumes increased on average by 10.6%, while entitlements (rights) volumes increased by 23.7%. Note that in 2024 equities represented 46.7% of the total volume (with a daily average of 369,608), followed by entitlements (rights) at 27.7% (daily average 219,489) and debt instruments at 13.8% (daily average 109,249) (Chart 21, panel a). This was broadly in line with the previous year.

Chart 20

Growth rates of volumes settled in T2S by securities category in 2024

(year-on-year changes, percentages)

Source: T2S.

Note: The migration day of 11 September 2023 is excluded from the calculation of the year-on-year change.

There are five transaction types in T2S: delivery-versus-payment (DVP), free-of-payment (FOP), payment-free-of-delivery (PFOD), settlement restrictions on securities (SRSE), and delivery-with-payment (DWP).[26] The majority of transactions in T2S are either DVP or FOP, which together accounted for 96.2% of the total settled volume in 2024, in line with the previous year (Chart 21, panel b). DVP transactions are the most numerous, accounting for 67.3% of the total volume (on average 532,776 transactions daily) in 2024. FOP transactions accounted for 28.9% (on average 228,781 transactions daily). PFOD transactions, SRSE transactions and DWP transactions together accounted for 3.8% (on average 29,859 transactions daily).

Chart 21

Volumes settled in T2S by securities category and by transaction type in 2024

a) By securities category | b) By transaction type |

|---|---|

(percentages) | (percentages) |

|  |

Source: T2S.

Note: Panel b): “Other” includes PFOD, SRSE and DWP.

Value developments

In 2024 the total value settled in T2S increased by 24.0%, reaching a record of €248,939.7 billion (Chart 22). This followed consecutive increases of 3.2% in 2021, 3.3% in 2022 and 9.0% in 2023.[27] The increase in value observed in 2024 was primarily supported by developments in the Spanish market driven by the general increase in issuance of fixed income instruments and the activities of the Spanish Treasury.[28]

Settlement efficiency in value terms increased by 2 percentage points compared to the previous year to 97.7%, marking the third consecutive year of improved settlement efficiency (Chart 22). In value terms, settlement efficiency has always stood at high levels, ranging from 94.1% in 2021 to 98.9% in 2015. The calculation of settlement efficiency in value terms was affected by the introduction of the new T2S statistical framework in 2020, when it was 3.2 percentage points lower than the previous year at 94.4%.

Chart 22

Values settled in T2S and settlement efficiency over time

(left-hand scale: yearly totals, EUR billions; right-hand scale: settlement efficiency at end of day, percentages)

Source: T2S.

Notes: CSDs joined T2S in several migration waves and subsequent expansions: 22 June-31 August 2015 (wave 1); 29 March 2016 (wave 2); 12 September 2016 (wave 3); 6 February 2017 (wave 4); 18 September 2017 (wave 5); 27 October 2017 (NCDCP); 29 October 2018 (Danish kroner); 11 September 2023 (BNBGSSS, CDAD, SKDD, Euroclear Finland, and Euroclear Bank). The migration day of 11 September 2023 is excluded from the statistics reported.

In 2024 T2S settled €972.4 billion on average per day, 23.0% more than the previous year (Chart 23). The highest daily value settled was reached on 18 September (€1,330.5 billion). The lowest daily value was recorded on 3 January (€607.4 billion), owing to beginning-of-the-year seasonal effects.

Chart 23

Values settled in T2S in 2024

(EUR billions)

Source: T2S.

Growth was lower in the first two months of the year (below 10%),but increased in March and remained at elevated levels for the rest of the year (around or above 20%) (Chart 24). The record value processed by T2S in 2024 was almost fully due to the increase in the value of debt instruments, which make up most of T2S turnover. With a daily average of €853.2 billion, debt instruments accounted for 87.7% of overall T2S turnover in 2024 (Chart 25, panel a). The turnover of debt instruments increased by 25.5% compared with the previous year. Monthly year-on-year growth rates stood at around 10% in January and February and fluctuated between 19.8% and 40.4% over the rest of the year. There were also high positive growth rates for most of the year for equities and entitlements (rights). However, as these together represent only 7.7% of the total value processed by T2S (Chart 25, panel a), they did not contribute significantly to the overall increase in value.

Chart 24

Growth rates of values settled in T2S by securities category in 2024

(year-on-year changes, percentages)

Source: T2S.

Notes: The migration day of 11 September 2023 is excluded from the calculation of growth rates.

In terms of transaction type, 96.1% of the value settled in T2S in 2024 came from DVP (Chart 25, panel b). The remaining 3.9% was either DWP or PFOD, as SRSE and FOP transactions do not imply a cash movement on a DCA and are therefore not included in the calculation of value-based statistics. These results were largely in line with previous years.

Chart 25

Values settled in T2S by securities category and transaction type in 2024

a) Securities category | b) Transaction type |

|---|---|

(percentages) | (percentages) |

|  |

Source: T2S.

