Foreword

Despite a succession of new shocks, the international role of the euro remained resilient in 2022. This was a year that saw the onset of Russia’s war in Ukraine, a rise in economic sanctions and a substantial increase in geopolitical risks – all with potential repercussions for the international monetary system. However, the share of the euro across various indicators of international currency use continued to average close to 20%. The euro remained the second most important currency globally.

This resilience was noteworthy in a context of rising inflationary pressures worldwide – in part owing to war-related energy and food price increases – which led to tighter monetary policies across major economies and higher interest rates on the main international currencies.

But there are developments ahead to monitor for the euro as an international currency. This year’s report discusses the future of the international monetary system following Russia’s invasion of Ukraine, reviewing the available evidence. So far, the data do not show substantial changes in the use of international currencies. However, they do suggest that international currency status should not be taken for granted.

This new landscape increases the onus on European policymakers to create the conditions for the euro to thrive. Its international role is primarily supported by a deeper and more complete Economic and Monetary Union (EMU), including advancing the capital markets union, in the context of the pursuit of sound economic policies in the euro area. The Eurosystem supports these policies and emphasises the need for further efforts to complete EMU. Further European economic and financial integration will be pivotal in increasing the resilience of the international role of the euro in a potentially more fragmented world economy.

The ECB will continue to monitor developments and publish information on the international role of the euro on a regular basis.

Christine Lagarde

President

1 Main findings

This 22nd annual review of the international role of the euro presents an overview of developments in the use of the euro by non-euro area residents. The report covers developments in 2022. This was a year that saw the onset of Russia’s war in Ukraine and a substantial increase in geopolitical risks with potential repercussions for the international monetary system. Rising inflationary pressures globally – in part coming from war-related energy and food price increases – and tighter monetary policies in major economies led to higher interest rates on the main international currencies.

Against this challenging background, a composite index of the international role of the euro remained resilient over the review period (Chart 1). Adjusting for exchange rate valuation effects, the index increased by around 1.3 percentage points. At current exchange rates, it remained largely unchanged. The share of the euro across various indicators of international currency use averaged close to 20%. The euro remained the second most important currency in the international monetary system (Chart 2).

Chart 1

The international role of the euro was resilient in 2022

Composite index of the international role of the euro

(percentages; at current and constant Q4 2022 exchange rates; four-quarter moving averages)

Sources: Bank for International Settlements (BIS), International Monetary Fund (IMF), CLS Bank International, Ilzetzki, Reinhart and Rogoff (2019) and ECB calculations.

Notes: Arithmetic average of the shares of the euro at constant (current) exchange rates in stocks of international bonds, loans by banks outside the euro area to borrowers outside the euro area, deposits with banks outside the euro area from creditors outside the euro area, global foreign exchange settlements, global foreign exchange reserves and global exchange rate regimes. The estimates for the share of the euro in global exchange rate regimes are based on IMF data for the period post-2010; pre-2010 shares were estimated using data from Ilzetzki, E., Reinhart, C. and Rogoff, K. (2019), “Exchange Arrangements Entering the 21st Century: which anchor will hold?”, Quarterly Journal of Economics, Vol. 134, Issue 2, May, pp. 599-646. The latest observation is for the fourth quarter of 2022.

Chart 2

The euro remained the second most important currency in the international monetary system

Snapshot of the international monetary system

(percentages)

Sources: BIS, IMF, Society for Worldwide Interbank Financial Telecommunication (SWIFT) and ECB calculations.

Notes: The latest data for foreign exchange reserves, international debt and international loans are for the fourth quarter of 2022. SWIFT data are for December 2022. Foreign exchange turnover data are as at April 2022. *Since transactions in foreign exchange markets always involve two currencies, shares add up to 200%.

The share of the euro in global official holdings of foreign exchange reserves increased in 2022 by 0.5 percentage points to 20.5%, when measured at constant exchange rates (Table 1). The share of the US dollar declined by more than 2 percentage points, while the share of the renminbi was substantially unchanged. Box 1 examines whether the renminbi could play a stronger role as an international reserve currency despite China’s lack of full financial account openness. A strong dollar and large changes in the price of bonds issued by major economies encouraged official reserve managers to manage their portfolios actively in 2022. Net official purchases of assets denominated in currencies other than the US dollar increased, offsetting valuation effects arising from the dollar’s appreciation – which mechanically raised the share of the US dollar in official reserve portfolios at current exchange rates. Whether inflation developments influenced the decisions of official foreign exchange reserve investors is unclear, as shown by the poor correlation between changes in the share of major currencies in global foreign exchange reserves and inflation rates in the issuing economies. Box 3 discusses how these developments are not exceptional and reflect conventional reserve management strategies by central banks. Interest rates are another factor which can influence the management of reserve portfolios. While interest rates in the euro area returned to positive territory, they remained lower than in other major economies, which could have discouraged rebalancing to euro-denominated assets. Box 2 shows that interest rate differentials are important determinants in the active rebalancing of the government debt portfolios of a sample of US mutual fund managers, much as they influence investment decisions of official reserve managers.[1] Finally, heightened geopolitical risks might have played a role in the investment decisions of official reserve managers in some countries. Special Feature A shows that the accumulation of gold as an official reserve asset was especially strong in countries that are geopolitically close to China and Russia. This may be because such countries are looking to reduce their exposure to the risk of financial sanctions. Higher inflation globally might confound these developments, however, insofar as gold is traditionally seen as a hedge against inflationary risks.

