- THE ECB BLOG

The outlook for the euro area

Blog post by Philip R. Lane, Member of the Executive Board of the ECB

11 September 2020

In this blog post, I will discuss the outlook for economic activity and inflation in the euro area, based on the new ECB staff macroeconomic projections for the euro area that were published yesterday.[1],[2]

I will also provide an assessment of our monetary policy. While our reading of the evidence is that the monetary policy decisions we took in March and June are providing considerable support for the economic recovery, there is no room for complacency. As was communicated in the introductory statement by President Lagarde at the post-meeting press conference, the current environment of elevated uncertainty means that the Governing Council will continue to assess carefully the incoming information, including developments in the exchange rate, with regard to the implications for the medium-term inflation outlook.

The economic outlook

Following the record decline in output of 11.8 percent in the second quarter and the cumulative decline of 15.1 percent in the first half of 2020, the incoming data indicate a strong rebound in euro area economic activity during the third quarter. The recovery is broadly in line with the pace set out in the Eurosystem staff macroeconomic projections published in June. Domestic demand is bouncing back significantly: consumer spending increased strongly in June and July, and business investment is also recovering.

However, economic activity remains well below pre-pandemic levels. Moreover, the recovery is asymmetric across sectors and countries and remains subject to elevated uncertainty. In particular, the recovery in the manufacturing sector is further advanced than in the services sector. In fact, momentum in the services sector, which is the sector that is most sensitive to infection fears and social distancing restrictions, has slowed recently, with the services business activity PMI declining to 50.5 in August from 54.7 in July.[3]

Although consumer spending has increased over the summer, many households are likely to continue to be cautious, especially in view of the elevated uncertainty about future employment and wage dynamics. Chart 1 shows the spectacular increase in the savings rate during the first half of the year. While the relaxation of the most severe lockdown restrictions has diminished the phenomenon of “forced” saving, the projections assume that the full normalisation of the savings rate will occur only gradually. In relation to investment, firms are likely to postpone or cancel some of their capital expenditure plans against a background of heightened uncertainty about future demand for their products, spare capacity and weakened balance sheets.[4]

Chart 1

Euro area household savings rate

(percentages of disposable income)

Sources: ECB staff macroeconomic projections and Eurostat.

Note: The latest observations are for Q1 2020 for actual data and Q4 2022 for projections.

This assessment is broadly reflected in the baseline scenario of the September ECB staff macroeconomic projections, which signals that output will recover in the third and fourth quarters by 8.4 percent and 3.1 percent, respectively. Overall, despite the rebound in activity in the second half of the year, the annual average level of output is foreseen to decline by 8.0 percent in 2020. Over the rest of the projection horizon, output is expected to grow by 5.0 percent in 2021 and 3.2 percent in 2022. The cumulative adverse impact of the pandemic is illustrated by the assessment that, in the baseline scenario, the economy will only return to pre-pandemic levels of activity in late 2022.