Note: Panel b): “Other” includes PFOD and DWP.

Business day phases

In T2S the new business day starts at 18:45 CET with preparation for night-time settlement (NTS). NTS processing starts at 20:00 CET and should be completed before 22:00 CET. It consists of two cycles: the first cycle is subdivided into five sequences and the second cycle into four sequences. Within each sequence, a pre-defined set of transactions or instruction types is settled. At the end of the second cycle, T2S submits for partial settlement all eligible transactions for which settlement failed during an earlier attempt made the same evening.

Once NTS ends, there is a short preparation period for real-time settlement (RTS), followed by the actual RTS phase. RTS is concluded at 18:00 CET, although it may be interrupted by the optional maintenance window, which, when activated, starts at 03:00 CET and ends at 05:00 CET. The mandatory weekly maintenance window is activated every weekend from 02:30 CET on Saturday to 02:30 CET on Monday. During the maintenance window T2S is closed for all settlement activities.

RTS includes five partial settlement windows starting at 08:00 CET, 10:00 CET, 12:00 CET, 14:00 CET and 15:30 CET. In each of these windows, T2S partially settles new settlement instructions arriving in T2S that are eligible for partial settlement, as well as previously unprocessed or partially processed settlement instructions that are likewise eligible. The first and last partial settlement windows have a duration of 30 minutes each, while the others have a duration of 15 minutes each. The RTS closure period starts with the DVP cut-off.

NTS accounted for 51.3% of T2S volumes in 2024, while RTS accounted for 48.7%. However, most of the value, 65.5%, is settled during RTS (Chart 26). This indicates that the RTS phases are typically more value-intensive, featuring transactions with a higher average value than the NTS cycles. By contrast, the NTS cycles are more volume-intensive. The distribution between NTS and RTS is consistent with the previous year and does not vary much across the year.

Chart 26

NTS and RTS volumes and values in T2S in 2024

a) Volume | b) Value |

|---|---|

(percentages) | (percentages) |

|  |

Source: T2S.

Box 3

Preparatory work on shortening the settlement cycle to T+1 in the EU

In May 2024 the United States transitioned to a T+1 settlement cycle, shortening the time between trading and settlement from two business days to one. The European Commission has proposed a transition to T+1 in Europe on 11 October 2027, based on a recommendation from the European Securities and Markets Authority. The move to T+1 is aimed at strengthening the efficiency and competitiveness of post-trade financial market services in the EU. In order to accelerate the preparatory work, a dedicated T+1 Task Force was set up in January 2025 under the T2S governance framework to assess the impact of the transition on T2S operations and evolution, contributing to the wider EU governance set-up for the T+1 initiative. The objective is to identify any need for change in T2S early in order to facilitate a smooth implementation in October 2027 and support T2S CSDs and their participants in maintaining a high level of settlement efficiency in a T+1 environment.

Intraday credit

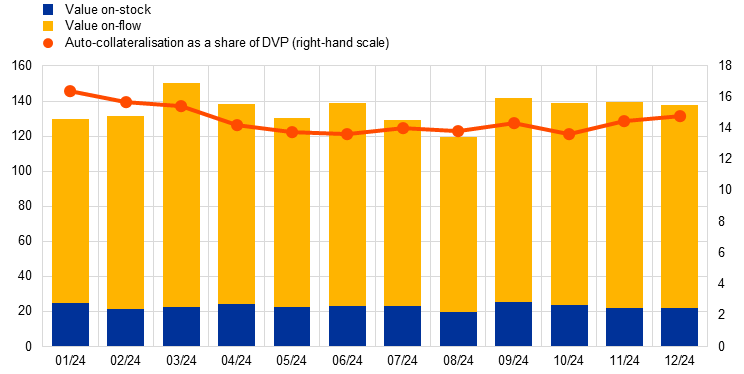

Auto-collateralisation in T2S is a form of intraday credit operation granted by the central banks. The operation is triggered when a T2S DCA holder does not have enough funds to settle securities transactions. Its ultimate purpose is to improve the buyer’s cash position and secure the funds necessary to settle the transaction. Auto-collateralisation is an automatic process aimed at facilitating smooth real-time DVP settlement in central bank money.[29]

Two types of auto-collateralisation are available in T2S:

- auto-collateralisation on-flow is the use of the securities which are about to be purchased as collateral to secure the credit needed to complete the transaction;

- auto-collateralisation on-stock is the use of other securities already held by the buyer as collateral to complete the transaction.