Other indicators of the international role of the euro tracked in this report also point to a noteworthy resilience in the attractiveness of the euro (Table 1). The share of the euro in the outstanding stock of international debt securities increased by more than 1 percentage point to 22.0% in 2022 compared with the previous year, when measured at constant exchange rates. The shares of the euro in the outstanding stocks of international loans and international deposits rose by around 2.4 and 1.5 percentage points, respectively, in 2022. The share of the euro in foreign exchange settlements also increased by almost 3 percentage points to around 38%, when measured at constant exchange rates, over the review period. However, the latest BIS Triennial Survey points to a decline in the share of the euro in global foreign exchange turnover of around 1.8 percentage points since 2019, to 30.5%, owing to the relatively stronger growth of trading in other currencies, such as the US dollar and the renminbi. Box 4 shows that the City of London remained the main venue for foreign exchange trading in euro and that the United Kingdom’s importance for international financial activities in euro did not change materially after Brexit, albeit with a few exceptions. The international role of the euro in foreign currency bond issuance, including the issuance of international green bonds, was substantially stable. Finally, the share of the euro in the invoicing of extra-euro area imports and exports did not change significantly. The impact of Russia’s war in Ukraine on the international role of the euro was particularly visible in the form of a temporary surge in net shipments of euro cash outside the euro area, presumably for precautionary reasons (Box 5). This reversed in the second half of 2022 on the back of higher interest rates and opportunity costs of holding cash (Section 2.5).

As stressed in last year’s edition of this report, the European Union’s economic and financial resilience to the current geopolitical challenges underlines the strength of the international role of the euro. The international role of the euro is primarily supported by a deeper and more complete Economic and Monetary Union (EMU), including advancing the capital markets union, in the context of the pursuit of sound economic policies in the euro area. The Eurosystem supports these policies and emphasises the need for further efforts to complete EMU.

This year’s report includes three special features. The first special feature sheds light on the debate surrounding the future of the international monetary system following Russia’s invasion of Ukraine, reviewing the available evidence. Shortly after the invasion, several packages of sanctions were imposed on Russia, including the freezing of nearly half of the Russian central bank’s foreign exchange reserves and the exclusion of several Russian banks from SWIFT, the dominant financial messaging system for cross-border payments. Some observers noted that these sanctions may encourage countries that are not fully aligned with the United States geopolitically to cut their exposures to the currencies of sanctioning countries, while others were more sceptical and pointed to challenges in moving away from the major international currencies. The special feature shows that evidence of a potential fragmentation of the international monetary system since Russia’s invasion is so far mainly restricted to announcements and specific cases and is not indicative of broader trends. Anecdotal evidence, including official statements, points to the intention of some countries to develop the use of alternatives to the sanctioned currencies, such as the renminbi, the rouble and the Indian rupee, for the invoicing of international trade – notably in commodities. There is also evidence that Russia has been using the Chinese renminbi to a significantly greater extent for international invoicing and cross-border payments in the past few months. However, on the whole, the available data do not show substantial changes in the use of international currencies. One noteworthy development is evidence of diversification into gold by countries that are geopolitically close to China and Russia, perhaps in an attempt to reduce their risk of exposure to sanctions.

The second special feature aims to give a broader perspective to ongoing discussions on the future of the international monetary system and reviews the evidence – both old and new – on how one leading international currency is replaced by another. The conventional historical narrative is that inertia in international currency use is substantial – it takes a long time for a challenger currency to replace the incumbent unit as the presence of network externalities gives rise to lock-in effects. However, one interesting exception is the invoicing of trade by countries neighbouring the euro area, where the euro overtook the US dollar in the space of a few years, i.e. between 1999 – the year of the euro’s creation – and 2019. Two competing hypotheses may explain these developments: a trade shock – in which stronger trade links with the euro area tilted invoicing towards the euro – and an exchange rate volatility shock – in which growing use of the euro as an exchange rate anchor spilled over to invoicing. New evidence from ECB staff research gives support to the first hypothesis, finding that a trade shock is a key determinant of the stronger role of the euro for invoicing international trade in countries neighbouring the euro area. In countries where trade links with the euro area increased, the shock accounts for almost 40% (on average) of the rise in the share of exports invoiced in euro between 1999 and 2019. By contrast, the impact of greater exchange rate stability against the euro is found to be statistically insignificant. Moreover, the estimates point to significant cross-country effects – the fact that countries’ invoicing currency choices are not just impacted by their own trade patterns and exchange rate volatilities, but also by those of their trade partners and competitors. These findings have implications for policy. They suggest that in response to the pandemic shock and the war in Ukraine, the reshoring or “friendshoring” of production chains could lead to stronger regional trade, notably on the European continent and, in turn, to a stronger role of the euro for invoicing international trade, with the caveat that such a reversal in global economic integration would bring other economic costs.

The third special feature looks at the role of international currencies in global finance. It provides insights into determinants of currency choice in cross-border bank lending, including bilateral distance, measures of linkages to the issuer countries through finance, trade and the use of vehicle currencies for trade invoicing. The special feature pinpoints several new facts. It highlights the centrality of the City of London for euro-denominated loans, albeit with tentative signs of adverse Brexit effects. It shows that offshore financial centres play a pivotal role in the international network of cross-border loans denominated in US dollars, which largely reflects lending to non-bank financial intermediaries (such as investment banks, finance companies, mutual funds, pension funds and insurance companies) in the Cayman Islands. Moreover, empirical estimates suggest that euro-denominated loans are driven by gravity effects, pointing to a stronger role of the euro in the immediate vicinity of the euro area, in contrast to US dollar loans which have a more global outreach. Finally, there is evidence that complementarity effects between trade invoicing and bank lending decisions – which are predicted to be significant according to recent theoretical models of international currency use – are stronger for the euro than for the US dollar.

