A stylised tracer for labour market cycles in the euro area based on assessments by corporate executives

Published as part of the ECB Economic Bulletin, Issue 7/2019.

This box assesses the current cyclical position of the euro area labour market by means of a stylised tracer for employment and output fluctuations using the Purchasing Managers’ Index (PMI) survey data. The PMI is a set of monthly indicators which, owing to their timeliness and monthly frequency, can be used to predict movements in the growth rate of key macroeconomic variables, such as employment and real GDP. However, the monthly PMI data can also be very volatile over time, as they contain information not only on structural factors and the cyclical position of the economy, but also on assessments by corporate executives regarding the immediate reactions of their firms to idiosyncratic events over time. This latter component of the PMI data is likely to be affected by possible measurement errors or by information asymmetries. As such, a stylised labour market tracer[1] is constructed by applying a low-pass filter to the underlying monthly PMI data on employment and output, with a view to smoothing the PMI data and isolating the relevant information in order to assess the current cyclical position of the labour market.

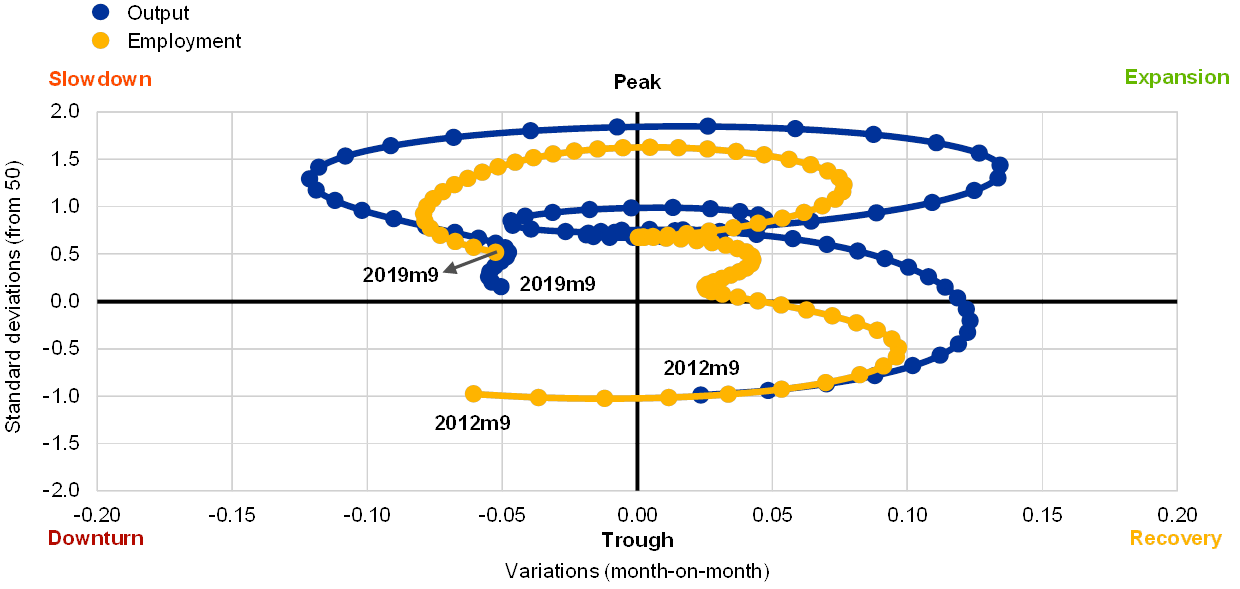

The stylised tracer for labour market cycles in the euro area is created by juxtaposing the developments in the PMI tracer for employment with those of the PMI tracer for output. If the PMI tracer for employment shows a level above (below) 50, it implies that employment is expected to grow (decline) that month. The same holds for the relationship between the level of the PMI tracer for output and expected developments in real GDP that month. Given the interpretability of PMI data to aggregate developments in employment and GDP, the stylised tracer for the labour market cycles in the euro area is created visually by plotting the levels of the PMI tracers for employment and output against their respective month-on-month variations. This allows four positions in the labour market cycle to be identified: (1) a level above 50 and which shows a month-on-month increase is interpreted as an expansion; (2) a level above 50 but falling month on month indicates a slowdown; (3) a level below 50 but decreasing is considered to indicate a downturn; (4) when the level is below 50 but shows monthly improvements, this denotes a recovery. In addition, a local peak (or trough) is achieved whenever the tracer shows no change over the month and is at a level above (or below) 50.

The stylised labour market tracer for the euro area points towards a slowdown in the labour market since February 2018, with the tracer for employment lagging that for output.[2] Chart A shows the cyclical position of the euro area labour market over the past seven years, from September 2012 to September 2019. The cyclical assessment by corporate executives of their firms’ employment and production developments is a leading indicator for the aggregate developments in hard data, in particular at the start of the current recovery. According to the stylised tracers based on the PMI for employment and output, the euro area labour market has experienced a recovery since December 2012, while output has been on a recovery path since September 2012. This is a couple of months earlier than the official trough announced for the euro area economy by the Centre for Economic Policy Research’s Euro Area Business Cycle Dating Committee. In September 2019 the euro area labour market is still assessed as being in slowdown territory, with the tracer for employment in slowdown territory since February 2018 and the tracer for output since October 2017. As such, current employment and output fluctuations are seen to be consistent with a more mature phase in the cycle, which is usually characterised by movements within the expansion-slowdown territory.

Chart A

Stylised tracer for the cyclical position of the euro area labour market

(y-axis: levels; x-axis: month-on-month variations; all values expressed in standard deviations from 50)

Sources: Markit and ECB staff calculations.