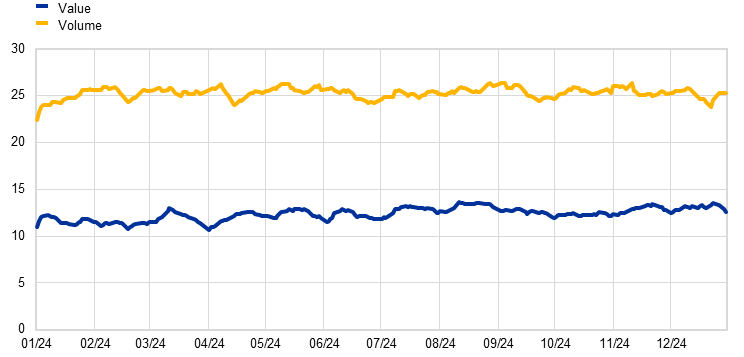

In 2024 auto-collateralisation reached a daily average value of €135.3 billion, up 4.9% compared to 2023 (Chart 27). Typically, the use of auto-collateralisation largely follows a similar pattern to that observed for DVP transactions settled throughout the year. In 2024 it accounted for 14.5% of the total value settled via DVP, compared with 17.1% in 2023.

Chart 27

Auto-collateralisation use by type in 2024

(left-hand scale: daily averages, EUR billions; right-hand scale: percentages)

Source: T2S.

On average, 83% of auto-collateralisation use by value was on-flow in 2024, almost unchanged compared to the previous year. The daily average value of auto-collateralisation on-flow was €112.2 billion, while the daily average daily value of auto-collateralisation on-stock was €23.0 billion. In 2024, 80.8% of auto-collateralisation took place during RTS (Chart 28), which was consistent with the pattern for 2023.

Chart 28

Use of auto-collateralisation in night-time and real-time settlement in 2024

(percentages)

Source: T2S.

Unsettled traffic

Not all transactions submitted for processing in T2S are settled on the intended settlement date (ISD). There are several possible reasons for this, including, among others, the cash and/or securities needed for settlement are not available, one of the two instructions underlying the transaction is set to on-hold status, or the instruction was submitted late. Note that unsettled transactions have a negative impact on settlement efficiency.

In 2024 the daily average number of unsettled transactions was 9,288, 4.3% higher than in 2023 (Chart 29). The monthly average number of daily unsettled transactions peaked in June at 11,172. This peak was driven by a large number of on-hold transactions related to a change in the business model of one large T2S participant. The volume of unsettled transactions increased across all transaction types in June, although the increase was primarily driven by DVP transactions. The daily average value of unsettled transactions also peaked in June, at €19.7 billion. In the second half of the year the value of unsettled transactions declined, also primarily driven by DVP transactions. The daily average value of unsettled transactions stood at €15.7 billion in 2024, which was 33.6% below the figure for 2023 despite the higher volumes.

Chart 29

Unsettled transactions in T2S in 2024

(left-hand scale: number of transactions, daily averages; right-hand scale: EUR billions, daily averages)

Source: T2S.

At the end of each day, unsettled transactions are not deleted but are instead automatically postponed (“recycled”) by T2S to the following business day. T2S attempts to settle such transactions over a period of time referred to as the “recycling period” (set at 60 business days for matched instructions), after which they are automatically cancelled.

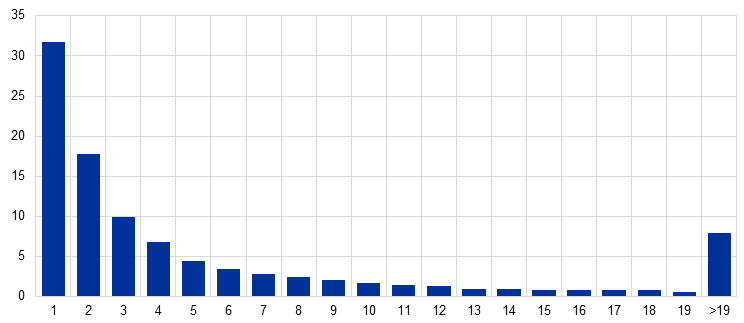

In 2024, 31.8% of unsettled payments were settled on the first recycling day, while 70.7% of unsettled payments were settled within five recycling days (Chart 30). 7.9% of unsettled payments still remained unsettled after 19 recycling days.

Chart 30

Unsettled transactions and number of recycling days before settlement in June 2024

(y-axis: percentages; x-axis: number of recycling days)

Source: T2S.

Notes: For data availability reasons, the chart shows the situation of unsettled transactions in June 2024. However, typically the situation is similar across the year. The maximum recycling period for matched settlement instructions is 60 business days.

Settlement efficiency

Settlement efficiency in T2S measures the volume (or value) of transactions that are settled on a given day relative to the total volume (or value) of transactions eligible for settlement on that day.[30] It provides an indication of the efficiency of T2S participants and their behaviour on the platform.