Table 1

The international role of the euro from different perspectives

Summary of data in this report

Sources: BIS, CLS Bank International, Dealogic, IMF, national sources and ECB calculations.

Notes: An increase in the euro nominal effective exchange rate indicates an appreciation of the euro. For foreign exchange trading, currency shares add up to 200% because transactions always involve two currencies.

Box 1

Internationalisation of the renminbi and capital account openness

Why doesn’t the currency of the second largest economy in the world play a more consequential reserve currency role? The share of the Chinese renminbi in global reserve portfolios, at about 3%, pales in comparison with those of the US dollar (about 60%) and the euro (about 20%).[2] What explains the difference?

More2 Key developments

2.1 Use of the euro as an international reserve and investment currency

The share of the euro in global official holdings of foreign exchange reserves increased in 2022 when measured at constant exchange rates. At the end of 2022, official investors held about €11.4 trillion (USD 12.0 trillion) in foreign exchange reserves. Total foreign exchange reserves declined by more than 7 percentage points, when measured at current exchange rates, compared with the previous year (Table 1). The share of the euro in global official holdings of foreign exchange reserves increased by 0.5 percentage points to 20.5% in 2022 when measured at constant exchange rates (Chart 3). By contrast, the share of the euro remained broadly stable, declining by about 0.1 percentage points, when measured at current exchange rates (Chart 5). Overall, in the past seven years the share of the euro in global official holdings of foreign exchange reserves has remained within a relatively narrow range.

Chart 3

The share of the euro in global official holdings of foreign exchange reserves increased in 2022

Shares of the euro, US dollar and other currencies in global official holdings of foreign exchange reserves

(percentages; at constant Q4 2022 exchange rates)

Sources: IMF and ECB calculations.

Note: The latest observation is for the fourth quarter of 2022.

Interest rates and fixed-income yields on highly-rated euro area government bonds turned positive in 2022, although they remained lower than in other major economies. Interest rate differentials with other major advanced economies widened over the course of 2022, except with Japan. For instance, euro area long-term interest rates remained lower by around 200 basis points compared with the United States and about 150 basis points compared with the United Kingdom, which could have discouraged rebalancing to euro-denominated assets (Chart 4). Box 2 shows how interest rate differentials are important determinants of active rebalancing for US mutual fund managers across currencies within their portfolios of government debt securities,[3] which is consistent with evidence from the literature for official reserve managers.[4]

Chart 4

Average interest rates in the euro area in positive territory but lower than in several advanced economies in 2022

Five-year and one-month interest rate in the major economies in 2022

(percentages)

Sources: Refinitiv Datastream, BIS, S&P Global and ECB calculations.

Note: The five-year government yield for the euro area is calculated as a debt-weighted average of five-year euro area yields of sovereigns with a Standard & Poor’s credit rating of at least AA.

A strong dollar and rising policy interest rates encouraged official reserve managers to manage their portfolios actively in 2022, to a large extent offsetting the valuation effects arising from exchange rate and bond price movements. In 2022 the share of the US dollar – the major global reserve currency – remained stable at around 58.4%, when measured at current exchange rates, although it declined by about 2.2 percentage points at constant exchange rates. Reserve managers sold an estimated USD 293 billion of US dollar assets in the review period. Net purchases of currencies other than the US dollar largely offset the impact of valuation effects stemming from the US dollar’s appreciation – which mechanically raises the share of the US dollar in official reserve portfolios. Net purchases of euro-denominated reserves by official investors reached an estimated €50 billion (USD 53 billion) in the review period.[5] Not only did the share of the euro increase at constant exchange rates but also the share of currencies other than the euro and the US dollar – by about 1.7 percentage points in the review period (Chart 3). In particular, the share of official reserve assets denominated in Japanese yen and pound sterling both increased by 0.5 percentage points, while the share of other major reserve currencies remained broadly stable (Chart 5). These developments are not exceptional and reflect conventional reserve management strategies by central banks. During periods of strong dollar appreciation reserve managers tend to stabilise the composition of their portfolios by selling dollar assets and purchasing assets in other major currencies, such as the euro (Box 3). In addition, foreign exchange interventions aiming at stabilising the exchange rate of the domestic currency against the US dollar or limiting its volatility become more likely when the US dollar appreciates, particularly in emerging markets, explaining net sales of US dollar-denominated reserve assets. According to a regular survey conducted by the investment bank UBS, rising interest rates in the US and inflation represented one of the main concerns for the investment of foreign exchange reserves.[6] The extent to which current inflation developments influenced the decisions of official foreign exchange reserve investors is not entirely clear as shown by the limited correlation between changes in the share of major currencies in global foreign exchange reserves and inflation rates in the issuing economies in 2022 (Chart 6).

Chart 5

Official reserve managers tried to manage their portfolios actively to offset the effects of a strong US dollar

Change in the share of selected currencies in global official holdings of foreign exchange reserves

(percentage points; at current and constant Q4 2022 exchange rates)

Chart 6

Inflation developments are uncorrelated with changes in the currency composition of foreign exchange reserves

Correlation between changes in the share of selected currencies in global official holdings of foreign exchange reserves and inflation in 2022

(x-axis: annual percentage changes in consumer price indices in 2022; y-axis: percentage point changes in currency shares of foreign exchange reserves, at constant exchange rates)

Sources: IMF and ECB calculations.

Note: The latest observation of the foreign exchange reserve data is for the fourth quarter of 2022.

Box 2

Investment funds and search for yield within the sovereign debt market of highly-rated issuers

To what extent do investors reallocate their portfolios of safe assets across major currencies in search for higher returns? In previous years, survey evidence suggested that relatively low yields in euro area fixed-income markets might have been a factor in moderating the global appeal of the euro as a reserve and investment currency.[8] The empirical evidence presented in this box indicates that investors tend to reallocate their portfolio of safe assets in response to changes in yields across major currencies.

