T2S in 2015

The year in review

From the outset, 2015 promised to be an eventful, fast-paced and thrilling year for T2S and its community – a decisive period for the Eurosystem’s ambitious project to create a single platform for securities settlement in Europe. Any hesitations about the launch of T2S were gone when the platform became operational on 22 June 2015. In the build up to this event, a number of crucial, albeit less visible, pieces were gradually put together to make T2S a reality.

Build-up to the launch

One of the steps which moved T2S closer to its launch was taken in January 2015 when wave 1 participants began multilateral interoperability testing activities, i.e. testing settlement processes with the other participating central securities depositories (CSDs) and central banks in the same wave. This was complemented by the delivery of an important T2S software release in the middle of the month, unleashing the full set of T2S functionalities. By February 2015, the production environment of T2S – namely the technical infrastructure and the organisational structures – was ready and in line with expectations. March 2015 was marked by the start of the community testing phase for wave 1, when the CSDs involved their national user communities in testing activities.

Reinforcing the progressive course of T2S, the Governing Council of the ECB formally renewed the mandate of the T2S Board in February 2015. Marc Bayle, Director General Market Infrastructure and Payments at the ECB, was appointed Chairman, with Pierre Beck, Executive Director at Banque centrale du Luxembourg, as Deputy Chairman, along with eight other Board members from the Eurosystem, two non-central bank members and one non-euro area central bank member. With the fast-approaching launch of T2S, the T2S Board and its commitment to support wave 1 participants played a vital role in ensuring that T2S went live on time.

Given the size, reach and complexity of T2S, there were also a few challenges on the homestretch to the launch of the platform. Most were overcome, but some setbacks inevitably occurred. Towards the end of May 2015, testing activities had reached their final phase and the go-live version of the T2S software was deployed and tested by the community. While the final rehearsal of the migration weekend was successfully completed by all wave 1 participants, the Italian community’s migration to T2S was rescheduled for 31 August 2015 to comply with its wish for additional time for internal testing.

The launch

The long-awaited moment arrived when the four CSDs from Greece, Malta, Romania and Switzerland started operating on the T2S platform on 22 June 2015. The migration was completed smoothly and well ahead of schedule, and the first transactions were settled successfully on an operational T2S. This milestone achievement was commemorated with a celebration event on 2 July 2015 which took place in the Rotonda della Besana in central Milan. ECB President Mario Draghi, the Governor of the Banca d’Italia, Ignazio Visco, ECB Executive Board Member Yves Mersch and established representatives from the CSDs, central banks and other stakeholders were in attendance and the event was widely covered in the media.

31 August 2015 saw the Italian market carry out its first business day on T2S, marking the completion of the first migration wave. The first few months of operations have been a success and the platform is stable, but most of all – we are now one step closer to achieving deeper financial market integration in Europe!

T2S in operation

Initial months

With the start of T2S operations on 22 June 2015 eight national central banks (Bank of Greece, Banca Naţională a României, Central Bank of Malta, Banque centrale du Luxembourg, Banque de France, Deutsche Bundesbank and De Nederlandsche Bank) also started providing dedicated cash accounts (DCAs) to the participants in the first migration wave.

The Italian CSD Monte Titoli and its national user community migrated to the platform on 31 August 2015. Together with Monte Titoli, the Banca d’Italia and the Banco de España also began live operations on the platform.

The full migration of the first wave was followed by a four-week stabilisation period and on 25 September 2015 it was confirmed that T2S was stable for daily operations.

The T2S users quickly got familiar with the new system and its functionalities as they started using advanced features such as auto-collateralisation and advanced tools for managing/optimising the use of securities and cash in T2S.

Facts and figures

T2S is in full operation and the settlement of securities transactions has been running smoothly since the launch of the platform.

The volume of settled transactions increased significantly following the migration of the Italian CSD to the platform on 31 August 2015. For the period September-December 2015 T2S settled, on average, 1.87 million securities transactions per month. 76% of them were settled overnight and about 24% in real time.

