Recent stress in money market funds has exposed potential risks for the wider financial system

Published as part of Financial Stability Review, May 2020.

Euro area money market funds (MMFs) provide short-term credit to banks and non-financial corporations (NFCs) through purchases of commercial paper (CP). The total assets of euro area MMFs amounted to €1.26 trillion in December 2019, of which €307 billion and €295 billion were debt securities issued by credit institutions domiciled in the euro area and in the rest of the world, respectively (see Chart A, left panel). Most securities are denominated in euro (51%), followed by US dollars (27%) and British pounds (21%). MMFs are particularly important for the short-term funding market, holding €251 billion and €40 billion in short-term securities issued by euro area banks and firms, respectively, including commercial paper (see Chart A, right panel). Although commercial paper is a minor source of bank funding, covering less than 3% of total funding needs, it provides a meaningful source of wholesale unsecured short-term funding, especially in US dollars, for internationally active banks.

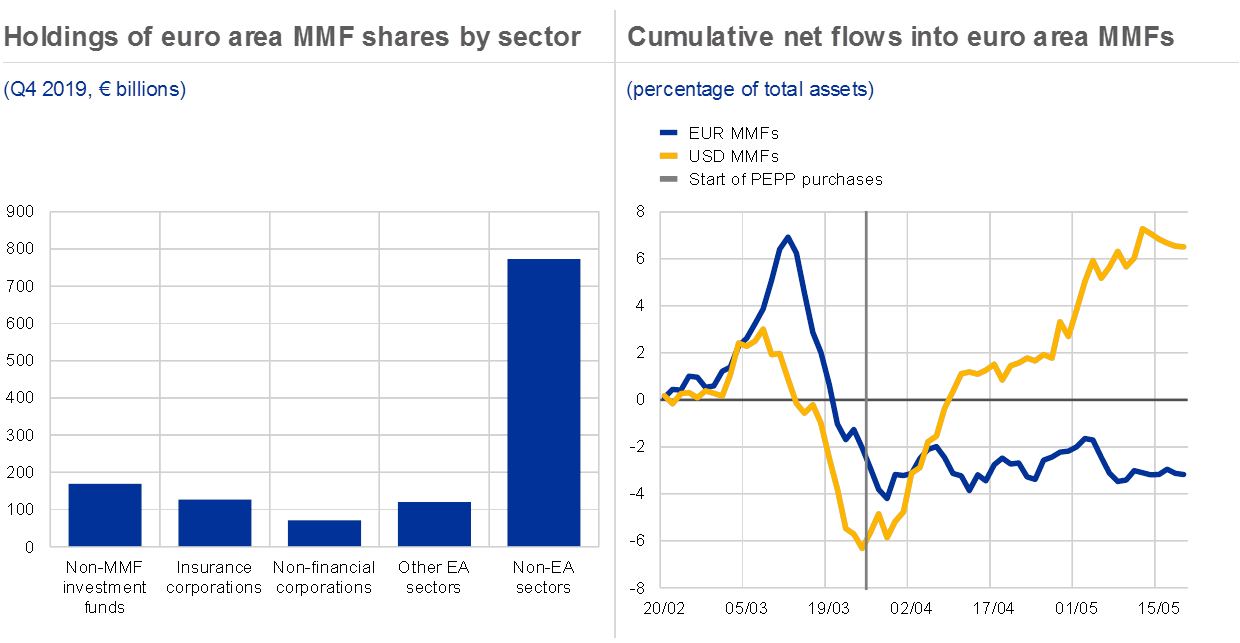

MMFs also play an important role in non-banks’ cash and liquidity management, given that the funds offer stable value and the possibility to redeem at short notice. Within the euro area, MMF shares are largely held by investment funds (IFs) (€169 billion), insurance corporations (€127 billion) and NFCs (€72 billion) (see Chart B, left panel). In particular, investment funds’ and insurers’ holdings of MMF shares equal 28% and 21% of their total MMF and cash holdings, respectively.

MMFs finance most of the short-term debt of banks and NFCs

Sources: ECB (securities holdings statistics and MFI balance sheet item (BSI) statistics) and ECB calculations. Notes: Left panel: euro area OFI debt securities are made up of OFI issuances (98%) and ICPF issuances (2%). Non-euro area debt securities can be broken down into bank and government-issued securities. It is assumed that the remaining debt securities were issued by the same sub-sectors as in the euro area. “Bank” refers to MFIs. The x-axis labels refer to the issuer domicile.