MoreBox 3

Valuation effects and rebalancing of official foreign exchange reserves

Movements in the exchange rates of major reserve currencies as well as in the market prices of securities held by central banks may have a significant impact on the currency composition of official foreign exchange reserves, when measured at current exchange rates. For instance, a broad US dollar appreciation, as was the case in 2022, mechanically increases the share of the US dollar, as other currencies lose value against that currency. Similarly, if yields increase, the market value of bonds falls, leading to a stronger decline in the value of reserve assets denominated in currencies experiencing the largest decreases in bond prices. These developments, as noted by Chinn et al. (2022)[9], confound active reserve management strategies through changes in the value of the underlying assets. This box reviews the evidence of the importance of these valuation effects for the adjustment of currency portfolios by reserve managers against the background of large fluctuations in exchange rates and bond prices seen in the past year.

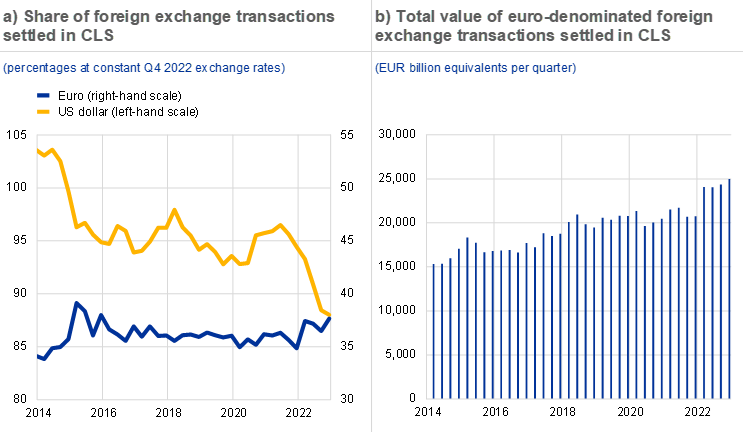

More2.2 The euro in global foreign exchange markets

The euro remained the second most actively traded currency in global foreign exchange markets after the US dollar. The share of the euro in global foreign exchange settlements increased slightly in 2022, according to data from the CLS system, standing at almost 38% in the fourth quarter of 2022 (Chart 7, panel a) – an increase of almost 3 percentage points from the previous year when measured at constant exchange rates.[10] By contrast, the share of the US dollar decreased by more than 6 percentage points, although the US dollar remained the leading currency in global foreign exchange settlements – being involved in almost 90% of all settlements in the fourth quarter of 2022.[11] Volumes of euro settlements increased by over 20% in the fourth quarter of 2022 compared with the previous year, consistent with trends in the past few years (Chart 7, panel b).

The latest evidence from the Triennial Central Bank Survey of foreign exchange and over-the-counter (OTC) derivatives markets, conducted by the BIS in April 2022, showed that the share of the euro decreased by 1.8 percentage points compared with the previous survey conducted in 2019 (Chart 8, panel a).[12] Global foreign exchange turnover increased by 14% compared with 2019, reaching USD 7.5 trillion. Overall, the US dollar remained the most used currency, being on one side of almost 90% of total OTC transactions, a share that is broadly stable compared with earlier surveys. Meanwhile, the euro was used in 31% of all trades, thereby remaining the second most actively traded currency.[13] Volumes of OTC trade in euro increased by USD 167 billion (or about 8%) relative to 2019, compared with even stronger increases for the US dollar and the Chinese renminbi of USD 830 billion (or about 14%) and USD 241 billion (or about 85%) respectively. The Chinese renminbi thus exhibited the largest increase in market share since the 2019 survey, being on one side of 7% of all trades in 2022 (up from 4% in 2019) to become the fifth most traded currency. The Japanese yen and pound sterling were on one side of 17% and 13% of all trades respectively, largely unchanged compared with the previous survey. Global foreign exchange trading activity involving the euro is concentrated in the United Kingdom, which accounts for more than 42% of total trading, as well as in the United States, the euro area, Hong Kong SAR, Singapore and Switzerland (Chart 8, panel b). Relative to the 2019 survey, euro foreign exchange (FX) trading activity in the United Kingdom contracted by 6 percentage points, standing close to the level prevailing at the time of the 2016 Brexit referendum.

Chart 7

The euro remained the second most important currency in global foreign exchange settlements

Sources: ECB calculations based on CLS Bank International data.

Note: As two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200% instead of 100%. The latest observation is for the fourth quarter of 2022.

Chart 8

The share of the euro in global OTC transactions decreased slightly in the latest BIS Triennial Survey compared with the previous survey

Sources: BIS and ECB calculations.

Notes: As two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200% instead of 100%. Adjusted for local and cross-border inter-dealer double-counting (i.e. on a “net-net” basis). The data on geographical locations include spot transactions, outright forwards, foreign exchange swaps, currency swaps, options and other products. They are adjusted for local inter-dealer double-counting (i.e. on a net-gross basis) and may differ slightly from national survey data owing to differences in aggregation procedures and rounding. The BIS uses several criteria to determine the location of a foreign exchange transaction, notably the location of the initiating sales desk.

2.3 Use of the euro in international debt and loan markets

2.3.1 The euro in international debt markets

The share of the euro in the stock of international debt securities increased in 2022.[14] When measured at constant exchange rates, the share of the euro in the stock of international debt securities stood at 22%, increasing by 1.2 percentage points in the review period. The share of the euro remains about 8 percentage points lower than its peak in the mid-2000s. By contrast, the share of the US dollar declined by about 1.2 percentage points, although it remains the leading currency in the international debt security markets, accounting for more than 65% of the global stock (Chart 9 and Table A4).