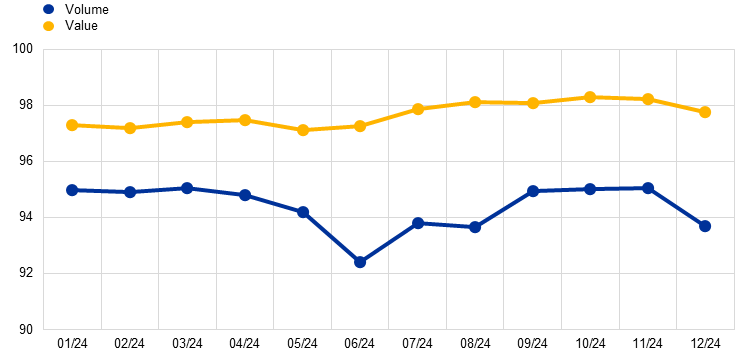

In 2024 settlement efficiency at end of day was on average 94.4% in volume terms and 97.7% in value terms (Chart 31). In volume terms, settlement efficiency was up only slightly compared to 2023, when it stood at 94.3%. The average was driven down by the low figure of 92.4% in June, which was most probably related to the high number of on-hold transactions in that month. In value terms, settlement efficiency was higher than in 2023 and improved over the year from 97.3% in January to 97.8% in December.

Chart 31

T2S settlement efficiency at end of day in 2024

(percentages)

Source: T2S.

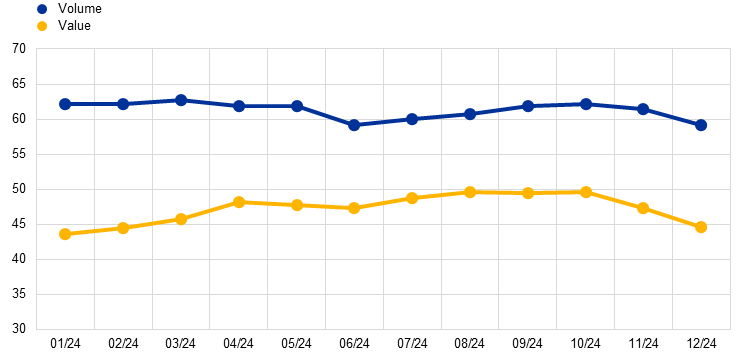

Average settlement efficiency during NTS is significantly lower than for the full business day. In 2024 average settlement efficiency during NTS reached 61.3% in volume terms and 47.3% in value terms (Chart 32). In volume terms, settlement efficiency during NTS was almost unchanged compared to the previous year, and over the year it varied by no more than 3.7 percentage points. In value terms, settlement efficiency during NTS was on average 5.5 percentage points higher than the previous year and varied by no more than 6.1 percentage points.

Chart 32

T2S settlement efficiency during NTS in 2024

(percentages)

Source: T2S.

Penalty mechanism

The entry into force of the Central Securities Depositories Regulation’s[31] settlement discipline regime on 1 February 2022 introduced cash penalties for late matching and settlement fails for trades settled in the EU to promote efficiency. Accordingly, T2S implemented a penalty mechanism that provides for: (i) the daily calculation and reporting of cash penalties for settlement fails, and (ii) monthly reporting of the aggregated amounts of cash penalties computed for a given month.

In 2024 T2S participants paid an average of 878,008 cash penalties per month for late matching and settlement fails (Chart 33), which was 7.8% higher than in 2023. The number of cash penalties peaked in June at 1,183,342. In value terms, cash penalties averaged €52.8 million per month in 2024, which was 26.1% lower than in 2023. The value of cash penalties spiked in May at €136.7 million, which was well over double the monthly average. The average value of a cash penalty in 2024 was €60.28.

Chart 33

T2S cash penalties in 2024

(left-hand scale: number of penalties, monthly totals; right-hand scale: EUR millions, monthly totals)

Source: T2S.

Other settlement-related matters

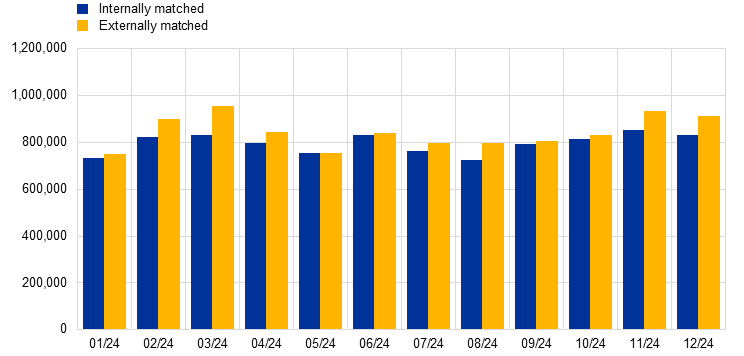

Internally and externally matched settlement instructions

In order to settle a securities transaction, the delivering and receiving parties provide the necessary details in the form of settlement instructions. The two settlement instructions have to be compared to ensure that both parties agree on the terms of the transaction. If the comparison is successful, the two settlement instructions are matched, generating a settlement transaction in T2S. This process can take place either inside T2S (internally matched), i.e. in the life cycle management and matching (LCMM) module which performs the validation and matching of individual settlement instructions, or outside T2S (externally matched), such as in a CSD.