Settlement efficiency has averaged 95% since T2S began operating. Settlement efficiency is calculated as the number of transactions settled on a given day divided by the total number of transactions intended for settlement on that day.

Figure 1

Number of transactions settled per month and settlement efficiency

Delivery-versus-payment (DvP) is the most common type of transaction in T2S, representing 95.26% of the total volume settled on the platform. The other types of transaction settled include payment free of delivery (2.35%), settlement restriction (1.98%), liquidity transfer order (0.38%) and delivery with payment (0.03%).

Figure 2

Volume of transactions by transaction type

A sharp rise in the daily average value of DvP transactions was observed between August and September 2015 owing to the migration of Monte Titoli to T2S. The numbers increased from €188 billion in September to €219 billion in November, followed by a slight drop to €213 billion in December

Figure 3

Daily average value of delivery-versus-payment (DvP) transactions per month

Preparing for live operations

Thorough preparations were required to ensure a safe operational environment for T2S in which all the actors know their roles, responsibilities, obligations and the sequence of actions they need to take in extraordinary situations.

The baseline version of the T2S Manual of Operational Procedures provides a reference guide for how to conduct daily operations smoothly in both normal and abnormal situations. It was endorsed by the T2S Board and subsequently the Governing Council of the ECB in March 2015. The document was updated ahead of the T2S launch to accommodate findings from the experiences of the CSDs testing the platform together with their user communities, referred to as “community testing”.

Preparing for the launch, crisis situations were simulated with the purpose of executing and testing the effectiveness of the operational procedures for reporting and communication in the event of abnormal situations.

Operational support and incident handling

Following the T2S launch, the Eurosystem, together with the 4CB (Banque de France, Banca d’Italia, Banco de España and Deutsche Bundesbank) as the service provider, regularly monitors the live operations of the platform. In order to assess the T2S service performance, the participating CSDs and the Eurosystem identified a set of key performance indicators, such as settlement efficiency, availability of the T2S platform, application-to-application (A2A) and user-to-application (U2A) messages response time, etc. Their values are compared with predetermined target values and the outcome is presented in a monthly Service Level Agreement Report sent to the CSDs. Based on this report, the T2S Operational Managers Group conducts regular service level reviews to evaluate the platform’s performance.

To ensure smooth interaction between the parties involved in daily operations, the CSDs and the central banks established local service functions. The 4CB put in place a T2S Service Desk, the ECB established the T2S Coordination Desk, and central banks set up local service functions/desks. These have proven to be very effective at resolving incidents.

In 2015 the T2S platform experienced 19 incidents which required the involvement of the T2S settlement and crisis managers. The majority of them were software-related (i.e. the issues were not due to the inappropriate functioning of hardware, to the network or to human error). Considering the magnitude and complexity of T2S, this number can be considered normal as there was a need to further stabilise and improve the functioning of the newly launched platform.

The problems have been addressed through the deployment of new software releases and hotfixes. Table 1 shows the change requests for the T2S software approved in 2015

The connection between T2S and the Eurosystem’s real-time gross settlement system TARGET2 worked as envisaged. No major issues occurred, despite two T2S-related incidents which caused a delay in the closing time of TARGET2.

Table 1: Approved change requests (CRs) in 2015

| Type | Description | Number of CRs | Project phase costs | Average annual maintenance and running costs |

|---|---|---|---|---|

| Market requests | Changes requested by the market and considered mandatory for the start of T2S | 9 | €1,272,179.84 | €120,548.35 |

| Migration activities | Changes raised in the context of the migration framework | 2 | ||

| 4CB testing | Changes stemming from the 4CB testing activities | 22 | ||

| Editorial | Changes of a mostly editorial nature to the T2S documentation | 8 | ||

| T2S settlement day | Changes to remove obsolete and/or unnecessary functionalities from T2S | 1 | ||

| Total | 42 | €1,272,179.84 | €120,548.35 |

Financial matters

T2S operates on a full cost recovery basis and its financial equilibrium requires that the costs incurred are covered by the revenues generated. The latter are driven by the volume that will be settled on the single settlement platform in the course of the set cost recovery period.