Chart 9

The share of the euro in the stock of international debt securities increased in 2022

Currency composition of outstanding international debt securities

(percentages; at constant Q4 2022 exchange rates)

Sources: BIS and ECB calculations.

Notes: Narrow measure. The latest observation is for the fourth quarter of 2022.

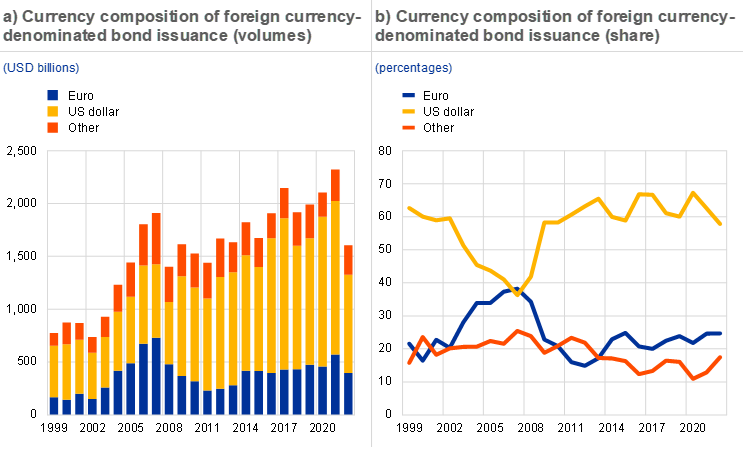

Granular data on international issuance of foreign currency-denominated bonds suggest that the volume of international bond issuance decreased markedly in 2022.[15] In 2022 the total volume of foreign currency-denominated bond issuance contracted by more than USD 700 billion, corresponding to a decline of 30% in relative terms over the review period. This decline occurred amid market concerns about the economic outlook, tighter financial conditions in advanced economies and geopolitical fragmentation risks (Special Feature A). In particular, the issuance of euro-denominated bonds decreased by about 30% in 2022 compared with the previous year, standing at €377 billion (USD 397 billion). However, the share of the euro in foreign currency-denominated bond issuance remained stable, at around 25% (Chart 10, panel a). Issuance of US dollar-denominated bonds (USD 930 billion in 2022) fell more markedly, by around 36% year on year, reducing the share of the dollar in international bond issuance by 5 percentage points.[16] Despite these developments, the US dollar remains by far the leading currency for international issuance of foreign currency-denominated bonds, accounting for more than 57% of total issuance in the review period (Chart 10, panel b). Notably, the share of currencies other than the US dollar and the euro increased to around 17%.

Chart 10

The share of the euro in international issuance of foreign currency-denominatedbonds remained stable in 2022

Sources: Dealogic and ECB calculations.

Note: The latest observation is for end-2022.

The retrenchment in euro-denominated international bond issuance was mainly driven by lower issuance in the United Kingdom, the United States and emerging markets. Issuance of euro-denominated international bonds contracted by 72% among emerging market economies in 2022 and by more than 40% in the United States, the United Kingdom and Japan (Chart 11, panel b). At the same time, in non-euro area EU Member States and other advanced economies, issuance of euro-denominated bonds increased by 6 and 8 percentage points respectively. Issuance of US dollar-denominated bonds in emerging market economies declined by 55% (Chart 11, panel a).[17] The retrenchment might have arisen from higher interest rates and financing costs in advanced economies, combined with heightened volatility in bond markets. This might have in turn dampened demand for foreign currency-denominated debt issued by emerging market economies. The impact of Brexit on the role of the City of London as a centre for the intermediation of foreign currency-denominated funding might also explain the lower issuance of euro and US dollar-denominated debt in the United Kingdom (Box 4).

Chart 11

Issuance of euro and US dollar-denominated bonds declined in emerging market economies in 2022

Sources: Dealogic and ECB calculations.

Note: The latest observation is for end-2022.

International issuance of green bonds also decreased substantially in the review period.[18] In absolute terms, the amount of international green bonds issued in major currencies contracted by about USD 41 billion (Chart 12, panel a). Issuance of green bonds denominated in euro decreased by €11 billion (USD 12 billion) for a total issuance of about €34 billion (USD 36 billion) in 2022. US dollar-denominated issuance also fell from USD 80 billion to USD 59 billion. In relative terms, the shares of euro and US dollar-denominated green bonds remained stable, with the two currencies accounting for about 31% and 51% of total issuance respectively.

Chart 12

International green bond issuance retrenched in 2022, although the share of the euro in total issuance remained stable

Sources: Dealogic and ECB calculations.

Notes: Annual totals are based on the aggregation of individual deals. The latest observation is for end-2022.

2.3.2 The euro in international loan and deposit markets

The share of the euro in the outstanding stock of international loans continued to increase in 2022. Euro-denominated international loans increased by about 2.4 percentage points in the review period, when measured at constant exchange rates (Chart 13 and Table A6).[19] The share of the euro in 2022, at around 19%, is close to its historical peak of about 20% seen in 2005. By contrast, the share of the US dollar in international loan markets continued to decline, although the US dollar remains the leading currency in international loan markets by a large margin, accounting for about 53% of total loans. Geographical distance or complementarities with trade invoicing patterns tend to affect demand for euro-denominated and, to a lesser extent, dollar-denominated international loans (Special Feature C).

Chart 13

The share of the euro in outstanding international loans remained close to historical peaks

Currency composition of outstanding amounts of international loans

(percentages; at constant Q4 2022 exchange rates)

Sources: BIS and ECB calculations.