In 2024 a majority of settlement instructions (51.5%) were matched externally. This was 1.3 percentage points higher than in 2023. The number of externally matched settlement instructions consistently exceeded the number of internally matched settlement instructions (Chart 34). On average, 795,733 instructions were matched internally on a daily basis, while 843,928 were matched externally.

Chart 34

Internally and externally matched settlement instructions in 2024

(number of instructions, daily averages)

Source: T2S.

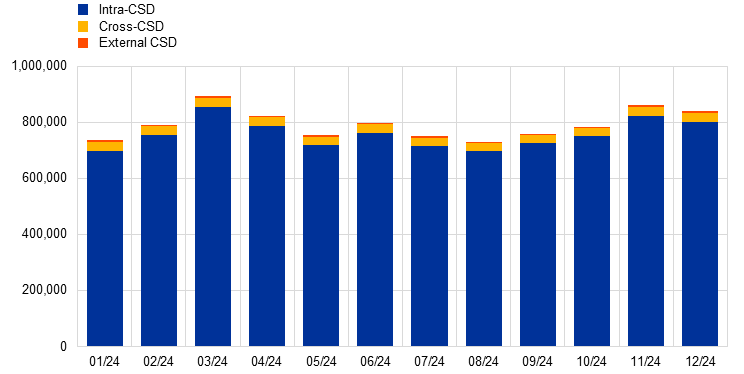

Intra-CSD, cross-CSD and external CSD settlement

Investors can access the different markets linked to T2S through multiple technical channels. Depending on the number of CSDs involved, it is possible to distinguish between intra-CSD, cross-CSD and external CSD traffic.

- Intra-CSD traffic refers to securities transfers where the delivering and receiving parties belong to the same CSD.

- Cross-CSD traffic occurs when the delivering and receiving parties belong to different CSDs, both of which are in T2S.

- External CSD traffic occurs when the delivering and receiving parties belong to different CSDs, one of which is not in T2S.

Intra-CSD transactions represent the majority of all transactions settled in T2S in both volume and value terms.

In 2024 intra-CSD transactions accounted for 95.5% of the total T2S settlement volume, 2.2 percentage points lower than in 2023 (Chart 35). Cross-CSD transactions accounted for 3.8%, 2.2 percentage points higher than in 2023. The shift from intra-CSD to cross-CSD transactions was largely due to the reorganisation of Euronext’s clearing activities in T2S. External CSD transactions accounted for 0.7% of the total.

Chart 35

Intra-CSD, cross-CSD and external CSD settlement volumes in 2024

(number of transactions, daily averages)

Source: T2S.

Intra-CSD transactions accounted for 96.3% of the total settled value in T2S in 2024, compared with 96.6% in 2023 (Chart 36). Cross-CSD transactions accounted for 3.7%, while the proportion of external CSD transactions was close to 0%.

Chart 36

Intra-CSD, cross-CSD and external CSD settlement values in 2024

(EUR billions, daily averages)

Source: T2S.

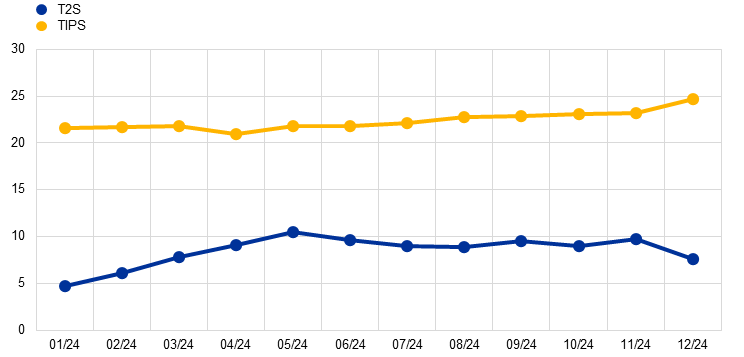

2.4 TIPS[32]

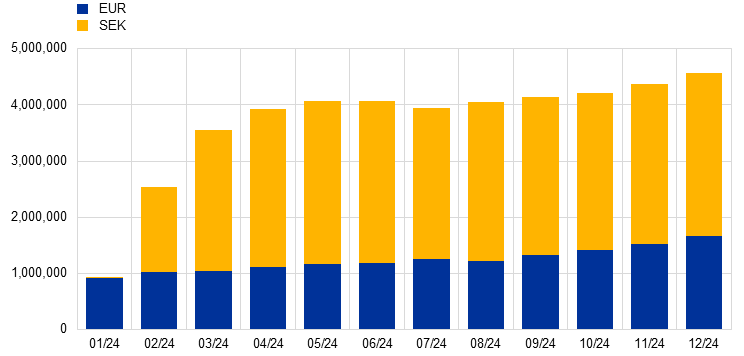

Volume developments

In 2024 a total of 1,354,847,183 instant payments were settled in TIPS, compared with 269,766,787 in 2023 (Chart 37). The more than five-fold increase in the volume of instant payments settled in TIPS was driven both by an increase in euro traffic and by the successful migration of the Swedish krona to the platform at the beginning of the year. Sweden is the first non-euro area country to join TIPS with its national currency and, as one of the most advanced countries when it comes to instant payments, it has been a major driver of TIPS traffic.