Note: The latest observation is for September 2019.

The slowdown in the euro area labour market is characterised by a dichotomy between weakness in the manufacturing sector and resilience in the services sector (see Chart B).[3] The tracer for employment suggests that the labour market in manufacturing entered a downturn in May 2019, three months later than output, after having been assessed as being in slowdown territory since December 2017. At the same time, employment in the services sector is perceived to be moving within the expansion-slowdown territory, with the tracer for employment in this sector being more resilient than the tracer for employment in manufacturing. The resilience of employment in the services sector seems broadly consistent with the developments in economic activity in the sector, despite the month-on-month variations in the tracer for output becoming slightly more negative in recent months. Meanwhile the tracer for output in manufacturing entered downturn territory, which could signal potential risks related to the transmission of the weakness in manufacturing to the services sector. Heuristically, as employment developments lag behind changes in economic activity for both sectors, the transmission of the weakness in manufacturing to output developments in the services sector makes close monitoring of the euro area labour market and of the channels causing this effect essential going forward.

Chart B

Stylised labour market tracer for manufacturing and for the services sector

(y-axis: levels; x-axis: month-on-month variations; all values expressed in standard deviations from 50)

Sources: Markit and ECB staff calculations.

Note: The latest observation is for September 2019.

Using a more granular approach to assess the current position in the labour market cycle suggests that the weakness in manufacturing is more prevalent in the capital goods and motor vehicles industries, while the resilience of the services sector is broad-based across industries. In September 2019 the weakness in employment in the manufacturing sector is tracked as being most prevalent among capital goods and intermediates, in particular the manufacturing of rubber and plastic, the manufacturing of machinery and equipment, and the motor vehicles industries. The weakness in employment in the manufacturing sector is not observed in the cyclical position of the industries producing consumer goods, a sector that is supported by robust domestic demand despite the current slowdown in economic activity.[4] On the other hand, the performance of the services sector labour market remains broad-based within the expansion-slowdown territories, with employment developments in services sector industries showing a degree of resilience to the current weakness in manufacturing.

Overall, these results suggest that the services sector continues to support employment growth in the euro area, while employment in manufacturing has been weaker since May 2019. The question is whether there will be any negative spillovers from manufacturing to services, particularly of weaknesses stemming from the transportation industry.[5] According to the tracer for output, transportation has weakened in 2019, in parallel with the observed weakness in manufacturing. As such, there are downward risks from a possible propagation of the weakness in transportation to other services sector industries owing to its centrality in the relationship between manufacturing and services. Looking ahead, and given that the tracer for employment seems to be lagging changes in the tracer for output, the downward risk of transmission of the weakness in manufacturing to the services sector strengthens the need for close monitoring of the euro area labour market. As a caveat, the stylised tracer discussed in this box should be treated with caution during periods characterised by high uncertainty and around cyclical turning points, as the methodological approach can be somewhat prone to large changes induced by new data releases.

- The approach undertaken in this box is similar to the Economic Climate Tracer (ECT) developed by the European Commission and applied to its Business and Consumer Surveys. For further details on how to produce the ECT, please see the related methodological documentation. Information on the most recent ECT can be accessed in the European Commission’s publication “European Business Cycle Indicators: 3rd Quarter 2019”. The data visualisation techniques employed in this box are comparable to those used by the European Commission. The stylised tracer in this box differs from the ECT, as it uses the approximate bandpass filter developed in Christiano, L. J. and Fitzgerald, T. J., “The Band Pass Filter”, International Economic Review, Vol. 44, No 2, 2003, pp. 435-465, which allows for a decomposition of each PMI indicator into a trend component, a cyclical component and a high frequency component able to capture the exuberance of changes in the PMI data and link them to very short fluctuations in the economy (cycles shorter than six quarters). The stylised tracer in this box is then constructed as the sum of the trend and cyclical components for the PMI for employment. A similar approach is applied to the PMI for output to compare the current cyclical position of the labour market with that of economic activity.

- The lagging developments in employment compared with those for output are consistent with the existence of adjustment costs to the labour input or with labour market rigidities at firm level. As such, the stylised labour market tracer provides evidence that firms consider adjusting other factors of production (including changes in the intensive margin of labour input) in response to fluctuations in their production levels before optimising their respective employment levels through adjustments to their hiring and firing processes. The lagged response of employment to GDP is also apparent in the national accounts data, as described in the box entitled “Employment growth and GDP in the euro area”, Economic Bulletin, Issue 2, ECB, 2019.

- See the box entitled “Developments in the services sector and its relationship with manufacturing”, Economic Bulletin, Issue 7, ECB, 2019.

- See the box entitled “Understanding the slowdown in growth in 2018”, Economic Bulletin, Issue 8, ECB, 2018.

- These transmission channels can be either domestic or foreign in nature, as described in the box entitled “Domestic versus foreign factors behind the fall in euro area industrial production”, Economic Bulletin, Issue 6, ECB, 2019. In particular, the relevant external shocks for the transportation industry could encompass weaker foreign demand or changes in oil prices, while the relevant adverse domestic shock would come from a weakening in the demand for the transportation industry coming through the domestic weakness in manufacturing. See Burstein et al., “Distribution costs and real exchange rate dynamics during exchange-rate-based stabilizations”, Journal of Monetary Economics, Vol. 50(6), 2003, pp. 1189-1214 for details on the interlinkages in production between transportation and other industries. This paper provides evidence on the centrality of the transportation industry in the relationship between manufacturing and the remaining services sector, by showing that distribution costs are an important component of the selling price (and costs) of retail products for final consumers.