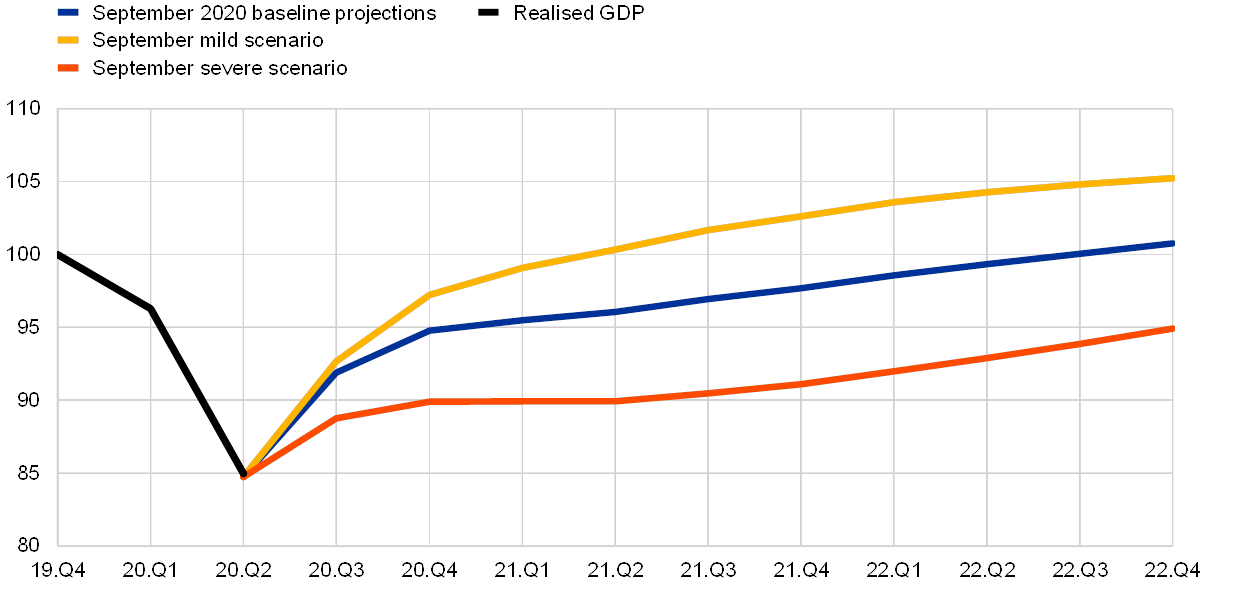

As shown in Chart 2, our updated scenario analysis highlights that the range of possible outcomes remains extremely wide, with a much faster and complete recovery in the mild scenario but a more protracted adjustment path under the severe scenario. The updated scenarios do indicate a narrowing in the range of possible outcomes compared with the June exercise: although the impact on output in the second quarter was severe, the outturn was slightly better than expected and this feeds into a higher output path under all scenarios. At the same time, the very high economic, financial and social costs associated with the severe scenario underline the importance of guarding against the emergence of downside risks.

Chart 2

Realised and projected output

(indexed real GDP, Q4 2019 = 100)

Sources: ECB staff macroeconomic projections and Eurostat.

Notes: The projections refer to the September 2020 ECB staff macroeconomic projections. The latest observations are for Q2 2020 for realised data and Q4 2022 for projections.

Turning to inflation, the headline rate fell to minus 0.2 percent in August from 0.4 percent in July, according to Eurostat’s flash estimate. Beneath this sharp decline, inflation excluding the volatile food and energy categories fell from 1.2 percent to an all-time low of 0.4 percent. Although temporary factors (including the revised timing of sales periods in some countries) distorted the August figure, underlying price pressures have weakened due to subdued demand and the scale of labour market slack. Market-based measures of inflation expectations have increased from the record lows reached in mid-March but remain at very depressed levels. Survey-based measures of longer-term inflation expectations remain well above market-based measures, but are still at historic lows.

Headline inflation is expected to remain negative for the rest of the year on account of the earlier collapse in oil prices and the temporary reduction in the VAT rate in Germany. Although base effects in the energy component and the reversal of the VAT reduction will generate a mechanical rebound in 2021, the recent appreciation of the euro exchange rate dampens the inflation outlook. Headline inflation is expected to remain persistently low over the medium term, notwithstanding a gradual pick-up over the projection horizon.