Notes: The latest observation is for the fourth quarter of 2022. International loans are defined as loans by banks outside the currency area to borrowers outside the currency area.

The share of outstanding international deposits denominated in euro continued to increase in 2022. The share of the euro rose by about 1.5 percentage points over the review period, when measured at constant exchange rates, standing at almost 18% (Chart 14 and Table A7).[20] By contrast, the share of US dollar-denominated deposits declined by about 1.4 percentage points in 2022 as investors reduced holdings of dollar-denominated deposits accumulated as liquid balances during the pandemic.[21] However, despite a marginal decline in 2022, the share of US dollar-denominated international deposits remained close to pre-pandemic levels, at around 52% of total international deposits.

Chart 14

The share of the euro in outstanding international deposits increased further in 2022

Currency composition of outstanding amounts of international deposits

(percentages; at constant Q4 2022 exchange rates)

Sources: BIS and ECB calculations.

Notes: The latest observation is for the fourth quarter of 2022. International deposits are defined as deposits with banks outside the currency area from creditors outside the currency area.

Box 4

Impact of Brexit on the international role of the euro

This box presents an early assessment of the changing role of the City of London for euro-denominated financial activities since Brexit.[22] Since its introduction in 1999, the City of London has been the leading financial centre for the international use of the euro in several market segments.[23] The decision of the United Kingdom in June 2016 to leave the EU was therefore seen as the portent of a potential change in the central role of the City of London for global financial markets.[24] This event was particularly relevant for euro financial activities that benefit from a harmonisation of rules and standards with the EU, such as trading in foreign exchange and OTC derivatives and banking services.[25] Data on these activities thus far, however, show no major shifts in the importance of the City of London for euro-denominated financial market segments, with some exceptions.[26]

More2.4 Use of the euro as an invoicing currency

The share of the euro as an invoicing or settlement currency for extra-euro area trade, in particular services exports, remained broadly stable in 2022. Extra-euro area exports of goods invoiced in euro declined by half a percentage point in 2022 to around 59%, while the share of extra-euro area imports of goods invoiced in euro also dropped by half a percentage point to below 52% (Chart 15, panel a and Table A8). However, such changes remain marginal and, from a long-term perspective, the role of the euro as an invoicing currency for trade in goods remains by and large unchanged. Almost 58% of extra-euro area services exports were invoiced in euro in 2022, down from around 60% in the previous year. The share of exports of services invoiced in euro, similar to the euro-invoiced share of exports of goods, also reached a historical low, continuing the downward trend seen since 2018. Likewise, just below 53% of extra-euro area imports of services were invoiced in euro in 2022, down by about 0.3 percentage points compared with the previous year (Chart 15, panel b).

Chart 15

The share of euro as an invoicing currency of extra-euro area trade in goods and services was broadly stable in 2022

Sources: National central banks and ECB calculations.

Note: The computation of the euro area aggregate is based on the latest observation reported by each Member State.

2.5 Use of euro banknotes outside the euro area

Cumulative shipments of euro banknotes to destinations outside the euro area decreased to a ten-year low in 2022. The value of net registered shipments of euro banknotes to destinations outside the euro area declined by about 11% over the review period, the largest year-on-year decline since the launch of the euro (see Chart 16).

Chart 16

Net extra-euro area shipments of euro banknotes saw an unprecedented decline in 2022

Net monthly shipments of euro banknotes to destinations outside the euro area

(EUR billions; adjusted for seasonal effects)

Source: Eurosystem.

Notes: Net shipments are euro banknotes sent to destinations outside the euro area minus euro banknotes received from outside the euro area. The latest observation is for December 2022.

However, developments in shipments of euro banknotes outside the euro area differed markedly between the first half and second half of 2022. In the first half of the year, the value of net registered shipments of euro banknotes to destinations outside the euro area increased by around 8%. This surge in demand for euro cash was likely caused by the outbreak of Russia’s war in Ukraine which spurred precautionary demand for euro banknotes in a number of central and eastern European countries outside the euro area neighbouring Ukraine (Box 5 on the impact of Russia’s war in Ukraine on foreign demand for euro cash).

In the second half of 2022, net shipments of euro banknotes to destinations outside the euro area decreased markedly as a result of two factors. First, the beginning of monetary policy normalisation by the ECB led to an associated rise in opportunity costs of holding cash and may have encouraged decreases in cash holdings. In anticipation of the increase in ECB policy rates in July 2022, net shipments decreased by around 4% month-on-month – an unprecedented deceleration – followed by significant banknote purchases in the subsequent months. Second, geopolitical developments likely reduced sales of euro banknotes to eastern European countries outside the EU significantly. These countries accounted for 15% of total sales in 2022, compared with almost 30% in 2021 (Chart 17, panel a).

Chart 17

In 2022 euro banknotes were mainly exported to and imported from countries neighbouring the euro area

Source: ECB calculations based on data from international banknote wholesalers.

Note: The data are for 2022.