The cost changes registered in the course of 2014 as well as additional changes approved in the first few months of 2015 were reviewed by the Governing Council of the ECB with the objective of keeping cost increases to an absolute minimum. In 2015 T2S costs only increased to reflect the changes requested and agreed by the T2S Community and implemented before the launch on 22 June 2015 (see Table 1 in the section T2S in operation). Excluding the cost increase brought about by additional changes requested by the T2S stakeholders (€2.6 million between 2012 and 2015), the Eurosystem has developed T2S within the budget approved at the time of the signature of the T2S Framework Agreement (2012). Once the migration phase is completed, annual operational costs will also be reviewed.

At the beginning of 2015, when reviewing the financial situation of T2S for 2014, the Eurosystem estimated that total investment in T2S before the start of live operations would amount to €401.8 million. By the end of June 2015, the Eurosystem paid the total of this amount to the entities conducting the work in the development phase, i.e. the 4CB and the ECB.

In that context, it was also estimated that operating and maintaining T2S would cost €64.6 million per annum; capital costs for the financing of T2S stood at €26.1 million according to the updated rates as at the end of 2014; and the provision for unforeseeable T2S costs incurred during operations to be included in the T2S pricing envelope remained at €45.0 million. Since the launch in June 2015, operational costs are being paid on a quarterly basis through fees collected and additional financing payments by the Eurosystem.

Table 2: T2S financials (amounts in EUR millions*)

| Development cost (total) | 401.8 |

|---|---|

| 4CB | 299.3 |

| ECB | 100.2 |

| Others | 2.3 |

| Running cost (per annum) | 64.6 |

| 4CB | 51.9 |

| ECB | 10.5 |

| Others | 2.2 |

| Capital cost (total) | 26.1 |

| Contingency reserve (total) | 45.0 |

*Figures might not add up because of rounding.

T2S revenues depend on three factors:

- the volume of securities settlement transactions settled in T2S;

- the length of the cost recovery period;

- the T2S fees which are charged according to the fee structure announced in 2010 (see the T2S Framework Agreement, Schedule 7).

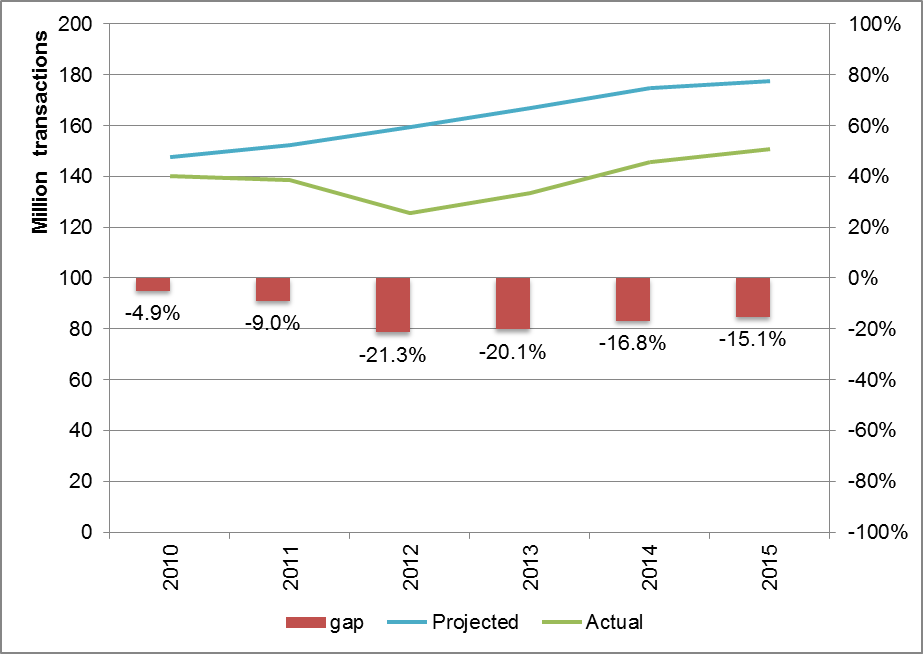

In 2015 the Eurosystem continued its regular settlement volume analysis, in order to allow for realistic projections of T2S volumes and future T2S revenue streams. Based on the volumes reported by European CSDs, projected volumes are calculated for the length of the cost recovery period using the growth rates anticipated by the T2S Advisory Group in 2010.