As the coronavirus crisis deepened, euro area MMFs experienced outflows of nearly 8% of assets under management between 13 and 20 March. Increasing cash needs of MMF investors, difficulties in monetising assets and flight-to-safety considerations drove large redemptions, which were further amplified by growing liquidity needs to meet margin calls on derivative exposures (see Special Feature B for investment funds). Both euro and USD-denominated funds experienced substantial outflows from 12 March (see Chart B, right panel), which were particularly pronounced for USD-denominated low-volatility net asset value (LVNAV) funds, while constant net asset value (CNAV) funds – primarily USD-denominated – received net inflows.[1] This divergence in flows may have reflected general flight-to-safety motives, since CNAV funds can only invest in public debt, while variable net asset value (VNAV) and LVNAV funds can invest in commercial paper (see Chapter 5). Euro area USD LVNAV funds may also have been perceived to be riskier, given their exclusion from the Federal Reserve’s Money Market Mutual Fund Liquidity Facility due to their offshore domicile.

LVNAV funds also suffered particularly large outflows because investors were concerned that the funds could soon lose their cash-like properties. LVNAV funds are allowed to offer a constant share price as long as the fund’s NAV at amortised cost does not deviate by more than 20 basis points from the corresponding market value.[2] Otherwise, the fund will “break its collar” and trade at a variable price, which can result in mark-to-market losses for investors. Some LVNAV funds, mostly denominated in US dollars, were close to reaching this threshold at the end of March.[3]

Outflows from MMFs created risks for the liquidity of non-banks and for the wider system

Sources: ECB BSI statistics, EPFR and ECB calculations.Notes: Left panel: the holdings of MMF shares by non-euro area sectors are computed as the difference between total assets and holdings of euro area sectors.

Stress in MMFs can impair the financial system’s and the real economy’s access to short-term funding and liquidity during crises. In normal times, MMFs can raise sufficient cash from maturing assets. However, when outflows are sufficiently large, such as during the recent period of market volatility, funds may be forced to sell assets. As part of remedial action to preserve fund liquidity, the asset manager can, in principle, also decide to suspend redemptions. So, severe stress in the MMF sector may spill over to those sectors that are reliant on MMFs to manage their liquidity. For example, other investment funds may need to raise cash to respond to outflows, and insurers and firms may need to access liquidity to meet their obligations or cover losses. Finally, liquidity strains in USD-denominated MMFs could also spill over to the broader foreign exchange funding market.

Market and supervisory intelligence suggests that a number of MMFs had difficulties in raising sufficient cash from maturing assets and liquid positions during March, as liquidity deteriorated rapidly, also in the CP market. In the absence of alternative buyers, this led MMFs in need of liquidity to request issuing banks to buy back their CP. From the perspective of banks, this caused the loss of a liquidity source at a time of impaired access to unsecured funding and increasing demand for cash by corporate clients. Some banks accommodated the requests of MMFs, some responded with aggressive pricing in an attempt to discourage the requests for buybacks and a few simply denied the requests altogether as there is no contractual obligation to buy back. At the same time, issuance in the CP market almost completely ceased, likely reflecting a lack of buyers.

Monetary policy action helped to improve financial market conditions more broadly, thereby also alleviating liquidity strains in the MMF sector. In particular, the inclusion of non-financial commercial paper in the ECB’s corporate sector purchase programme and the ECB’s US dollar operations provided an important backstop in this market, against a backdrop in which MMFs and other investors had tried to sell non-bank commercial paper or became increasingly reluctant to invest in it. This action also supported the overall provision of liquidity through capital markets, helping companies to manage their short-term funding needs. The Eurosystem also increased the concentration limits for bank-issued unsecured debt in its collateral framework, which incentivised banks to buy other banks’ short-term debt, thereby supporting liquidity in the CP market (see Chapter 2). Finally, the ECB introduced the pandemic emergency longer-term refinancing operations (PELTROs), which contributed to preserving the smooth functioning of money markets by providing an effective backstop after the expiry of previous longer-term refinancing operations.[4]

Despite the strains in the MMF sector seen during March, an immediate loss in confidence was avoided. While some funds had difficulties in raising cash due to exceptionally large outflows, investors were able to access their funds at all times. Inflows into MMFs were seen during April (see Chart B, right panel), alongside a reduction in buybacks. Market and supervisory intelligence suggests that central bank action, the build-up of sufficient liquidity buffers by MMFs and decreasing redemptions by investors could have played a stabilising role.

- [1]According to Crane data, LVNAV funds held around 49% of total euro area MMF assets at the end of February, while VNAV and CNAV funds held 43% and 8% of total assets, respectively.

- [2]In accordance with Regulation (EU) 2017/1131 of the European Parliament and of the Council of 14 June 2017 on money market funds (OJ L 169, 30.6.2017, p. 8).

- [3]NAV deviations have been most prevalent in USD-denominated LVNAV funds. On 24 March, Fitch Ratings lowered its sector outlook for LVNAV funds from stable to negative, following the heightened outflows and price volatility (see the Fitch Ratings website).

- [4]See also “The ECB’s commercial paper purchases: A targeted response to the economic disturbances caused by COVID-19”, “Improving funding conditions for the real economy during the COVID-19 crisis: the ECB’s collateral easing measures” and “ECB announces new pandemic emergency longer-term refinancing operations” on the ECB’s website.