Box 5

The impact of war: extreme demand for euro cash in the wake of Russia’s invasion of Ukraine

Proximity to war boosts foreign and domestic demand for euro cash

Geopolitical conflicts can have a significant impact on the demand for euro cash outside the euro area, as illustrated by Russia’s invasion of Ukraine in February 2022. Chart A, panel a, compares the deviation of demand for euro banknotes from historical averages, both from non-euro area countries (blue line) and from countries within the euro area (dotted grey lines) between January 2021 and May 2022 – immediately after demand returned to near-average levels. In the months before the invasion, foreign demand for euro cash remained below its historical average. However, it rose far above its historical average just after the invasion (in March 2022), to an extent greater than in most euro area countries in that period. This suggests that precautionary motives were a determinant of demand for euro cash from non-euro area countries, mainly driven by high-value denominations (€100 and €200) which are mostly used for store-of-value purposes.[27]

More3 Special features

A Geopolitical fragmentation risks and international currencies

Shortly after Russia invaded Ukraine, several packages of unprecedented sanctions were imposed on Russia, including the freezing of nearly half of the Russian central bank’s foreign exchange reserves and the exclusion of a number of Russian banks from SWIFT, the dominant financial messaging system used to facilitate cross-border payments. Several observers noted that these sanctions may have far-reaching consequences for the role of the currencies of the sanctioning countries – including the US dollar and the euro – in the international monetary and financial system. According to these observers, countries that are not fully aligned geopolitically with the United States might reduce their exposures to the currencies of sanctioning countries going forward. However, other observers have been more cautious and pointed to challenges involved in diversifying from the major international currencies. This special feature sheds light on this debate by reviewing the available evidence on the effects of geopolitical fragmentation risks on the use of international currencies. It shows that evidence of potential fragmentation in the international monetary system since Russia’s invasion has so far been mainly restricted to announcements and specific cases rather than pointing to broader trends. Anecdotal evidence, including official statements, points to intentions of some countries to develop the use of alternatives to major traditional currencies, such as the Chinese renminbi, the Russian rouble or the Indian rupee for invoicing international trade. There is also evidence that Russia has been using the Chinese renminbi to a significantly greater extent for international invoicing and cross-border payments in the past few months. However, the available data do not show substantial changes in the use of international currencies as yet. One exception is evidence of increased accumulation of gold as an alternative reserve asset, possibly driven by countries geopolitically closer to China and Russia.

MoreB How is a leading international currency replaced by another? Old versus new evidence

This special feature reviews the evidence – both old and new – on how a leading international currency is replaced by another. The conventional historical narrative is that inertia in international currency use is substantial – it takes a long time for a challenger currency to replace the incumbent owing to the existence of network externalities that give rise to lock-in effects. The US dollar remains the leading currency for global trade and finance today, despite the decline in the United States’ share of global output and trade, which testifies to the importance of inertia. However, one interesting exception is the currency invoicing of trade of countries neighbouring the euro area between 1999 – the year of the euro’s creation – and 2019, when the share of the euro increased by more than 20 percentage points on average, at the expense of the US dollar.

Two competing hypotheses may explain these developments: a trade shock – where stronger trade links with the euro area tilt invoicing towards the euro – and an exchange rate volatility shock – where growing use of the euro as an exchange rate anchor spills over to invoicing. Recent evidence from ECB staff research empirically tests the relative importance of these two shocks. The estimates give support to the view that a trade shock is a key determinant of the stronger role of the euro for invoicing international trade in countries neighbouring the euro area. In those countries where trade links with the euro area increased, the shock explains on average almost 40% of the rise in the share of exports invoiced in euro between 1999 and 2019. By contrast, the impact of greater exchange rate stability against the euro is statistically insignificant. Countries’ invoicing currency choices are not just impacted by their own trade patterns and exchange rate volatilities but also by those of their trade partners and competitors. These effects operate mainly via bilateral trade linkages rather than strategic complementarities in export price setting, which underscores the relevance of changes to input-output linkages as determinants of invoicing currency patterns.

These findings have implications for policy. They suggest that, in response to the pandemic shock and the war in Ukraine, reshoring or friendshoring of production chains could lead to stronger regional trade, notably on the European continent. That in turn could strengthen the future role of the euro for the invoicing of international trade.

MoreC Determinants of currency choice in cross-border bank loans

Dominant currencies confer important economic, financial and strategic advantages on the issuer, so it is important to understand why some currencies have a more prominent international role than others. This special feature provides insights into various potential determinants of currency choice in cross-border bank lending, such as bilateral distance, measures of financial and trade linkages to issuer countries of major currencies, and invoicing currency patterns. Cross-border bank lending in US dollars, and particularly in euro, is highly concentrated in a small number of countries. The United Kingdom is central in the international network of loans denominated in euro, although there are tentative signs that this role has diminished for lending to non-banks since Brexit, with such loans now possibly booked by newly-established US (or euro area) subsidiaries. Offshore financial centres are pivotal for US dollar loans, reflecting, in particular, lending to non-bank financial intermediaries in the Cayman Islands, possibly as a result of regulatory and tax optimisation strategies of large multinationals and high net worth individuals. An empirical analysis suggests that euro-denominated loans face the “tyranny of distance”, in line with predictions of standard models of trade, as captured by a variety of variables, in contrast to US dollar loans. Complementarities between trade invoicing and bank lending are found for both the euro and the US dollar. Overall, the analysis suggests that the euro tends to be more of a regional currency, while use of the US dollar in cross-border bank lending is global.

More4 Statistical annex

See more.

© European Central Bank, 2023

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

The cut-off date for the statistics included in this report was 30 April 2023.

PDF ISBN 978-92-899-5527-0, ISSN 1725-6593, doi:10.2866/518597, QB-XN-23-001-EN-N

HTML ISBN 978-92-899-5552-2, ISSN 1725-6593, doi:10.2866/063496, QB-XN-23-001-EN-Q

See Arslanalp, S., Eichengreen, B. and Simpson-Bell, C. (2022), “The Stealth Erosion of Dollar Dominance and the Rise of Nontraditional Reserve Currencies”, Journal of International Economics, Vol. 138, No 103656.

See also Anaya Longaric, P. and Di Casola, P. (2022), “The internationalisation of the renminbi: regaining strength?”, The international role of the euro, European Central Bank, June.