Chart 37

Volumes settled in TIPS over time (all currencies included)

(number of transactions, yearly totals)

Source: TIPS.

The average daily number of instant payments settled in TIPS stood at 3,681,650 in 2024, compared to 741,118 in 2023 (Chart 38). Although payments in Swedish kronor represented around two thirds of the volume in 2024, payments in euro also rose throughout the year. The uptake of instant payments in euro was particularly visible over the last quarter of 2024, with growth of 21.1% compared to the previous quarter. These developments were strongly influenced by preparations for the implementation of the provisions of the Instant Payments Regulation (IPR)[33], which required PSPs in the euro area to be able to receive instant payments as of 9 January 2025.

Chart 38

Volumes settled in TIPS in 2024

(number of transactions, daily averages)

Source: TIPS.

Note: A few test payments in Swedish kronor were also settled before Sweden officially joined TIPS.

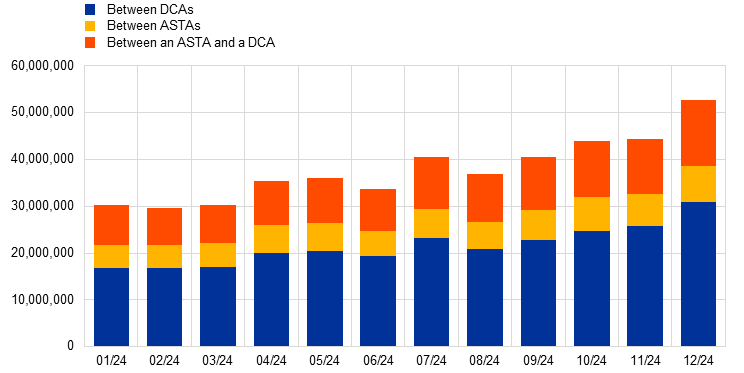

As far as the euro is concerned, instant payments between TIPS DCAs was the largest payment category in 2024, representing on average 56.8% of the total volume settled in a month (Chart 39). At the same time, instant payments between an ASTA and a DCA and instant payments between ASTAs also made significant contributions to TIPS traffic, at 27.1% and 16.1% of the total volume respectively. This shows that TIPS is fulfilling its dual objective of providing instant payment settlement services to PSPs and supporting interoperability across other CSMs. The growth at platform level in the last quarter of 2024 was supported in particular by a robust increase in instant payments settled between DCAs.

Chart 39

Volumes settled in TIPS in euro by account type in 2024

(number of payments, monthly totals)

Source: TIPS.

Note: Owing to limited data availability, this breakdown is based on business days rather than calendar days.

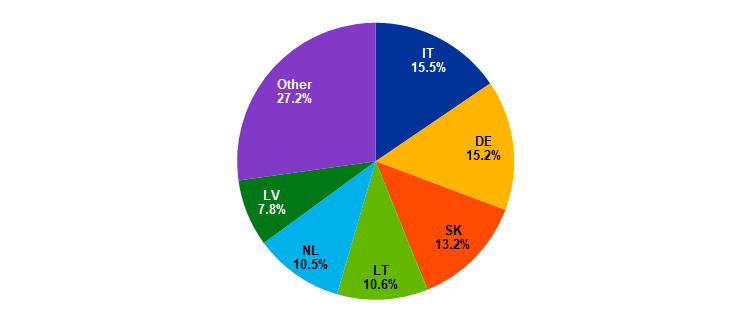

In volume terms, PSPs in Italy, Germany and Slovakia were the largest contributors to instant payments in euro in TIPS in 2024, with shares of 15.5%, 15.2% and 13.2% respectively (Chart 40). Several participants joined TIPS in 2024, and PSPs started channelling regular monthly payments, such as salaries and loan instalments, via the platform. Lithuania, the Netherlands and Latvia, which were early adopters of instant payments, accounted for 10.6%, 10.5% and 7.8% respectively. All the other countries together accounted for 27.2%.

Chart 40

Volumes settled in TIPS in euro by country in 2024

(percentages)

Source: TIPS.

Note: The country is identified by the BIC of the originator participant for each payment. The chart includes data from 14 March 2024 to the end of the year.

As a result of preparations for the IPR, the six countries named above experienced significant growth in their instant payment traffic in TIPS in the last quarter of 2024 compared to the previous quarter, ranging from 13.6% in the Netherlands to 41.8% in Slovakia.