According to the latest data reported by CSDs to the Eurosystem, the volumes settled by CSDs that have signed the T2S Framework Agreement remained 15.1% below the levels projected for 2015. However, overall volumes increased in comparison with 2014, when the gap vis-à-vis the initial volume projections amounted to -16.8%. Following the same trend, the gap for total EU volumes, including non-signatory CSDs, shrank to -17.5 %.

Figure 4

Projected versus actual volumes of transactions by T2S CSDs per year since 2010

The pricing policy stipulated in the Framework Agreement foresees the possibility of increasing T2S prices subject to certain conditions, namely (i) if the additional volume deriving from the contribution of non-euro currencies is less than 20% of the euro settlement volume, or (ii) if market volumes are more than 10% below the initial projections.

In March 2012 the T2S Programme Board clarified the T2S pricing policy, emphasising that it did not intend to propose any revision of the benchmark price of 15 euro cent per DvP settlement instruction until, at the earliest, one year after the last migration wave (i.e. not before 2019). This is to allow for the build-up of a stable volume basis in T2S before assessing it against the two above-mentioned conditions in light of the overall financial situation. In 2015 the T2S team remained focused on monitoring market trends, while the T2S Board continued exploring the markets inside and outside Europe to attract additional sources of revenue to T2S.

T2S: an ongoing project

2015 reminded us that when you undertake a big project like T2S, you should be prepared for last-minute adjustments.

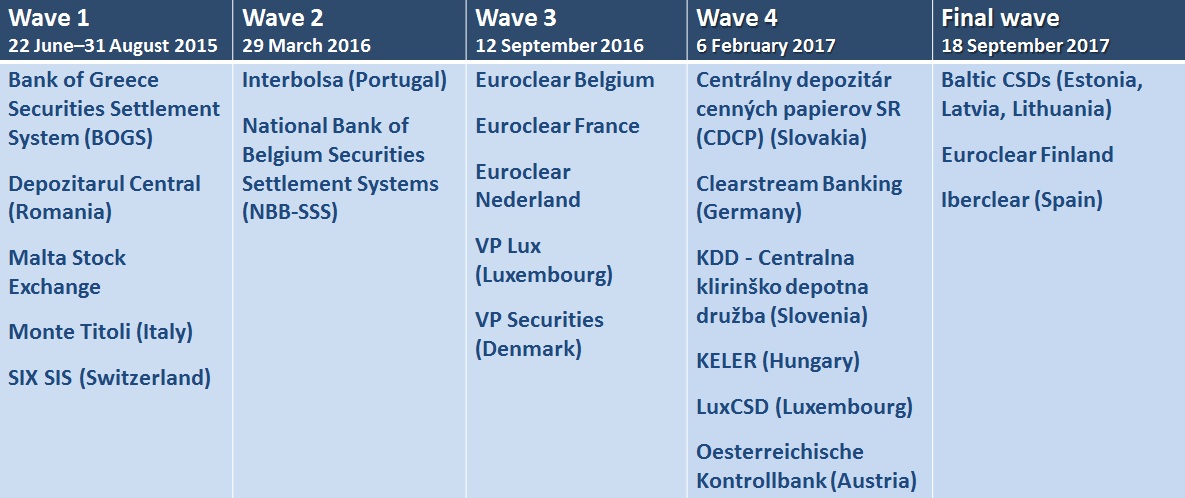

In October 2015, following an extensive internal testing period for the CSDs joining in wave 2, Euroclear Belgium, Euroclear France and Euroclear Nederlands (known as Euroclear ESES) informed the T2S Board that they would need six months more than initially planned to prepare for migration to T2S. This required a revision of the whole migration plan. Some CSDs decided to move their migration forwards by one wave, while others decided to stay in their planned migration wave. A new final wave was introduced for 18 September 2017. Table 3 below shows the new T2S migration plan, which means full migration will be achieved seven months later than initially planned. Financially, this adjustment will imply both a revenue loss and a cost increase.