Estimates presented in Box 2, for example, show that an increase of 100 basis points in the yields of highly-rated euro area debt securities relative to yields on the debt of other reserve currency issuers leads to an increase in the share of the euro area of over 1 percentage point on average across funds. This corresponds to a total reallocation of around USD 300 million in each quarter.

See Arslanalp, S., Eichengreen, B. and Simpson-Bell, C. (2022), “The Stealth Erosion of Dollar Dominance and the Rise of Nontraditional Reserve Currencies”, Journal of International Economics, Vol. 138, No 103656.

Purchases were derived from changes in holdings over the review period. The estimates account for valuation effects arising from exchange rate and bond price changes that influence nominal amounts of reserves denominated in euro and reported in US dollar terms. See Box 3 for a detailed review of the methodology used.

See UBS (2022), “UBS Annual Reserve Manager Survey”, Zurich, June

University of Lausanne. The analysis was prepared when Marco Graziano was a trainee at the ECB.

See Section 2.1 of The international role of the euro, European Central Bank, June 2021.

Chinn, M.D., Ito, H. and McCauley, R.N. (2022), “Do central banks rebalance their currency shares?”, Journal of International Money and Finance, Vol. 122, No 102557.

CLS is operated by CLS Bank International, a specialised financial institution providing settlement services for its members in the foreign exchange market. Although not all foreign exchange transactions are settled in CLS, which partly reflects the fact that the foreign exchange market is largely decentralised, it has been estimated that over 50% of eligible global foreign exchange transactions are settled in CLS. This suggests that data on activity in CLS might be indicative of broader market trends.

Since transactions in foreign exchange markets always involve two currencies, shares add up to 200%.

See the BIS Triennial Central Bank Survey: OTC foreign exchange turnover in April 2022, October 2022. Compared with CLS data, which cover 18 major currencies, the BIS triennial survey is more comprehensive and includes, among others, the trading of the Chinese renminbi, which is not covered by CLS. The strong growth in renminbi trading could explain differences in the relative shares of currencies in CLS data and the BIS Triennial Survey.

The USD/EUR is the most liquid currency pair, accounting for around 23% of all transactions.

The discussion here is based on the “narrow” definition of international debt issuance, which focuses on the foreign currency principle. This definition therefore excludes all domestic currency issuance, i.e. all securities denominated in the currency of the economy in which the issuer resides, from the standard (also known as “broad”) definition of international debt issuance. For instance, the narrow definition excludes a euro-denominated bond issued by a German company, whether issued outside the euro area (e.g. in the United States) or inside the euro area (e.g. in France).

The fact that the data on the share of the euro in foreign currency-denominated bond issuance reveal a different pattern to the data on the stock of international debt securities may be because the latter also depend on net redemptions and developments in money market instruments.

Issuance in currencies other than the US dollar and the euro also decreased by about 6 percentage points (USD 17 billion).

Issuance of US dollar-denominated bonds also declined in the euro area (-35%), Japan (-42%) and across other advanced economies (-13%).

International issuance of green bonds refers to issuance in a foreign currency based on the nationality of the issuer or the parent entity of the issuer.

International loans are defined as loans by banks outside the currency area to borrowers outside the currency area. For instance, “international loans in euro” refers to all euro-denominated loans by banks outside the euro area to borrowers outside the euro area.

The definition of international deposits is equivalent to the definition of international loans. International deposits are defined as deposits with banks outside the currency area made by creditors from outside the currency area. For instance, international deposits in euro correspond to all euro-denominated deposits with banks outside the euro area made by creditors from outside the euro area.

See “International role of the euro”, European Central Bank, Frankfurt am Main, June 2022.

This box draws on and updates some of the data first discussed in BIS (2022), “London as a financial centre since Brexit: evidence from the 2022 BIS Triennial Survey”, BIS Bulletin, No 65. The author is grateful to Jakub Demski, Robert N. McCauley and Patrick McGuire for discussions and assistance regarding the data, as well as Guy-Charles Marhic, Alexandra Born and Claudia Lambert for discussions and helpful comments.

See “The euro’s contribution to financial market activity in the City of London” in ECB (2003), “Review of the international role of the euro”.

The most important milestones in the Brexit timeline include the United Kingdom’s vote to leave the EU on 23 June 2016, the agreement on a transition phase on 19 March 2018, the EU’s approval of postponing the Brexit date on 29 October 2019 and the end of the Brexit transition period on 31 December 2020.

See EY Financial Services (2017): “Brexit Tracker”, PricewaterhouseCoopers (2016): “What does Brexit mean for London, the UK and Europe?” and New Financial (2016) “The potential impact of Brexit on European capital markets”. Estimates predicted that the removal of passporting rights and the loss of regulatory equivalence could lead to a 30% shift in operations, the moving of 13% of staff (of a total of 400,000) and an additional 13,000 financial sector jobs at risk in London.

In early 2021, equity trading of EU-listed corporates saw an abrupt relocation from the City of London, mainly to Amsterdam. This was the result of the European Commission not recognising UK exchanges as having the same supervisory status as EU exchanges. The implications of Brexit for the real economy, particularly for trade and labour markets, have been more pronounced (see the article entitled “The impact of Brexit on UK trade and labour markets” in Issue 3/2023 of the ECB Economic Bulletin).

Significantly large increases in precautionary cash demand were observed globally in past financial, technological or natural disaster-related crises. See “The paradox of banknotes: understanding the demand for cash beyond transactional use”, Economic Bulletin, Issue 2, ECB, Frankfurt am Main, 2021.

The views expressed here are those of the authors. They do not represent the views of the Bank for International Settlements, the ECB or the Eurosystem.

- 21 June 2023