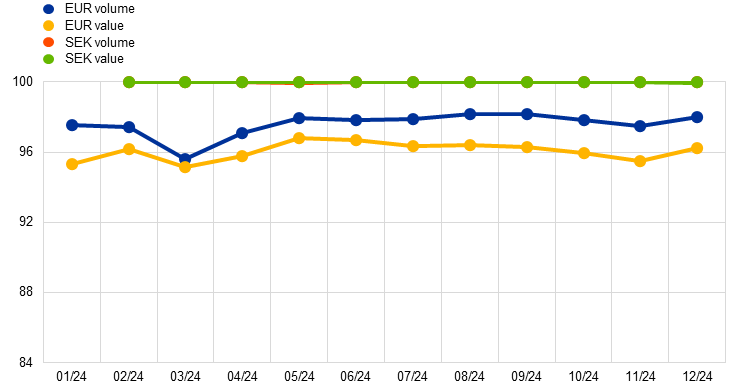

Value developments

The total value of instant payments in euro settled in TIPS stood at €283.4 billion in 2024, up 63.7% compared to 2023. As these are retail payments, which are typically high in number and low in value, the year-on-year increase in total value does not necessarily follow the same pattern as the increase in volume. The daily average value stood at €0.8 billion in 2024 (Chart 41), compared to €0.5 billion in 2023. This followed an increasing pattern throughout the year, reaching €1.1 billion in December 2024.

Chart 41

Values settled in TIPS in 2024

a) Instant payments in euro | b) Instant payments in Swedish kronor |

|---|---|

(EUR millions, daily averages) | (SEK millions, daily averages) |

|  |

Source: TIPS.

Note: A few test payments in Swedish kronor were also settled before Sweden officially joined TIPS.

Instant payments in Swedish kronor were onboarded in TIPS in early 2024 and amounted to a total value of SEK 464.7 billion. This corresponded to a daily average value of SEK 1.3 billion. Unlike for the euro, daily average traffic in Swedish kronor was quite stable over the year.

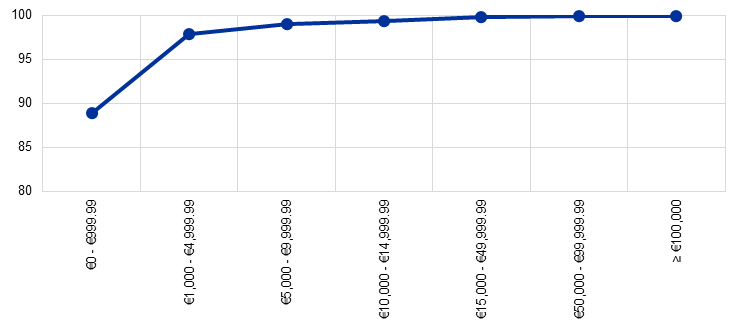

As far as the euro is concerned, almost 90% of instant payments in TIPS had a value of less than €1,000 in 2024, while transactions with a value of €50,000 or more accounted for only 0.1% of traffic (Chart 42). The average value of an instant payment in euro in TIPS in 2024 was €623.2. These results show that TIPS was mainly used for retail payments of low value in euro in 2024.

Chart 42

Distribution of TIPS instant payments in euro across value bands in 2024

(percentages, cumulative)

Source: TIPS.

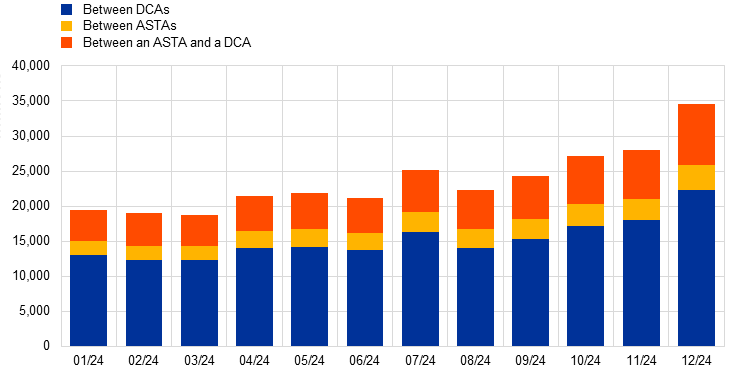

As in the case of volumes, instant payments between TIPS DCAs was also the largest payment category in value terms in 2024, with an average of 64.7% of the monthly total values (Chart 43). Instant payments between an ASTA and a DCA followed with 24.1%, while instant payments between ASTAs stood at 11.2%. Overall, the pattern in value terms was very similar to the pattern in volume terms.

Chart 43

Values settled in TIPS in euro by account type in 2024

(EUR millions, monthly totals)

Source: TIPS.

Note: Owing to limited data availability, this breakdown is based on business days rather than calendar days.