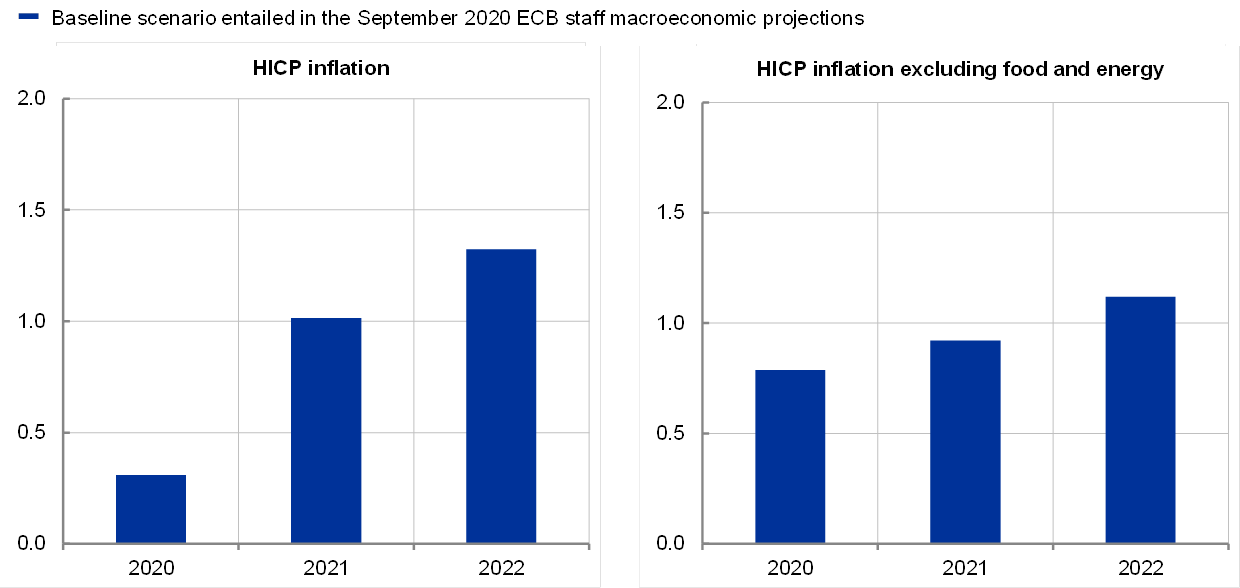

As shown in Chart 3, the new projections foresee annual HICP inflation at 0.3 percent in 2020, 1.0 percent in 2021 and 1.3 percent in 2022. Compared with the June projections, the outlook for headline inflation is unchanged for 2020, revised up for 2021 and unchanged for 2022. Looking in more detail, the unchanged projection for 2022 masks an upward revision in inflation excluding food and energy.

This upward revision in core inflation in part reflects the positive impact of our monetary policy measures. In particular, the June recalibration of the pandemic emergency purchase programme (PEPP) has fostered more favourable financial conditions. The outlook for core inflation has also benefited from the further expansion in the fiscal stance since the June projection exercise. The substantial extra fiscal impulse in 2020 provided by the scaling up of discretionary fiscal measures from 3.5 percent of GDP to 4.5 percent of GDP is calculated to raise the GDP contribution of fiscal policy this year from 2.5 percent to 2.8 percent: the overall adverse impact of the pandemic on the economy would have been significantly worse in the absence of counter-cyclical fiscal policy measures. Another type of fiscal support is provided by the innovative nature and scale of the Next Generation EU recovery fund that has clearly contributed to the significant reduction in average bond yields and enhanced the prospect of a sustained area-wide recovery.[5]

In the other direction, the scale of the upward revision in core inflation has been significantly muted by the appreciation of the euro exchange rate. In addition, the impact of the upward revision in core inflation on headline inflation in 2022 has been offset by the changed profile for the path of energy price inflation compared with the June projections exercise.

Chart 3

Projected headline inflation and headline inflation excluding food and energy

(year-on-year percentage changes)

Source: ECB staff macroeconomic projections.

Monetary policy

Turning to monetary policy, it is clear that our current measures are providing crucial support to the recovery of the euro area economy. In particular, the configuration of monetary policy is contributing to accommodative funding conditions in all parts of the economy. The July data indicate that bank lending rates remained close to their historic lows. Moreover, bank lending to firms has been very high since March, with the annual growth rate of loans to firms standing at 7 percent in July, which is far above the pre-pandemic rate of credit expansion. The targeted longer-term refinancing operations (TLTROs) continue to be a major force behind the declining path of lending rates and are supporting the flow of credit to households and businesses.

Overall, the projected paths of both output and inflation would be lower than foreseen in the September projections had the ECB not recalibrated the PEPP in June. That said, it should be abundantly clear that there is no room for complacency. Inflation remains far below the aim and there has been only partial progress in combating the negative impact of the pandemic on projected inflation dynamics. Moreover, the outlook remains subject to high uncertainty and the balance of risks continues to be tilted to the downside.

Over the coming months, a richer information set will become available that will help to inform the calibration of monetary policy. We will have a better idea about the success of containment and treatment measures in controlling the pandemic. Fiscal spending plans for 2021 will crystallise with the finalisation of national budgetary processes in the coming weeks, while we will also have more clarity on the post-transition Brexit arrangement. In addition, we will have greater insight into the recovery and durability of the recent rebound in consumption and investment. The Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.

- I am grateful to Danielle Kedan and Sebastiaan Pool for their contributions to this blog post.

- Available on the ECB’s website.

- In particular, activity levels in the most-affected sectors, such as accommodation and travel, remain exceptionally low.

- For a more detailed discussion of the impact of the pandemic shock on consumption and investment, see my blog post from 1 May 2020 entitled “The monetary policy response to the pandemic emergency”.

- The baseline projections do not incorporate the additional expenditure that may be financed out of the Next Generation EU programme. This expenditure will feed into subsequent projection rounds, once the plans are finalised. Looking beyond the typical two-year horizon of our projections, the five-year period of the programme provides sustained policy support for medium-term growth prospects.