Table 3: New T2S migration plan

Despite the hurdles the T2S migration plan has encountered, the CSDs from the upcoming migration waves have reported good progress in their preparations to connect to T2S. In 2015 the Portuguese CSD Interbolsa and National Bank of Belgium Securities Settlement Systems (NBB-SSS), which are part of the second migration wave, successfully completed, on time, three migration rehearsals and other testing activities ensuring their operational readiness. The two CSDs have indicated that they are confident of being ready to migrate, and we look forward to welcoming them to the T2S platform on 28 March 2016 as scheduled.

Market infrastructure integration in Europe

Progress in the T2S harmonisation agenda

Substantial progress was made in 2015 regarding the compliance of the 21 T2S markets with the 24 defined T2S harmonisation activities.

Currently, and as shown in Table 4, three out of the total 24 activities remain to be addressed. The capital markets union action plan issued by the European Commission may provide the momentum and the political will to make progress in these remaining areas

Table 4: Dashboard of the T2S harmonisation activities (status: 11/01/2016)

The five markets from the first migration wave (Greece, Italy, Malta, Romania and Switzerland) are now almost fully compliant with the T2S harmonisation standards, except for a few issues with respect to corporate actions and the settlement day schedule. Concrete action has already been taken in order to ensure their full compliance. Belgium and Portugal, which will join T2S with National Bank of Belgium Securities Settlement Systems (NBB-SSS) and Interbolsa on 28 March 2016, have also shown considerable progress in complying with almost all of the T2S harmonisation activities.

Table 5: Compliance status per T2S market (status: 11/01/2016)

T2S and the capital markets union

On 30 September 2015 the European Commission published an action plan which sets out the building blocks for putting a well-functioning and integrated capital markets union, encompassing all Member States, into place by 2019. The goal is to ensure that capital can flow freely across the EU Member States.

One of the essential ingredients needed for a strong capital markets union is a safe, efficient and integrated financial market infrastructure. In this regard, T2S lays the foundations for the capital markets union by providing a single platform for securities settlement and consolidating some elements of the fragmented post-trade landscape that we used to have in Europe. Moreover, the T2S programme has proven to be an excellent catalyst for the harmonisation of business practices across European markets. It therefore facilitates the cross-border trade of securities, and thus investment, across the EU Member States.

Among other issues, part of the capital markets union action plan is to address the remaining Giovannini barriers to efficient cross-border clearing and settlement and, where relevant, to address new ones. This work goes hand in hand with the T2S harmonisation agenda, which also tackles technical, legal and regulatory issues impeding investor access to issuers of financial instruments across Europe, and vice versa. With the progressive migration of settlement activity to T2S, the following six Giovannini barriers are being removed:

- national differences in information technology and interfaces

- national clearing and settlement restrictions that require the use of multiple systems

- differences in national rules relating to corporate actions, beneficial ownership and custody

- absence of intra-day settlement finality

- practical impediments to remote access to national clearing and settlement systems

- national differences in operating hours/settlement deadlines.

Together, T2S and the CSD Regulation removed nine of the 15 Giovannini barriers.

For more information about the links between T2S and the capital markets union, see the article entitled “How does T2S feed into the European Commission’s plan for a capital markets union in Europe?”

The Eurosystem’s vision for 2020

On 14 October 2015 the ECB’s Executive Board Member Yves Mersch announced the three main pillars of the Eurosystem’s vision for the future of Europe’s financial market infrastructure. One of the pillars has a direct impact on T2S as possible synergies between the two settlement systems TARGET2 and T2S will be explored. The ultimate goal is to consolidate the technical infrastructures so that TARGET2 can benefit from state-of-the-art features currently available in T2S.

T2S has proved that close collaboration with direct stakeholders is very beneficial for developing and implementing big market infrastructure projects. Acknowledging that, the Eurosystem will continue to work together with the market in order to make the vision for 2020 a reality.