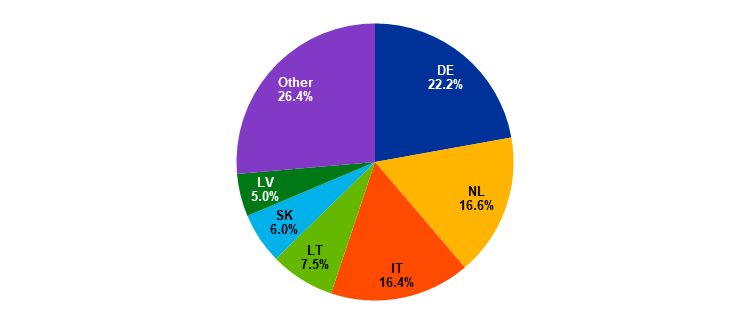

In value terms, PSPs in Germany, the Netherlands and Italy were the largest contributors to instant payments in euro in TIPS in 2024, with shares of 22.2%, 16.6% and 16.4% respectively (Chart 44). Lithuania, Slovakia and Latvia followed, with shares of 7.5%, 6.0% and 5.0% respectively, while all other countries together accounted for 26.4%.

Chart 44

Values settled in TIPS in euro by country in 2024

(percentages)

Source: TIPS.

Note: The country is identified by the BIC of the originator participant for each payment. The chart includes data from 14 March 2024 to the end of the year.

Unsettled traffic

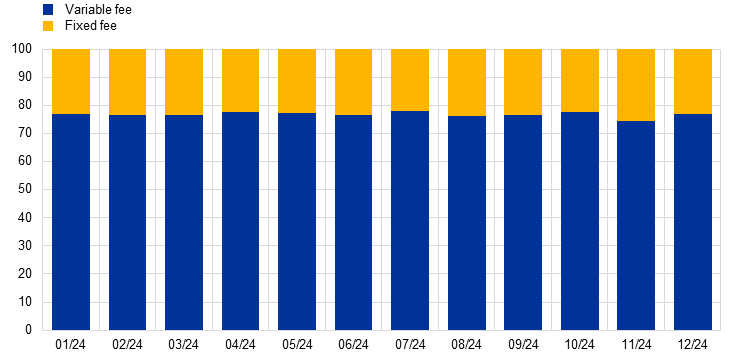

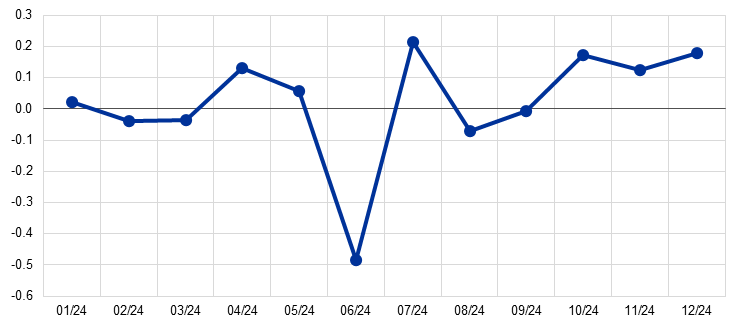

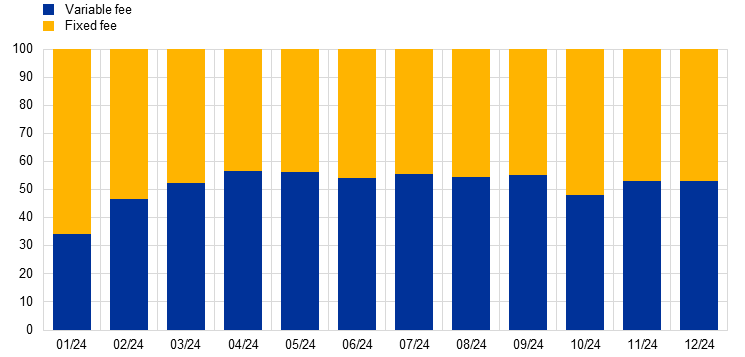

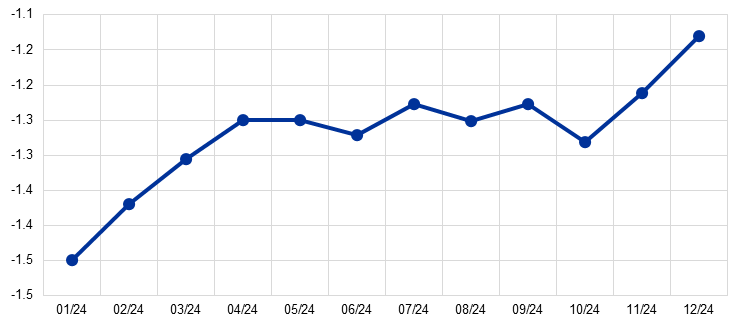

Instant payments that are not settled in TIPS either fail, are rejected or expire. A payment fails if an error occurs (for instance, there are insufficient funds), it is rejected if the receiving party does not accept it, and it expires if the receiving party does not accept it in time. As TIPS is a platform designed to process a very high number of payments within seconds, it is of great importance for the TIPS operator to identify settlement failures and their reasons.